Majority of us have engaged in eCommerce at some point for doing online shopping. So, it should come as no surprise that eCommerce is expansive. The sector has developed quickly, with brands like Amazon, Shopify, and eBay becoming well-known and widely used, especially in the U.S. market. The eCommerce business has become more popular due to the advent of free shipping, which creates a perception of savings and increases convenience for customers, even though the cost is often absorbed by sellers or included in product pricing.

To run a successful and prosperous eCommerce business you need to keep constant check on your finances. Always be aware where your business stands financially. This is the important factor regardless of whether you sell on Amazon, Shopify or Ebay.

The eCommerce industry in reality has changed significantly in the last ten years. This has provided various opportunity to reach and engage with your target market globally. Every business needs to understand the significance of accounting and bookkeeping. But eCommerce companies that operate in the ever-evolving digital market may need to understand it even more. All owners of eCommerce businesses need to understand why accounting for eCommerce companies is crucial if they want to not only survive but also grow.

Why is eCommerce Accounting so crucial?

One cannot stress the significance of accounting. This is because it is essential to any company’s ability to remain financially stable. It assures that other aspects of your company’s finances, such as your day-to-day cash flow, liquidity, regulatory needs, and tax liabilities, are met as well.

Accounting for eCommerce companies enables them to plan ahead, manage their current cash flow, and provide financial projections that assist them attract bank, investor, and lender funding. Accounting for eCommerce companies is essential for other reasons as well.

Budgeting for eCommerce Business: To make sure you always stay on track you must develop a budget that will support your growth ambitions. You may create a budget that works for you with the assistance of an eCommerce accountant.

In order to obtain finance for your company in the future, eCommerce accountants frequently possess a wealth of knowledge assessing business performance. When creating a budget, an eCommerce accountant will take into account the following costs:

- Revenue and Expenses

- Employee wages and salaries Marketing and advertising expenses

- Materials and equipment used in the manufacturing process

- Purchases of inventory: After these goals are well-defined, accountants can allocate funds appropriately.

Calculate the profitability: The accountant can then decide how best to streamline your company’s procedures. This entails choosing the best resources to help you reach your goals and figuring out the best pricing points.

Measure new strategies: Finally, in order to establish a longer-term strategy for your firm, an eCommerce accountant may assist you in measuring your strategies using current financial data. eCommerce accounting will become more important as the eCommerce business becomes more competitive.

Benefits of Accounting for eCommerce Companies

Financial Transparency: A thorough understanding of your company’s financial situation is possible with e-commerce accounting. It contains information about your earnings, losses, and expenses as well as your revenue.

This transparency is essential because it enables you to recognise trends, comprehend the financial health of your company, and make data-driven decisions that can support the expansion of your enterprise.

Efficient inventory management: Maintaining an inventory record is a necessary part of good accounting procedures. In eCommerce, this is particularly crucial. Both overstocking and understocking can result in higher storage expenses and unhappy consumers as well as missed sales.

You may raise sales and improve customer happiness by effectively managing your inventory through accounting, which will guarantee that the proper products are available when they’re needed.

Cash Flow Management: Any business depends on its cash flow to survive. You may keep a healthy balance between your revenue and expenses by keeping an accurate accounting record of your cash flow.

It lets you budget for upcoming costs, take advantage of fresh opportunities, and make sure your company stays solvent. By giving businesses the financial stability, they need to take advantage of new possibilities as they present themselves, effective cash flow management can promote corporate growth.

Tax Compliance: Fulfilling your tax obligations requires timely and accurate accounting. In the U.S., this includes navigating complex sales tax laws, which vary by state. Since the Supreme Court’s Wayfair v. South Dakota decision, even remote sellers must often collect and remit sales tax in states where they have economic nexus. It assists you in figuring out how much tax you actually owe, preventing fines and legal problems. You can preserve the long-term viability and expansion of your company as well as its reputation by adhering to tax regulations.

Attract Investors: Your company may attract more investors if its financial documents are trustworthy and easy to read. Investors need assurances on the safety of their capital and the possibilities for corporate expansion.

By using eCommerce accounting to keep accurate financial records, you can showcase your company’s profitability and growth potential and draw in investment for future development and expansion.

How to do Accounting for eCommerce Companies?

Beginning an eCommerce accounting project may seem intimidating, especially considering the particular difficulties and complexities of the eCommerce industry.

On the other hand, the process can be controlled and even empowering if done correctly. This is a more thorough, step-by-step tutorial on accounting for online retailers.

- Know your business financial needs: First and foremost, give careful thought to the financial requirements of your company. This covers every aspect, from keeping tabs on daily revenue and outlays to comprehending tax liabilities, managing inventory, and engaging in strategic financial planning. Your e-commerce accounting procedure starts with this phase.

- Find an eCommerce accountant: Look for a professional eCommerce accountant if you don’t feel comfortable handling the intricate world of ecommerce accounting on your own. These experts can successfully negotiate the distinct financial environment of eCommerce, guaranteeing precise and effective handling of your company’s financial matters.

- Integrate with Automation tool: In eCommerce accounting, automation is essential. Manual data entry is not a practical solution due to the large number of transactions and the requirement for real-time precision. Select an automation solution that can quickly and easily connect your eCommerce platform and accounting software, reducing the chance of errors and simplifying data transfer.

- Regular Financial Analysis: You can comprehend your company’s financial status and make wise business decisions by conducting regular financial analysis. Utilise these insights to drive business growth and profitability by analysing important financial variables and benchmarking your performance against industry standards.

What does an eCommerce Accountant do?

When looking for a successful partnership, selecting an accountant with an emphasis on eCommerce can make all the difference. We discussed the important considerations while looking for the best eCommerce accountant for your company in our post on how to find one.

Strategic Tax Planning: Whether operating domestically or internationally, eCommerce businesses face a wide range of tax compliance obligations.

Considering the particulars of eCommerce sales tax, they offer advice on tax responsibilities, guarantee tax compliance, and assist in the development of methods to reduce tax liability.

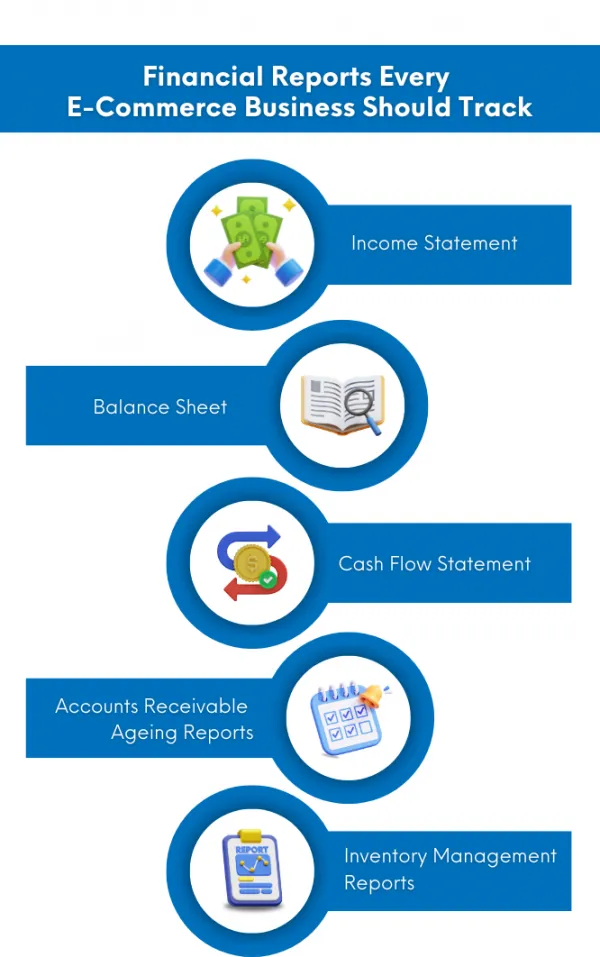

Specialist reporting: Large volumes of data are produced by eCommerce companies, and an eCommerce accountant needs to be skilled in transforming this data into insights that can be put to use. They assist the company in understanding its financial performance and making data-driven decisions by preparing and presenting comprehensive financial reports.

Financial Benchmarking: They provide insights that can help the company increase its financial performance and competitiveness by analysing important financial variables and comparing them to industry benchmarks.

Complex Accounting Tasks: Creating financial reports and gathering specific data on inventory purchases, operating costs, and income. They are able to offer thorough insights into the financial health of the company because of their in-depth analysis of the financial data.

Conclusion:

Specialised accounting is crucial for the success of eCommerce because of the particular issues faced by the sector. A successful eCommerce company must have accurate COGS calculation, automated multi-state sales tax compliance, efficient inventory management, and accurate financial reporting.

In order to successfully traverse this complexity and attain financial success. E2E Accounting provides the knowledge and specialised solutions. Don’t allow accounting difficulties to hinder your online store. To find out how our accounting services for eCommerce enterprises may help you succeed, get in touch with E2E Accounting right now.