Running a dental practice is a manageable responsibility, but handling its finances can be a significant headache. We say that because a dental practice has to deal with unique financial challenges, compliance, and regulations, which require special tools and expertise. From insurance reimbursements and patient payments to lab fees, payroll, and regulatory compliance, it cannot be handled using general accounting software.

To handle these unique accounting requirements, you will need specialized accounting software built for dental workflow and complexity. Choosing the right accounting software for dental practices can save time, reduce errors, ensure compliance, improve financial visibility, and help your practice grow confidently.

In this blog, we will explore the best accounting software options for dental practices, ensuring your practice finances remain stable and enable expansion.

Let’s begin

Why Dental Practices Need Specialized Accounting Software

It may puzzle you as to why a regular accounting software is unable to handle the accounting requirements of your dental practice. However, it is essential to note that a dental practice has specific, unique accounting requirements that only a specialized dental accounting software can handle.

These requirements are:

- Handling multiple income sources, such as insurance payments and patient payments

- Multiple small transactions like co-pays and supply purchases

- Handling of Insurance claims and denials

- Complying with the Health Insurance Portability and Accountability Act (HIPAA) and state health mandates, along with IRS regulatory and tax compliance

- Integration with practice management software for billing, scheduling, and charting

These requirements can only be fulfilled by an accounting software for dental practices.

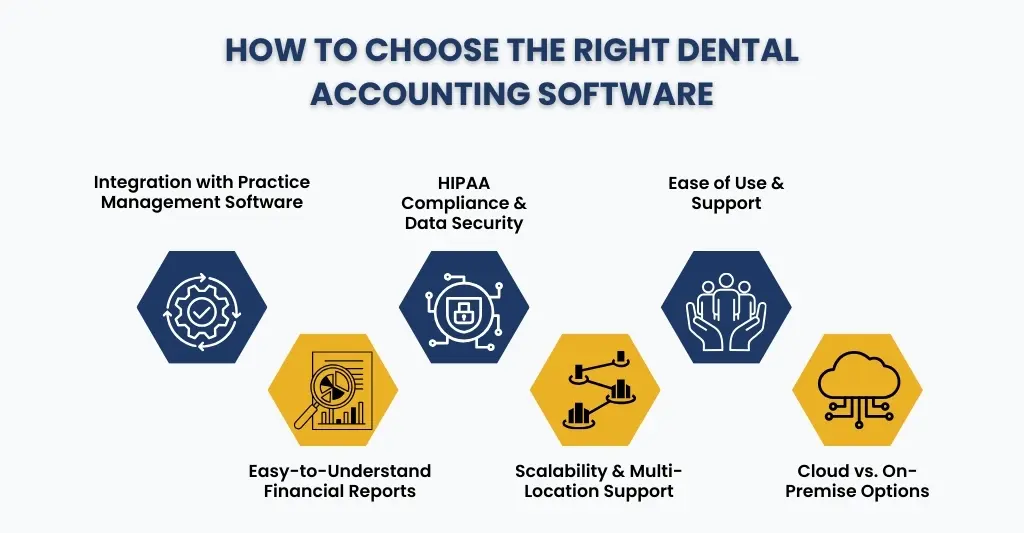

Criteria for Choosing the Best Dental Accounting Software

Dental accounting software is designed specifically for dental practices, providing comprehensive financial management, integration, and efficiency. If you are looking for dental accounting software that meets specific criteria or features, it can make your life easier by keeping patient information private and ensuring compliance.

Here are some criteria to look for in a dental accounting software.

Integration With Your Practice Management Software

Is the accounting software integrating well with your practice management software? If not, then you will have a bad time. The integration is essential for seamless operations because it brings scheduling, treatment planning, billing, and patient communication in one streamlined workflow. Make sure to choose a dental software that integrates well with your practice management.

Does it Generate Easy to Understand Financial Reports?

Financial reports will help you track incoming and outgoing money, as well as actual profits. What you will need is a dental accounting software that will generate and send you accurate and easy-to-understand reports.

When you see accurate numbers, such as collection ratios and insurance aging, you can make informed decisions that boost your bottom line and make everything run more smoothly. Also, going through financial statements gives you insight into how your practice is performing financially.

Following HIPAA Compliance and Keeping Your Data Safe

Is the dental accounting software you selected complying with the Health Insurance Portability and Accountability Act (HIPAA)? It is important to keep your patient information private. Staying compliant requires access control, records of user activity, and secure data backups in your dental accounting software.

To further secure your data, you should look for features like multi-factor authentication and end-to-end encryption to keep patient data away from unauthorized people. These measures don’t just protect patient privacy.

Scalability & Multi-Location Support

Also, check if the dental accounting software can scale as your practice grows to more locations and staff, handling increasingly complex insurance and payments.

Ease of Use & Support

Lastly, check how easy it is to operate and learn the accounting software. By getting easy-to-understand software, it will help you in training your staff without much effort.

Cloud vs. On-Premise Solutions, Mobile Features & Data Security in Dental Accounting

Dental accounting software comes in two flavors: cloud (hosted online) and on-premise (installed locally). Cloud solutions offer anywhere access, automatic updates and a mobile app for on-the-go financials.

On-premise solutions give you more control and customization but require dedicated IT infrastructure and maintenance. Mobile access is important for busy dentists who need quick financials between patients.

Data security is key since you’re dealing with patient and financial data. Look for end-to-end encryption, multi-factor authentication and regular backups. Make sure the software is HIPAA compliant and meets US data protection regulations.

Top 9 Accounting Software for Dental Practices in 2025

We have shortlisted 9 dental accounting software that are ideal for US-based dental practices of various sizes. Some of them are specialized, some are general accounting software, and some offer strong integration with dental systems.

Here is the list:

QuickBooks Online

One of the most widely used accounting software programs is a key reason for its popularity, as it integrates with dental practice management systems. This accounting software offers invoicing, payroll, expense tracking, and powerful reporting tools. For dental practices, QuickBooks is particularly supportive because it integrates well with billing systems and supports payroll add-ons for staff management.

Xero

Xero is a cloud-based accounting software that is known for its simple interfaces, real-time information, and detailed reporting. It’s a strong competitor to QuickBooks, and it’s ideal for practices operating in multiple locations thanks to its collaboration features and multi-user access.

FreshBooks

Its user-friendly design makes invoicing and expense tracking simple, all while maintaining the integrity of financial reporting. Its easy-to-use features make it ideal for solo dental practitioners.

Wave

Wave accounting software covers the basics such as income and expense tracking, invoicing, and receipts, making it useful for small dental practices. It is ideal software for budget-conscious practices that are not interested in advanced features.

Sage Intacct

Sage Intacct is the ideal choice for large dental practices or growing practices. It puts on the table advanced financial reporting, multi-entity support, and customizable dashboards. This software enables gaining deeper insights into profitability.

Dentrix + QuickBooks Integration

Dentrix, which is a dental practice management software combined with QuickBooks, is a complete solution. This combination ensures that clinical billing, scheduling, and patient management flow directly into accounting, eliminating duplicate work and improving accuracy.

Open Dental

Open Dental is a practice management software that also supports robust billing, charting, and data exports. It is ideal for practices that want more control over their systems, plus it integrates well with Xero and QuickBooks.

CareStack

CareStack is an accounting software that brings in accounting with patient management, billing, collections, and reporting. Making ideal for practices are looking to reduce multiple detached systems.

ZarMoney

ZarMoney is a web-based accounting platform that offers dental practices visibility into expenses, vendor management, and scheduling payments. It’s a good fit for dentists who want more traditional business accounting features with modern usability.

Additional Options & Specialized Add-ons

- Bill.com for automating payables and receivables.

- Practice management add-ons that sync insurance claims and billing directly with accounting systems.

- Cloud reporting tools like Fathom or Spotlight Reporting for advanced analytics.

Comparison Table: Features, Pricing, and Suitability

| Software | Approx Monthly Cost | Good For | Key Features | Drawbacks / What to Check |

| QuickBooks Online | $30-$60+ depending on plan & add-ons | Small to mid-sized practices | Strong integration with practice management, payroll modules, reporting | Transaction fees, add-on costs, complexity if using many modules |

| Xero | Starting $20, higher tiers $50-$90+ | Practices wanting cloud-based, simple to more advanced accounting | Bank feeds, multi-currency, inventory, expense tracking, reporting dashboards | Add-ons needed for payroll, caution with invoice limits in lower tiers |

| FreshBooks | Moderate cost | Very small practices, solo dentists | Simple invoicing, time tracking, easy expense management | Less powerful reporting, may need extra tools for insurance claim tracking |

| Wave | Free (for core features) | Small practices tight on budget | Basic accounting, invoicing, receipts, expense tracking | Limited advanced features, limited integrations, fewer enterprise tools |

| Sage Intacct | Higher cost, usually used in larger practices or DSOs | Multi-location, needing strong financial controls | Multi-entity accounting, strong analytics, custom financial reports | Higher learning curve, more cost, possible overkill for solo or small practices |

| Dentrix + QuickBooks | Combined cost (Dentrix subscription + QuickBooks) | Practices already using Dentrix or wanting dental-specific features with accounting strength | Dental charting + scheduling + accounting integration | Need set up, training; ensuring data sync works well; cost can add up |

| Open Dental | Varies; cost of server/cloud hosting + support | Practices wanting flexibility and control | Highly customizable, exportable data, strong billing features | Requires technical comfort, proper setup; support costs; hosting decisions matter |

| CareStack | Subscription based; premium features cost more | Practices that want all-in-one dental PM + billing + collections + insights | Deep dental-centric features; patient payment plans & collections; analytics dashboards | Cost, implementation time, onboarding; some features may require premium plans |

| ZarMoney | Moderate cost; depends on number of users/features | Practices needing solid accounting features with good web interface | Payables calendar, financial reports, dashboards, online billing | May require integrations; verify dental-specific workflow support |

Common Pain Points When Switching Dental Accounting Software

Switching to new dental accounting software can simplify things but often brings transitional headaches. Migrating financial and patient data requires careful planning to avoid errors and downtime. Staff training can be time consuming if the new software is complicated.

Integration issues can arise especially with practice management and billing software. Hidden costs for training, customizations or third-party integrations can surprise you if you only budgeted for subscription fees. Knowing these pain points will help your team be better prepared for the transition.

How to Choose the Right Accounting Software for Your Dental Practice

Here are some points that will guide you towards selecting the right software for your dental practice:

- Assess the volume of transactions it can handle, which includes the number of patients, insurance claims, supplies, and payroll complexity.

- Check important features like claim tracking, insurance aging, provider-level revenue reporting, and HIPAA compliance, to name a few.

- Find out whether it can integrate with your practice’s scheduling, clinical, imaging, and patient billing software.

- Find out whether it can scale up when you require it, especially when you are in an expansion phase.

- Ask for a demo or a free trial for a month and use real data to see how the software handles everyday work.

- Get the final price clarity for the software, which includes subscription, onboarding, training, support, data migration, and integrations.

Additional Tips for Efficient Dental Practice Accounting

Here are some additional tips that will help in streamlining your dental practice accounting. The tips are as follows:

- Maintain a simple chart with categories applicable to dental operations, like supplies, lab fees, hygienist labor, and dental insurance adjustments.

- Get your bank reconciliation tasks automated via live bank feeds.

- Separate patient billing income vs. insurance reimbursements clearly

- Implement EFT reconciliations every week

- Full use of cloud-based tools to coordinate with staff in multiple locations

- Maintain a backup and ensure the software you use uses two-factor authentication and encryption.

FAQs: Frequently Asked Questions

Is standard accounting software enough for dental practices, or do I need something specialized?

For your dental practice you will need specialized accounting software with special features to handle unique workflows such as insurance aged reports, co-pay tracking, lab fees, patient payment plans, to name a few. A standard accounting software will handle only basic accounting requirements.

What are the three levels of dental practice management software?

There are three levels of dental practice management systems: basic, intermediate, and advanced. Your office’s needs will determine what level of capability in features (such as billing or imaging integrations) you need to sustain and grow.

Can I use QuickBooks or Xero and still handle dental insurance workflows?

Yes, both can work well if configured properly and if you use add-ons or integrations with practice management software to capture insurance billing, claims, and reimbursements.

What is CRM in dentistry?

Customer relationship management (CRM) software is essential for modern dental clinics to manage patient interactions, appointments, and treatment plans efficiently.

What is HIPAA compliance for accounting software, and why does it matter?

HIPAA compliance means protecting patient data privacy and ensuring the security of health information. Even accounting software can handle patient billing & payment data, so you need software that meets data security standards to avoid legal and financial risk.

Conclusion

Choosing the right accounting software for dental practices in 2025 means picking a tool that understands dental workflows, supports insurance and patient payments, offers strong reporting, and scales with your practice. Whether you go with QuickBooks, Xero, or a more dental-focused system like Dentrix + QuickBooks or CareStack, focus on the features that matter most to your practice’s financial health. With the right software, your dental office can reduce administrative burden, improve cash flow, increase accuracy, stay compliant, and ultimately focus more on patient care and growth.

Choosing the right software for your dental practice in 2025 is crucial due to its direct impact on the practice’s operational efficiency and financial stability. It means evaluating a software that can understand dental workflows, supports insurance and patient payments, offers strong reporting, and scales with your practice.

Regardless of the software you use, focus on the features that matter most to your practice’s financial health. With the right software, your dental office can reduce administrative burden, improve cash flow, increase accuracy, stay compliant, and ultimately focus more on patient care and growth.

The easiest and most cost-effective way to access this software for your practice is through outsourcing, and E2E Accounting will give you access to the best. We have a team of specialized accountants who are well-versed in dental accounting requirements and in operating dental accounting software. Our Dental Accounting services have helped many clients streamline their finances. Do you need assistance with your accounts? Connect with us, and we will take care of your accounts.