Selling on Amazon may appear simple, but when tax season rolls around, things can get difficult. Suddenly, questions arise: What taxes are Amazon seller taxes required to pay? And what about the sales tax, which Amazon handles for you?

Taxes are an important aspect of being an Amazon seller. They can influence your pricing, growth, and profits. With tax authorities devoting closer attention to online marketplaces, mistakes in this area may result in fines, account suspensions, or unexpected tax obligations.

The purpose of this guide is to clear up any confusion. We explain the main Amazon seller taxes that Amazon sellers must be aware of, how marketplace regulations operate, when registration is required, and the most frequent errors that sellers make.

What are Amazon Seller Taxes?

Amazon seller taxes are the taxes you pay on your Amazon sales and profits in the United States. These usually include:

- Sales tax on taxable transactions.

- Federal income tax on business profits

- State income tax, if applicable.

While Amazon may collect and remit certain taxes on your behalf, you are still responsible for registration, reporting, and compliance.

Do Amazon Sellers Have to Pay Taxes?

Sure. You are legally obligated to pay taxes on your profits if you sell on Amazon. This holds whether you are a limited business, partnership, or sole proprietor. Depending on your location and turnover, you might have to pay income tax or corporation tax on profits, as well as sales tax on qualified sales. You, the seller, are still responsible for reporting and compliance, even if Amazon collects some taxes automatically.

Understanding Sales Tax for Amazon Sellers

One of the most misinterpreted aspects of Amazon selling is sales tax, mostly because the regulations differ by nation and, occasionally, by state or locality. Your responsibilities as an Amazon seller vary depending on your location, the locations of your customers, and the storage facilities for your merchandise.

When Do Amazon Sellers Need to Charge Sales Tax?

When you have a tax duty in a certain location, you typically have to charge sales tax as a part of your overall Amazon seller taxes. This can be produced by:

- Having stock kept in that nation or state (for instance, via Amazon FBA facilities)

- Having a base or registration there

- Reaching specific transaction or sales thresholds established by regional tax authorities

Before conducting taxable transactions, you might have to register for sales tax if any of these apply to ensure you are accurately reporting your Amazon seller taxes.

Does Amazon Collect Sales Tax for Sellers?

Amazon acts as a marketplace facilitator in numerous nations and US states. This means that for orders that qualify, Amazon automatically computes, gathers, and sends sales tax on your behalf. Your daily workload is decreased, but your compliance responsibilities remain.

You must still do the following:

- Register for sales tax, if applicable.

- Maintain correct sales and tax documentation.

- Even if there is no tax due, submit sales tax returns.

- Make sure to accurately report marketplace-collected tax in your filings.

How Amazon Handles Sales Tax?

Although Amazon actively participates in sales tax collection in many areas, its role is frequently misinterpreted. Amazon does not completely monitor tax compliance for sellers, even if it is able to collect and remit sales tax on specific transactions. It is crucial to comprehend what Amazon handles and does not.

Marketplace Facilitator Rules:

Amazon is categorized as a marketplace facilitator in numerous US states and nations. These regulations mandate that Amazon:

- At checkout, determine the appropriate sales tax.

- Obtain the tax from the client.

- Directly pay the tax to the appropriate authority.

This typically refers to regular goods sales made via the Amazon marketplace.

What Amazon Does for Sellers?

According to marketplace facilitator regulations, Amazon will:

- Add the necessary tax automatically to orders that qualify

- In your seller reports, display the collected tax.

- Pay the tax to the appropriate tax authority.

This lowers the possibility of undercharging taxes and makes daily tasks easier.

Income Tax Filing for Amazon Sellers

The profit you make from selling on Amazon is subject to income tax, which is distinct from sales tax. Regardless of whether Amazon collects sales tax on their behalf, all Amazon sellers must disclose their company income.

You must report:

- Amazon’s sales income

- Minus allowable expenses such as Amazon fees, ads, shipping, software, and professional costs.

Limited corporations file company accounts and pay corporation tax, whereas sole proprietors file through self-assessment. To prevent mistakes, fines, or overpaying taxes, it is crucial to maintain precise records of sales, costs, fees, and refunds.

Essential Tax Forms Every Amazon Seller Should Know

Certain tax documents are necessary to comply with IRS regulations if you sell on Amazon in the United States. These forms support appropriate tax filings and assist you in accurately reporting your income.

Common Tax Forms Amazon Sellers Use:

Form 1099-K: Sellers that fulfill the IRS reporting requirements receive Form 1099-K from Amazon. It displays the total amount of money you have paid to Amazon. The income must be mentioned in your tax return since this form is also given to the IRS.

Form W-9: US sellers are required to submit Form W-9 to Amazon to submit their taxpayer information, including their Employer Identification Number (EIN) or Social Security Number (SSN). Amazon may refuse payments if this isn’t done.

Schedule C (Sole Proprietors): Amazon income and company expenses are reported on Schedule C of your personal tax return if you are a sole proprietor.

Form 1120 (C- Corporations): Form 1120 is filed by Amazon sellers who are C-corporations to record business income, costs, and corporate tax.

Form 1065 (Partnerships): Each partner in a partnership reports their portion of revenues on their individual returns using Form 1065.

Knowing these documents enables Amazon sellers to stay compliant as their business expands, prevent reporting errors, and confidently reply to IRS warnings.

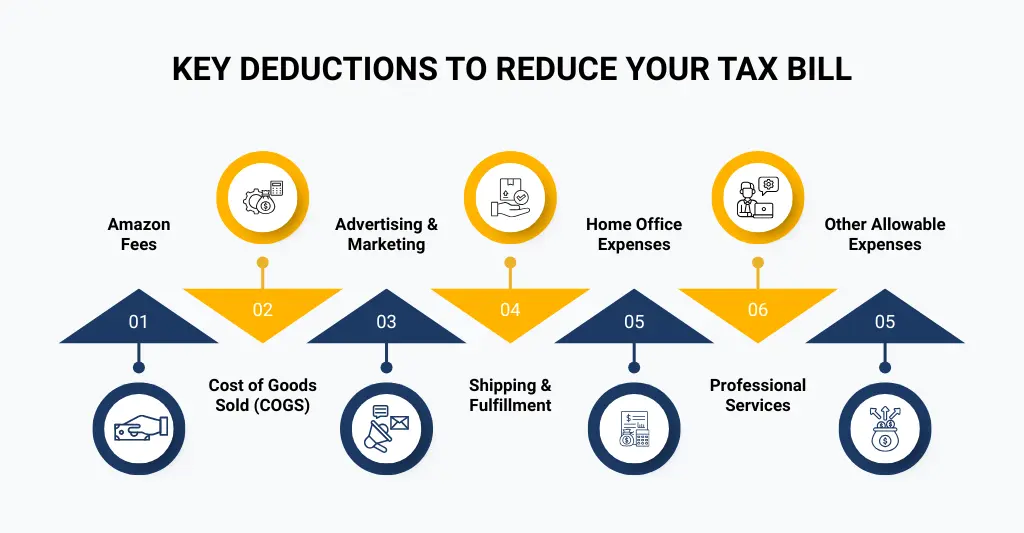

Top Tax Deductions for Amazon Sellers

The amount of tax you pay on your Amazon revenue might be greatly decreased by making the appropriate tax deductions. Expenses must be solely and entirely associated with operating your Amazon business to be eligible.

- Amazon Fees: Referral fees, FBA fees, storage fees, and subscription prices are all deductible Amazon-related expenses.

- Cost of Goods Sold (COGS): This covers import charges, packing, and the price of buying or producing your goods.

- Advertising and Marketing: Influencer payments, external advertising, Amazon PPC advertisements, promotions, and listing optimization expenses are all deductible.

- Shipping and Fulfilment: Freight expenditures, courier fees, inbound delivery to Amazon facilities, and third-party fulfillment expenses are all deductible.

- Home Office Expenses: Based on business use, you may be eligible to recover a percentage of your rent, electricity, internet, and phone expenses if you run your Amazon business from home.

- Professional Services: Payments to bookkeepers, tax experts, accountants, and legal professionals are completely deductible.

- Other Allowable Expenses: Business insurance, instruction on selling on Amazon, office supplies, and bank fees are examples of this.

Maintaining accurate records and receipts for every expense guarantees that you may accurately claim deductions and lower your tax bill without running the risk of noncompliance.

How to Organize Your Tax Records and Bookkeeping

For Amazon seller taxes, maintaining orderly tax documents is crucial. During tax season, it helps you complete accurate returns, stay in compliance with IRS regulations, and prevent last-minute stress.

Here’s how to do it the right way:

Separate business and personal finances: Use a different credit card for Amazon-related expenses and open a special company bank account. This greatly simplifies audits, spending classification, and income monitoring.

Track all Amazon income accurately: Your actual income is not represented by your bank deposits. Amazon settlement reports should always be used for recording:

- Gross sales

- Refunds and returns

- Amazon fees (FBA, referral, storage, advertising)

- Sales tax collected by Amazon

This ensures your income figures match IRS expectations.

Keep clear records of deductible expenses: Maintain records for expenses such as:

- Cost of goods sold (inventory, shipping, customs duties)

- Amazon advertising (PPC)

- Software tools and subscriptions

- Home office expenses (if eligible)

- Professional fees (accountants, tax advisors)

Save invoices and receipts digitally and keep them organised by month.

Record inventory properly: Keep track of purchases, closing inventory, and opening inventory. Accurate inventory valuation is essential, particularly if you sell through FBA, as it directly impacts your taxable profit.

Use cloud-based accounting software: Bank feeds may be automated, transactions can be categorized, and reports required for tax filing can be produced with the use of programs like QuickBooks, Xero, or Wave. Select software that is compatible with Amazon.

Reconcile accounts monthly: Every month, compare your bank statements and Amazon reports with your accounting records. Frequent reconciliation makes your records tax-ready all year long and aids in the early detection of problems.

Store records for IRS compliance: In general, the IRS advises retaining tax documents for a minimum of three years and, in some circumstances, up to six years. Digital copies should be backed up frequently and stored safely.

Quarterly Estimated Tax Payments Explained

Since no tax is deducted from your earnings, you often have to pay quarterly estimated taxes if you sell on Amazon in the United States.

Who needs to pay?

Self-employed vendors who anticipate paying at least $1,000 in federal taxes this year.

What do these payments cover?

Federal income tax

Self-employment tax (Social Security and Medicare)

When are payments due?

April 15

June 15

September 15

January 15 (next year)

Why does it matter?

Quarterly payments help you avoid penalties, spread out your tax expenses over the course of the year, and avoid a big year-end tax bill.

Amazon Taxes for Different Seller Models

Amazon seller taxes differ according to how you run your company. This is a summary of the seller model.

Individual (Sole Proprietor): Schedule C is used on your personal tax return to disclose income. On your net profit, you pay both self-employment tax and federal income tax.

Single-Member LLC: Unless you choose otherwise, you pay the same taxes as a sole proprietor. Self-employment tax is applicable, and profits are carried over to your personal return.

Partnership or Multi-Member LLC: Form 1065 is used to report income, and Schedule K-1 is used to distribute profits to partners. Taxes are paid on each partner’s portion.

S Corporation: Owners must pay themselves a fair salary (subject to payroll taxes) even though profits pass through to them. The remaining profit could lower the self-employment tax.

C Corporation: Owners pay tax on dividends, and the company pays corporation tax separately. Due to double taxes, it is less often the case for small Amazon sellers.

It’s important to discuss this with a US tax expert because selecting the appropriate structure has an impact on both the amount of tax you pay and how you report it.

Mistakes Amazon Sellers Make with Taxes

Many Amazon merchants encounter tax problems as a result of preventable errors. These are the most common ones.

Treating bank deposits as total income: Deposits made with Amazon are net of fees and reimbursements. Amazon reports, not bank accounts, should be the source of your taxable revenue.

Ignoring quarterly estimated taxes: IRS penalties and interest are frequently incurred when quarterly payments are missed.

Poor record keeping: Higher tax bills and disorganized filings are the results of improper inventory, cost, or fee tracking.

Misunderstanding sales tax rules: Compliance gaps may result from assuming Amazon manages all sales tax without verifying state requirements.

Waiting until tax season to organise books: Missed deductions, hurried filings, and mistakes are all results of late bookkeeping.

When to Hire a Professional Amazon Tax Accountant

When your sales start to increase, you sell in several states, or you have questions about quarterly tax payments, you should think about working with a competent Amazon tax accountant. They’re also crucial if you wish to legally lower your tax bill while maintaining compliance, receive an IRS letter, or find it difficult to keep track of inventory and FBA fees.

You trust Amazon to handle your marketplace—shouldn’t your taxes be handled by specialists too? Get expert support from accountants who understand Amazon seller taxes inside out.

FAQs: Frequently Asked Questions

Does Amazon take care of sellers’ sales tax?

As a marketplace facilitator, Amazon collects and remits sales tax in numerous states; nevertheless, sellers are still in charge of paying Amazon seller taxes and verifying state-specific regulations.

What records should Amazon sellers keep for taxes?

Bank statements, inventory records, sales reports, cost receipts, and Amazon charge statements should all be retained, with the help of Amazon accountants and eCommerce accountants.

How long should my Amazon tax records be kept on file?

In general, the IRS advises maintaining records for a minimum of three years, and in certain situations, up to six years.

What records should Amazon sellers keep for taxes?

Check your Seller Central account under Tax Settings and review your 1099-K form for tax details. Consult local tax regulations and a tax professional if necessary.

Does Amazon report your sales to the IRS?

Yes! Amazon must submit 1099-K forms directly to the IRS by January 31st for any third-party seller who meets transaction minimums ($20,000 in gross sales and 200 or more transactions) in a calendar year.

Conclusion:

Although it doesn’t have to be difficult, handling Amazon seller taxes in the US requires accuracy, consistency, and a thorough awareness of tax laws. Being proactive is essential for everything from keeping documents organized and paying quarterly taxes to avoiding frequent errors and selecting the best seller structure. Amazon sellers can stay in compliance, avoid fines, and confidently concentrate on expanding their businesses with accurate bookkeeping and timely tax preparation in Touch.

.