Running an HVAC business isn’t just about keeping systems running and customers cool or warm. Behind the curtain, you’re also managing invoices, payroll, parts, fuel costs, and taxes-often on top of long days in the field.

Many owners of HVAC businesses are great on the actual job themselves, but keeping up with the numbers can be overwhelming. Income changes with the seasons, expenses add up in a blink of an eye, and sometimes it is not clear if specific jobs are making the money. Without solid bookkeeping, even busy HVAC companies can feel stretched and unsure about their finances.

This guide is here to boil things down in simple terms. It explains how good bookkeeping keeps your HVAC business organized, improves cash flow, and avoids tax time surprises. Set up the right financial systems, and you can stop sweating the paperwork and start focusing on growing your business, no matter the season.

What Is Bookkeeping for HVAC Businesses?

Bookkeeping for HVAC is the process of recording, organizing, and managing all financial transactions related to an HVAC business.

This includes:

- Tracking income and expenses

- Managing accounts receivable and payable

- Recording payroll and labor costs

- Monitoring inventory and equipment purchases

- Preparing financial reports

Unlike general bookkeeping, bookkeeping for HVAC requires an understanding of job costing, service revenue, inventory usage, and contractor-specific expenses.

How HVAC Bookkeeping Differs From Standard Small Business Bookkeeping?

HVAC bookkeeping is more complicated than standard small business bookkeeping since HVAC work is job-specific and seasonal.

Here’s how it differs, simply stated:

- Job-based income tracking: HVAC companies make money per service call or installation. In contrast to traditional firms that offer the same products on a daily basis, each work has a unique cost.

- Job costing is essential: HVAC bookkeeping keeps track of labor hours, parts, gasoline, and travel expenses for each operation. Regular bookkeeping normally simply considers total income and costs.

- Seasonal income changes: HVAC work grows in the summer and winter, and decreases in the other months. Bookkeeping for HVAC assists in managing cash flow during slow seasons.

- Complex payroll management: HVAC professionals frequently work overtime, emergency shifts, and weekends. Proper bookkeeping can accurately record fluctuating hours.

- High operating expenses: Truck repairs, tools, parts inventories, and fuel are all frequent costs in HVAC operations that must be closely monitored.

- Service and maintenance contracts: HVAC companies may offer annual maintenance plans that require accurate tracking, which ordinary bookkeeping can not always provide.

Why Bookkeeping for HVAC Contractors Matters?

Bookkeeping for HVAC is important for contractors because it allows them to understand where their money comes from and goes. HVAC work is hands-on and fast-paced, and without adequate bookkeeping, it is simple to lose track of income, expenses, and profits.

- Helps you know if jobs are profitable: Bookkeeping for HVAC contractors identifies which jobs generate revenue and which cost more than projected. This allows you to price future jobs accurately.

- Improves cash flow management: HVAC contractors frequently deal with delayed payments. Bookkeeping keeps track of invoices and unpaid debts to ensure that payments arrive on time.

- Makes tax time easier: Maintaining accurate records enables HVAC companies to file taxes appropriately and avoid penalties from the IRS.

- Prepares you for slow seasons: Bookkeeping for HVAC allows you to plan for months when company slows down, keeping your spending under control.

- Builds trust with lenders and partners: Before making a loan, banks and lenders require clear and true financial documents. This can be possible because of proper recordkeeping.

Key Tasks in HVAC Bookkeeping

Bookkeeping for HVAC involves various daily and monthly responsibilities. These chores assist HVAC professionals in keeping their finances clean, organized, and easily understandable. When done correctly, they help to avoid future confusion and financial troubles.

- Recording daily income and expenses: Every payment made for service calls or installations is recorded. All expenses, such as components, fuel, tools, and supplies, are carefully recorded so that nothing is overlooked.

- Invoicing customers on time: Bookkeeping ensures that invoices are prepared and issued promptly after a job is completed. Faster invoicing frequently results in faster payments.

- Tracking payments and unpaid invoices: It displays which clients have paid and which are still outstanding. This improves cash flow and allows for better follow-up on late payments.

- Bank and credit card reconciliation: Bookkeeping reconciliation should be done based on records with bank and credit card statements to ensure that data is accurate.

- Payroll processing for technicians: Technician salary, overtime, and bonuses are appropriately computed. This reduces payroll errors and maintains employee satisfaction.

- Managing expenses and receipts: Receipts should be properly sorted and stored to prevent from being lost.

Common Bookkeeping Challenges HVAC Contractors Face

HVAC contractors tend to focus more on their fieldworks rather than their financial aspects. This means that any bookkeeping problem might gradually build up over time. Below are the most common challenges that HVAC contractors encounter in the United States:

- Blending Personal and Business Finances: Most contractors have a combined business and personal account at the bank. This causes a problem in isolating the real net profit for the business.

- Late or missed billing: Working long hours means billing is often postponed. This results in late payments, which in turn causes cash flow issues.

- Seasonal Cash Flow Challenges: HVAC projects are seasonal; that is, work slows down during certain months. If not planned for, expenses will remain the same while proceeds decrease.

- Payroll and overtime inaccuracies: Inaccurate manual calculation of hours worked, overtime, and emergency calls may lead to payroll discrepancies and unhappy employees.

- Falling Behind on Bookkeeping: If bookkeeping is put off for weeks or months, it becomes unpleasant work to play catch-up.

- Lost receipts and missing records: Small expenses for things like fuel or parts may go unclaimed. Missing records mean missing claims for taxes.

- Poor Job Costing: Without proper work costing, contractors have no idea whether it is a profitable job or an unprofitable job.

When You Should Hire Professional HVAC Bookkeeping Services?

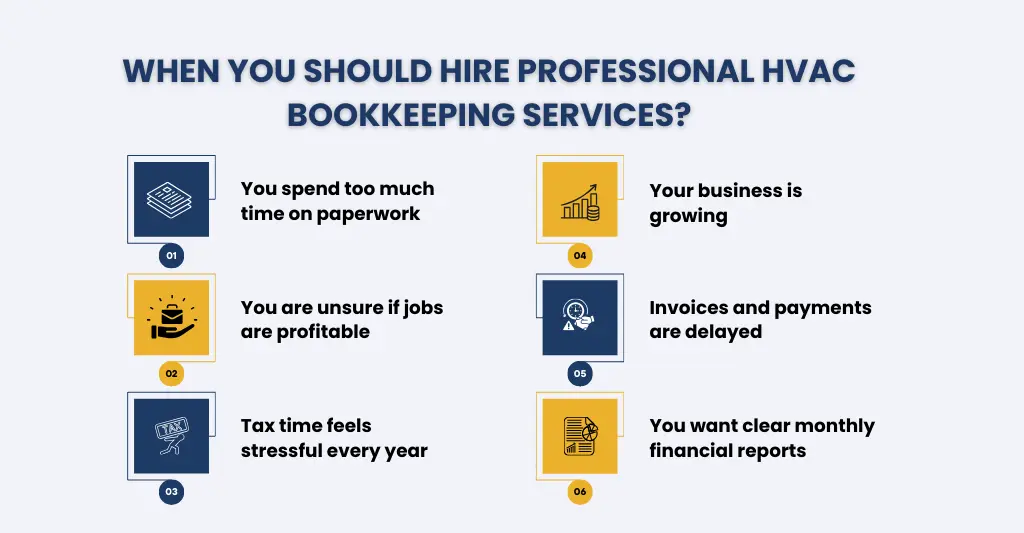

Many HVAC contractors start by doing their own bookkeeping. That may work in the early stages. However, when the firm expands, bookkeeping gets more difficult to handle. Here are obvious signals that it’s time to seek professional HVAC bookkeeping services:

- You spend too much time on paperwork: If bookkeeping is taking time away from work, customers, or your team, it’s time to seek assistance.

- You are unsure if jobs are profitable: If you are unsure which HVAC jobs produce money, professional bookkeeping can provide job costing reports.

- Tax time feels stressful every year: If taxes are complicated or penalties are common, a professional bookkeeper can assist keep records IRS-ready.

- Your business is growing: The addition of technicians, trucks, or service areas increases financial complexity. HVAC bookkeeping services ensure that expansion proceeds smoothly.

- Invoices and payments are delayed: Late invoicing and missed follow-ups hurt cash flow. Bookkeepers keep invoicing organized and on time.

- You want clear monthly financial reports: Professional bookkeepers provide easy-to-read reports that show real business performance.

Bookkeeping Best Practices for HVAC Contractors

Proper accounting helps ensure an HVAC business is profitable, in compliance, and ready to expand. The below are real-world best practices in the US designed specifically around how HVAC contractors operate: service calls, installs, seasonal variation, and work-oriented pricing.Using tools like QuickBooks for Contractors can streamline these processes, ensuring better tracking of job costs and invoicing.

Keep Business and Personal Funds Separate:

- Open a specific company bank account and credit card.

- Paying self by owner’s drawer, or payroll.

- It makes tax returns easier and protects you in case of audits.

Track Income by Job & Service Type:

- The accounting system for revenue arising from installation, maintenance, or repair jobs ought to record each separately.

- Assists you in identifying which services offer you the maximum margins.

- Necessary for proper job costing.

Use Job Costing in Every Project:

- All jobs should be tracked for labor hours, materials, permits, and subcontractors.

- Find those jobs that look as if they are making profits but are in reality losing funds.

- Essential for proper valuation of future HVAC projects

Record Expenses Weekly:

- Log the fuel cost, parts, tools, clothing, software, and ads regularly

- Weekly updates are useful in avoiding missing deductions.

- Provides stable cash flows in off-peak seasons.

Maintain Digital Copies of All Things:

- Save invoices, receipts, vendor bills, and payroll reports in electronic format.

- It decreases stress associated with audit processes, loans, and taxes.

- Saves against misplaced documents and last-minute scramble

Use HVAC-Friendly Accounting Software

- Select software that provides task costing, invoicing, and payroll.

- Integrates with field service tools if possible.

- Saves hours each month and reduces errors.

HVAC Accounting Services for Contractors in the US

HVAC contractors in the United States face job-based work, seasonal income variations, technician payroll, and complicated tax rules. Because of these issues, general accounting is rarely adequate. HVAC accounting and bookkeeping services in New York and across the United States are tailored to meet industry-specific requirements. The essential services listed below are thoroughly explained to demonstrate how each one benefits your organization.

Job Costing and Profit Tracking:

Bookkeeping for HVAC focuses on tracking expenditures for individual jobs. This includes work hours, materials,and subcontractor fees. Contractors can optimize future pricing by comparing predicted costs to actual expenses, allowing them to identify which jobs are profitable and which diminish margins.

Accurate Financial Reporting:

Accountants create monthly profit-and-loss statements, balance sheets, and cash flow reports. These reports reveal how much the company earns, what it owns, what it owes, and how much cash it has. Clear reports assist contractors in making more informed employment, expansion, and equipment purchasing decisions.

Cash Flow Management and Forecasting:

HVAC businesses frequently experience cash flow fluctuations owing to seasonality. Accounting services assist you keep track of receiving cash, outgoing expenses, and forthcoming commitments. Forecasting guarantees that there is adequate cash to cover payroll, fuel, parts, and slow periods.

Payroll Processing and Labor Compliance:

HVAC contractor’s payroll comprises hourly salaries, overtime pay, payroll taxes, and perks. Accountants ensure technicians are paid appropriately and on schedule by processing payroll tax forms, workers’ compensation, and federal and state labor requirements to the U.S. Department of Labor – Wage and Hour Division.

Invoicing and Accounts Receivable Management:

Accounting services guarantee that bills are sent on time and appropriately reflect the completed work. They also track overdue bills, follow up on late payments, and balance customer payments to keep cash flowing. Reliable bookkeeping services in New York are especially important for HVAC contractors managing multiple jobs and various transactions.

Are Late Invoices and Missed Job Costs Hurting Your HVAC Profits? Corient helps US HVAC contractors track every job, manage seasonal cash flow, and stay fully IRS-compliant — without the bookkeeping headache.

FAQs: Frequently Asked Questions

How often should HVAC businesses update their books?

Bookkeeping for HVAC businesses should be done weekly to accurately track job costs, cash flow, payroll, and expenses, and avoid financial surprises.

Do I need HVAC accounting software?

Yes, HVAC accounting software comes highly recommended. It enables you to track task expenses, many more tasks and keep organized in real-time. Using contractor-specific software simplifies financial administration, lowers errors, and provides more detailed insights into your business’s success.

What does HVAC bookkeeping include?

Bookkeeping for HVAC involves keeping track of daily financial activities such as income and costs, job costing, invoicing, payroll monitoring, bank and credit card reconciliations, and accounts receivable and payable.

Do HVAC contractors need specialized accounting?

Yes. HVAC contractors require sophisticated accounting since their operations include job-based labor, seasonal income, technician payments, and complicated tax requirements. General accounting frequently fails to effectively track job costs or manage cash flow during quiet seasons.

Conclusion:

HVAC contractors do not fail due to a lack of business; rather, they struggle when financial management lags behind daily operations. Without appropriate accounting, even busy HVAC businesses can experience cash shortages, tax concerns, and declining margins without recognizing it.

Professional HVAC accounting services provide clarity in the numbers. They demonstrate which jobs generate revenue, ensure that professionals are properly compensated, keep taxes under control, and assist contractors in preparing for slow seasons. With reliable financial data in place, business leaders can make more confident judgments rather than depending on guesswork.