Being a landlord or managing a property, you are aware that owning real estate is not only about renting a bunch of money but also about operating a living, breathing business. Hiding behind every successful rental operation is one important component, which is the property management accounting.

Regardless of having a single rental property or a whole portfolio, proper financial tracking is what can make the difference between prosperity and unforeseen losses. Knowing how to write down the transactions, cash flow, management of trust account, and preparing tax returns will ensure that you are compliant and profitable.

At E2E Accounting, we understand that every landlord deserves a concise perspective of their financial state. This guide will help you know it all about property management accounting, including the fundamentals of accounting as well as the advanced knowledge to help you optimise your returns, ease your stress, and make better financial choices.

What Is Property Management Accounting?

Property management accounting is the method of financial accounting that is applied by property managers and landlords to document, categorize and evaluate all financial operations in their rental properties.

Imagine it as the foundation of your property business, as it tells you how much you earned in rent, how much you spent, how much you had in security deposits and trust accounts that your books have accurate financial performance.

In its general concept, property accounting entails:

- Recording rental payments and fees

- Managing operating expenses and maintenance costs

- Handling trust accounting for property managers (when managing money on behalf of property owners)

- Preparing property management financial statements

- Ensuring compliance with IRS rules and tax deadlines

When done right, property accounting doesn’t just keep you compliant, it gives you a data-driven foundation for making better investment and management decisions.

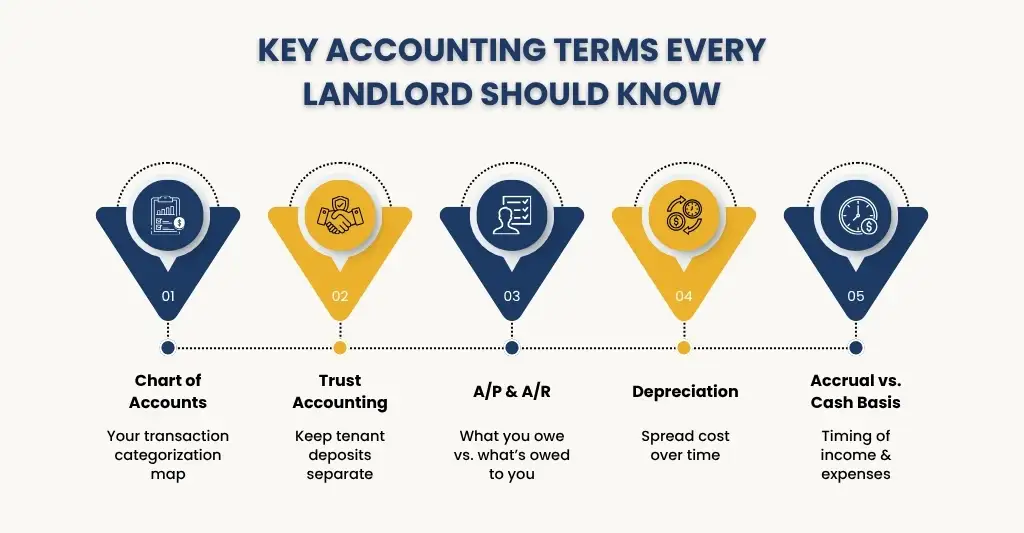

Key Property Management Accounting Terms You Should Know

You can do well to be informed of the most important accounting terms you will come across before going into detail:

- Chart of Accounts for Rental Properties: This is a system of categories which are utilised to classify all transactions, like income, maintenance, utilities, taxes and insurance.

- Trust Accounting: You are required to have a trust account when you have a tenant deposit or money on behalf of property owners. Trust accounts should not be mixed with business or personal funds.

- Rental Income and Expenses Tracking: All the rent collected and expenses incurred, such as repair & maintenance, management fees and mortgage interest, should be recorded.

- Accrual vs. Cash Basis: The two main accounting methods. Cash records income when received; accrual records it when earned.

- Depreciation: This is a non-cash expense that is used to amortise the cost of property over its useful life.

- Accounts Payable (A/P): Bills or expenses that you owe to vendors or contractors.

- Accounts Receivable (A/R): Rent or money due to you by tenants.

The knowledge of these terms will make your rental property accounting remain in order and audit-ready.

The Accounting Cycle in Property Management (Step-by-Step Breakdown)

Here’s how the property management accounting cycle typically works:

1. Transaction Recording

Every financial event — rent payments, repairs, management fees, must be logged accurately in your system.

2. Categorisation

Use your chart of accounts for rental properties to classify each transaction correctly. For example, categorise “plumbing repairs” under maintenance.

3. Bank Reconciliation

Reconcile bank and trust accounts at the end of every month and make sure that you are in agreement with your statements.

4. Financial Reporting

Generate monthly reports such as income statements and balance sheets to review property performance.

5. Adjustment Entries

Depreciation of records, accruals, or adjustment of unpaid bills or unearned rent.

6. Closing the Books

Bring your books to a close (at the end of the accounting period, monthly or annually) and make them ready to file tax returns or undergo an audit.

The process of maintaining your books clean, transparent and ready to file with the IRS is a constant practice.

How to Set Up an Effective Property Accounting System?

If you’re still managing your books manually, it’s time to upgrade. Here’s how to create an efficient system for rental property bookkeeping:

1. Choose the Right Accounting Method

Decide between the cash basis and the accrual basis.

- Cash basis is simpler and works well for most landlords.

- The accrual basis provides a more accurate financial picture for larger portfolios.

2. Create a Chart of Accounts

Include income categories (rent, late fees), expense categories (repairs, utilities), and balance sheet accounts (assets, liabilities, equity).

3. Use Real Estate Accounting Software

QuickBooks Online, Buildium, AppFolio, or Hemlane examples simplify the process of recording rental income and expenses and automate the process of reconciling with the bank.

4. Maintain Separate Accounts

Separate business, personal and trust accounts. Do not confuse operating funds and tenant deposits.

5. Automate Data Entry

Automate your bank feeds or use artificial intelligence-based tools to mitigate human error and accelerate reconciliations.

An organised accounting system will save your time and provide you with real-time monitoring of the financial performance of your property.

Property Management Financial Reports You Must Understand

Financial reports are the truth about your performance in the rentals. The following are the most important ones that you should consult frequently:

- Income Statement (Profit & Loss): Shows your property’s income and expenses over time.

- Balance Sheet: Lists assets (properties, cash), liabilities (mortgages, taxes), and owner’s equity.

- Cash Flow Statement: Tracks inflows and outflows, helping you assess liquidity and cash reserves.

- Owner Statement: Common in property management firms — provides property owners with a breakdown of income, expenses, and distributions.

- Rent Roll Report: Summarises tenant details, lease terms, and rent status.

Knowing these property management financial statements will make it easier to make decisions about your budgets and making investments.

Filing Taxes for Different Property Scenarios (with IRS Forms Explained)

The process of filing taxes when you are a landlord may be complicated, depending on your setup. The major forms that you are likely to come across are as follows:

| Scenario | IRS Form | Purpose |

| An individual landlord renting a property | Schedule E (Form 1040) | Reports income and expenses for rental real estate |

| Real estate partnership | Form 1065 | Reports partnership income, losses, and deductions |

| Corporation or LLC electing corporate taxation | Form 1120 or 1120-S | Corporate income tax filing |

| Depreciation reporting | Form 4562 | Lists property depreciation and amortisation |

| Estimated tax payments | Form 1040-ES | Quarterly estimated taxes for landlords |

| Security deposits retained as income | Schedule E | When deposits are kept due to a lease breach |

Maintaining records in detail will mean easy filing and less audit risk. One of the things that can make you remain compliant is having a professional accountant who is conversant with real estate accounting software.

Tracking, Categorizing, and Maximizing Deductible Expenses

As a landlord, you would not want to leave money on the table. The correct tracking of expenses is important in claiming landlord tax deductions and enhancing cash flow.

Common Deductible Expenses Include:

- Mortgage interest

- Property taxes

- Repairs and maintenance

- Insurance premiums

- Property management fees

- Advertising costs

- Utilities (if paid by landlord)

- Travel expenses for property visits

To make this process easier:

- Keep digital receipts and vendor invoices.

- Categorise expenses immediately using your accounting software.

- Review monthly reports to identify potential write-offs.

Effective management of cash flow in rental properties is important so that you are not paying excessive taxes and that your cash flow remains in order all year round.

Common Mistakes That Undermine Property Accounting

Even experienced landlords commit accounting errors that could be detrimental to their bottom lines or cause IRS audits. Here are a few to avoid:

- Mixing personal and business funds – It is always advisable to have separate accounts.

- Ignoring security deposit rules – mishandling of trust accounts may incite legal conflict.

- Skipping reconciliations – Unrecoverable mistakes can be concealed by overlooking bank and book accounts.

- Poor recordkeeping – Receipts are lost and it is difficult to claim any deductions.

- Not budgeting for vacancies – Cash flow planning is a must in order to be stable..

- Delaying financial reviews – Check-ins monthly will assist in identifying problems.

Observing best practices of keeping books as a landlord can make you remain audit-proof and profitable.

Don’t risk costly mistakes—get expert property management accounting insights today. Contact us to secure your financial success with E2E Accounting!

Advanced Insights: Using Accounting Data to Improve ROI

When your accounting system is running efficiently, you can make smarter investing decisions by using the data. These are the steps that you can use to transform your books into business intelligence:

- Analyse Expense Ratios: Compare property expenses to total income to identify areas of inefficiency.

- Monitor Rent Collection Trends: Find out those who are behind in paying and modify lease policies.

- Evaluate ROI by Property: Does the analysis of net operating income (NOI) identify the assets with the best performance?

- Forecast Cash Flow: Map out capital improvement or new acquisition using historical data.

- Leverage Software Analytics: The majority of real estate accounting software will include instant performance tracking in the form of a dashboard.

Data-driven decisions turn your accounting system into a powerful ROI engine.

FAQs: Frequently Asked Questions

What’s the difference between property management accounting and general accounting?

Compared to general accounting, property management accounting has property-related transactions such as rent, maintenance, and deposits of tenants in mind, and general accounting has a wider range of business finances.

Why is trust accounting important for property managers?

Trust accounting ensures tenant deposits and owner funds are held separately, protecting you legally and maintaining client trust.

What’s the best accounting method for rental properties cash or accrual?

Cash method is applied by most small landlords, whereas the accrual approach is used by larger property management firms because the accrual method is more accurate and predictive.

Can I manage multiple properties under one accounting system?

Yes. Depending on the configuration and software, one can control hundreds of entities, trust accounts, and reports on a single dashboard.

Which software works best for property management accounting?

The most popular are QuickBooks Online, Buildium, AppFolio, and Hemlane – all these solutions are aimed at managing the rental property so that the accounting and reporting of the results become efficient.

Conclusion

Property management accounting is not a compliance problem it is the glossary towards the financial prosperity of your property. Knowing your numbers would help you make better decisions, limit risks, and increase long-term profitability.

With proper management of trust account, proper maintenance of books and with the help of the right real estate accounting software, you will always know where your money is going – and how you can make it work even harder in your favor.

No matter the type or level of management, be it one rental property or a large-scale real estate organisation, it begins with a clear accounting strategy.

For expert support customized as per your needs, E2E Accounting provides comprehensive property management accounting services designed to simplify your finances and maximize your returns. Contact us today to build a strong financial foundation for your rental business.