Dental accounting is the process of managing and tracking the financial transactions of a dental practice. It involves recording income, expenses, payroll, insurance claims and tax compliance to keep the practice financially healthy.

Accurate dental accounting is crucial for dental practices to avoid revenue loss, stay IRS compliant and make informed decisions for growth. This article will cover the core of dental accounting, best tools to use and how it helps your dental practice overall.

What Is Dental Accounting?

Dental accounting is a process that enables your accounting staff or you to manage and organize the financial transactions of your dental practice. Under it, you or an accountant will track expenses, income, and profits, and create detailed financial reports to inform decision-making.

Under dental accounting comes:

- Creating and analyzing financial statements, P&L, etc.

- Tax returns

- Daily accounts receivable

- Marketing costs

- Rent, mortgage, or utilities

Why Dental Accounting is Important for your Dental Practices?

These days, running a dental practice involves not only providing quality care to your patients but also managing finances, handling insurance payments, tracking expenses, and ensuring compliance with IRS regulations. Through dental accounting, you can ensure your practice remains financially organized and ready for audits. When you are financially confident and fully compliant, you can focus better on your patient care.

Here’s why dental accounting is essential:

Accurate Revenue Tracking

Your practice has to deal with multiple payment sources, including insurance reimbursements, co-pays, and out-of-pocket payments. It’s essential to track these incomes to prevent revenue leaks.

Expense Management

A dental practice has to deal with multiple expenses, including payroll, medical equipment, and lab fees. Dental accounting will monitor those expenses and identify areas where expenses can be cut.

Insurance & Claims Handling

Insurance claim will be handled correctly, thus reducing delays and errors and streamlining cash flow.

Tax Compliance

Your practice will have to deal with specific tax rules and deductions, and dental accounting will make sure you are compliant.

Financial Planning & Growth

Dental accounting will help in preparing accurate financial reports. It will help you make informed decisions, such as hiring, expanding services, or investing in new equipment.

Core Components of Dental Accounting for US Dentists

Dental accounting ensures that every dollar is tracked correctly, thus helping you manage the cash flow, reduce risks, and make informed decisions. When you focus on the right components, you will be able to keep your practice financially healthy.

Core components of dental accounting include:

Revenue Cycle Management

For tracking income from patient payments, insurance reimbursements, and co-pays to avoid missed revenue.

Expense Monitoring

To manage operational costs, including payroll, lab fees, supplies, and equipment, to maintain profitability.

Insurance Claim Tracking

For recording, verifying, and reconciling claims to ensure timely reimbursements and reduce cash flow delays.

Tax Planning & Compliance

Under it, deductions will be maximized while complying with federal and state tax laws.

Payroll & Staff Compensation

Payment of salaries, benefits, and retirement contributions for dental teams with exactness and efficiency.

Financial Reporting & Analysis

Generation of monthly and annual reports to track your practice performance and plan for future strategies.

How Dental Accounting Supports Your Practice’s Financial Health

The success of your dental practice depends not only on the excellent care you give to your patients, but also on strong financial management. Dental accounting provides the insights that will help you keep the practice financially stable. By tracking revenue, expenses, and IRS compliance, dental accounting will maintain your financial stability while you can focus on your patients.

Here’s how dental accounting supports your practice:

- Improved Cash Flow

- Cost Control

- Compliance & Tax Readiness

- Clear Financial Insights

- Strategic Decision-Making

Managing EFTs and Reconciliation: Keeping Your Dental Practice’s Finances Accurate

These days, many patients have insurance and would like to make their payments through their insurance. However, this has created additional responsibility for your dental practice, as you will now need to reconcile deposits with claims regularly. To avoid getting overloaded with this task, you will need the assistance of a specialist dental accountant. It will ensure:

- EFT payments match submitted claims

- Any shortfalls or denied claims are identified quickly

- Bank reconciliations are accurate and error-free

- Cash flow remains predictable and reliable

What Are the Best Accounting Tools & Software for US Dental Practices?

Getting dental accounts done through accounting tools and software is the modern way of handling your accounts. To achieve the best results, select the most suitable accounting software for your practice.

We have shortlisted a few:

- QuickBooks Online: This software is ideal for bookkeeping, expense tracking, and payroll.

- Xero: Ideal for cloud-based accounting with strong reporting features.

Common Accounting reports used for Dental Practices

One of the major requirements for keeping your dental practice financially sound is to obtain financial reports. These reports can be generated accurately through dental accounting.

Some of the key reports that you will need for keeping your practice financially stable are:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

- Accounts Receivable Aging Reports

Benefits of Hiring a US-Based Dental Accountant or Outsourcing Accounting Services

Running a dental practice successfully means balancing patient welfare and financial stability. This delicate balance can be achieved successfully and without straining your resources through outsourcing accounting services. Through it, you can ensure your practice is compliant and financially sound for further growth.

Expertise in Dental Industry-Specific Financial Management

A dental accountant through a professional outsourcing service provider will be well-versed with the unique challenges faced by dental practices, like insurance reimbursements, EFT reconciliation, lab fees, equipment costs, and compliance requirements. A dental accountant will provide tailored solutions.

Time Savings, Letting You Focus on Patients

Instead of focusing on bookkeeping, payroll, and tax filings, you can pay complete attention to your patients while a third-party accountant looks after your numbers.

IRS-Compliant and Audit-Ready Books

By partnering with a professional accounting service provider, you will get access to accountants who will keep you compliant with IRS requirements. This way, they are reducing penalty risk and keeping you audit-ready.

Strategic Tax Planning for Maximum Savings

Dental accountants know which deductions, credits, and write-offs apply to practices, helping you legally reduce tax liability and increase savings.

Real-Time Reporting and Advisory for Growth

Under outsourcing dental accounting, you will get access to dashboards and cloud-tools. These tools give a real-time insight into your cash flow and practice performance which will enable you to make smarter decisions.

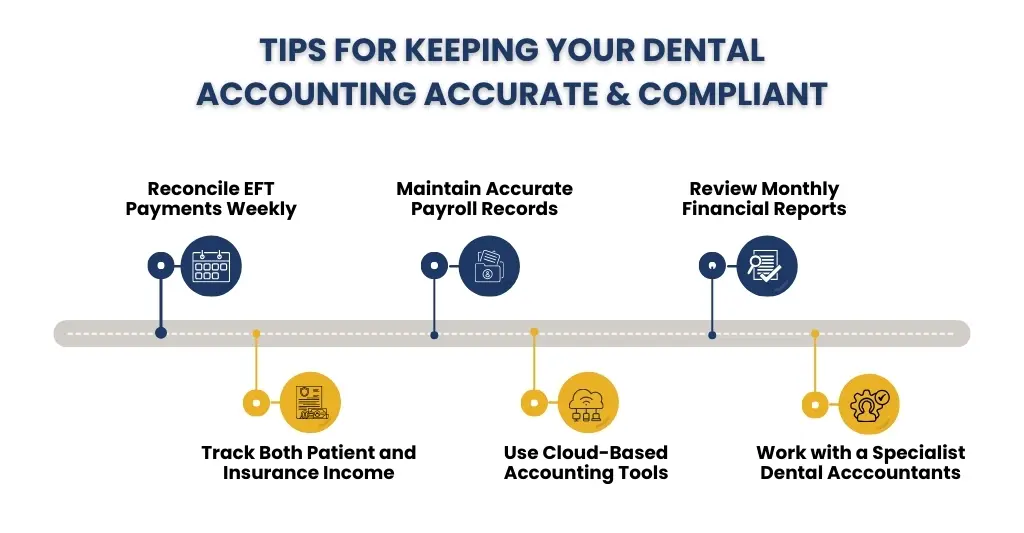

Tips to Keep Your US Dental Accounting Accurate and Compliant

Dental practices face unique financial challenges, from managing EFT (electronic fund transfer) reimbursements to handling staff payroll and staying IRS-compliant. By following these best practices, you can keep your dental accounting accurate, transparent, and stress-free.

Reconcile EFT Deposits with Claims Weekly

Most dental practices rely on EFT payments from insurance companies and reconcile these payments with claims every week to ensure no revenue slips. This will ensure no revenue loss or errors.

Track Both Patient Payments and Insurance Reimbursements

There are two major sources of income for a dentist: from patients and from insurers. Hence, it must be adequately tracked to avoid duplication in billing, missing co-pays, and delays in collections. Such tracking will ensure a healthy cash flow.

Maintain Accurate Payroll and Staff Compensation Records

Payroll errors have the potential to demoralize your staff. Maintaining a proper record of salaries, overtime, benefits, and retirement contributions ensures smooth operations and IRS compliance.

Doing these tasks is a time-consuming process, and in such cases, you can always take assistance from a professional outsourcing accounting service partner like E2E Accounting.

Work with a CPA Familiar with Dental Practices

You must either hire a specialized dental accountant or utilize the services of an accounting outsourcing partner. Such accountants understand the industry expenses and compliance requirements, thus reducing tax risks and maximizing deductions.

Use Cloud-Based Tools for Real-Time Visibility

Tools like QuickBooks, Xero, or dental practice management software must be used to ease the work pressure and make it easier to monitor and spot discrepancies. Operating these tools requires expertise and training, but you can avail yourself of their services through outsourcing.

Review Monthly Reports to Spot Issues Early

Regularly reviewing profit & loss statements, cash flow reports, and accounts receivable aging reports helps you identify problems like rising expenses, delayed payments, or declining profitability before they become serious.

IRS Tax Forms and Deadlines for Dental Practices

Dental practices need to file these IRS tax forms and deadlines to avoid penalties:

- Form 941: Quarterly Federal Tax Return for payroll taxes.

- Form 1120 or 1120S: Corporate tax return.

- Form 1065: Partnership return if applicable.

- Form W-2 and W-3: Annual employee wage and tax statements.

- Form 1099-MISC: For independent contractors.

- Deadline Awareness: Payroll tax deposits are monthly or semiweekly; corporate returns are due March 15 or April 15; W-2’s are due end of January.

DIY Dental Accounting Problems

DIY dental accounting can lead to:

- Multiple payment sources (co-pays and insurance reimbursements) not being tracked correctly

- Tax deductions missed because of lack of industry knowledge

- Manual claims and payment reconciliation taking too much time

- Audit risk due to non-compliance or missing documentation

FAQs: Frequently Asked Questions

What is dental accounting?

Dental accounting is a specialized form of accounting that focuses on handling revenue, expenses, compliance, and insurance claims for dental practices.

Why do dentists need specialized accounting?

Dental practices have to face unique challenges such as insurance reimbursements, EFTs, and high equipment costs. These challenges cannot be tackled adequately through general accounting.

Can dental accounting improve profitability?

Dental accounting enables tracking expenses, revenue, and revenue leaks in real-time, thus helping in increasing profitability.

What accounting software is best for dental practices?

In our opinion, QuickBooks and Xero are ideal for dental practices and are commonly used.

Should I hire an in-house dental accountant or outsource?

Your decision must be based on the size of your practice. Ideally, we suggest you go for outsourcing if you are mid-sized. You will gain access to specialized accountants, saving you time.

Conclusion

Dental accounting is not just about keeping your books clean; it’s about maintaining financial stability and preparing your practice for long-term success. Through dental accounting, you will be in a position to manage your revenue cycles, EFT reconciliation, generate reports, and comply with IRS laws, thus ensuring smooth functioning. You can choose between managing it in-house or outsourcing, but investing in dental accounting will be the smartest move.

An even more brilliant move would be to outsource the dental accounting work to a professional accounting service provider like E2E Accounting, thus allowing you to focus on your core expertise.

We have a team of specialized accountants who are well-versed in dental accounting requirements and have helped many clients streamline their finances. Do you need assistance with your accounts? Connect with us, and we will take care of your accounts.