Tax season is about to start. During tax season, when you check your annual spending, the figure can be frightening. As your spendings include tools, maintenance, safety equipment, travel, and subcontractor fees. You question whether you are losing out on chances to lower your tax liability and how much of it actually qualifies as a deduction.

The good news is that more tax write-offs are available to contractors than most people are aware of. Additionally, those deductions can greatly increase your bottom line when implemented properly. By working with expert Construction Accountants, you’ll be guided through the most important tax deductions, ensuring you retain a larger portion of your income and experience less anxiety throughout tax season.

What are Construction Tax Deductions, and Why Do They Matter?

Contractors are able to deduct business expenses from their taxable income through construction tax deductions. These include charges for things like fuel, tools, equipment, training, subcontractor fees, protective gear, and even a portion of your home office.

They are important because the construction sector has narrow profit margins, variable material costs, and irregular project schedules. Contractors can lower their tax liability, enhance cash flow, and retain more profit by taking advantage of all available deductions. In other words, the more effectively you monitor and report your spending, the more money you save and the more robust your construction company becomes.

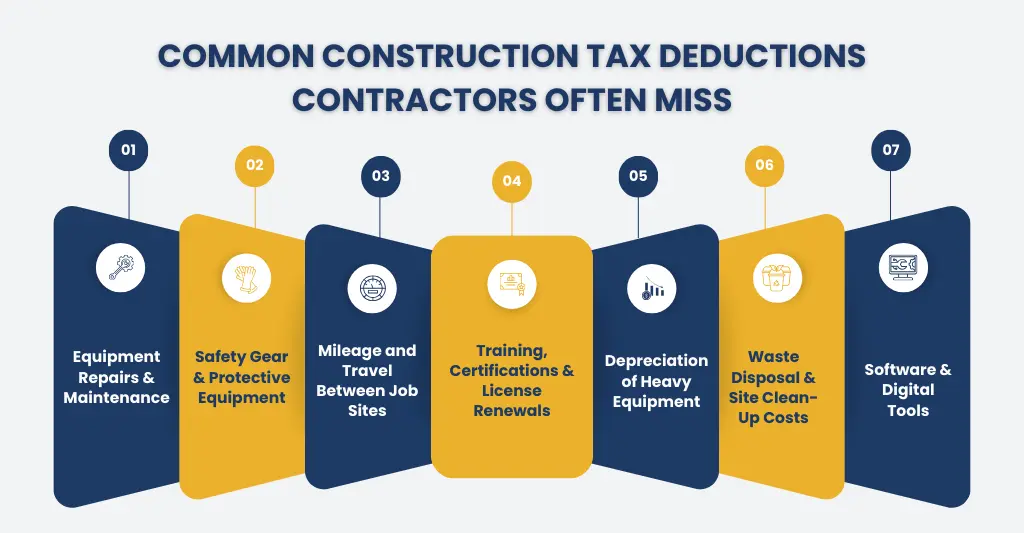

Common Construction Tax Deductions Contractors Often Miss

Many contractors leave significant deductions on the table because they don’t understand which are applicable. These are a few of the most often neglected ones:

- Equipment Repairs & Maintenance: Even while routine maintenance, repairs, and small part replacements for tools and machines are entirely deductible, they are frequently overlooked when costs mount up during peak seasons.

- Safety Gear & Protective Equipment: Helmets, gloves, boots, and high-visibility apparel are examples of items that are considered important business expenses; nonetheless, many contractors do not keep track of these modest but frequent purchases.

- Mileage and Travel Between Job Sites: Multiple site visits, client meetings, and trips to suppliers can soon mount up. Many contractors miss important yearly deductions because they are unaware of these deductions.

- Training, Certifications & License Renewals: Although sometimes disregarded, any training that aids in maintaining or improving your skills, such as professional licenses and safety certifications, is deductible.

- Depreciation of Heavy Equipment: The value of large machines gradually decreases over time. Although accurate depreciation claims can significantly lower your taxable income, many contractors underclaim due to the complexity of the regulations.

- Waste Disposal & Site Clean-Up Costs: Contractors often ignore legitimate project-related costs, including skip hire, disposal fees, and site cleaning services.

- Software & Digital Tools: Although they are typically not regularly recorded, project management applications, bookkeeping software, and construction estimating tools are deductible business expenses.

Materials, Labour, and Project-related Expense Deductions

Numerous moving components are involved in construction projects, and many of the expenses incurred to finish a contract are entirely deductible but sometimes disregarded. Contractors can lower their taxable revenue and increase overall profitability by knowing which expenses are eligible.

- Direct Material Costs: The cost of raw materials utilized directly in a project, such as steel, concrete, wood, tiles, fittings, and fixtures, is deductible. As long as they are connected to the completion of the project, even modest consumables like screws, nails, glue, and protective sheets are eligible.

- Subcontractor and Labour Payments: Payments to temporary employees, skilled laborers, site managers, and subcontractors may be written off as operating expenditures. This covers both hourly and project-based labor expenses.

- Equipment & Tool Hire: The cost of renting temporary site equipment, lifts, machinery, and tools is completely deductible. Because tool invoices frequently remain outside of standard accounting systems, many contractors neglect these deductions.

- Site Preparation & Clean-Up Costs: Clearing land, clearing debris, leveling the site, erecting a temporary fence, and establishing access routes are all expenses that can be written off as necessary to complete the project.

- Transportation of Materials & Equipment: Project-related expenses that are deductible include fuel, renting a car, delivery fees, supplier transport costs, and transporting large equipment between job sites.

- Project Management & Administrative Costs: Project-specific administrative services like cost-estimating tools, planning applications, site permits, blueprint printing, and project management software subscriptions are also eligible.

Tools, Equipment, and Machinery Deductions for Construction Work

In the construction business, some of the largest continuous investments are tools and machinery. Fortunately, a lot of these expenses are completely deductible, regardless of whether you purchase, fix, maintain, or rent them. Understanding what is eligible can drastically lower your taxable income.

- Purchase of Tools and Equipment: You can deduct the cost of any new tools, power tools, ladders, generators, and specialised construction equipment you use for your projects. As long as they are essential for your task, even little hand tools are acceptable.

- Heavy Machinery and Capital Allowances: Excavating equipment, loaders, cranes, and compactors are examples of large assets that can be claimed through capital allowances but do not qualify for a full deduction all at once. As a result, contractors can deduct a share of the asset’s annual worth.

- Tool & Machinery Repairs: Because they are necessary to keep equipment safe and operational, repairs, part replacements, service, and regular maintenance for tools and machinery are deductible costs.

- Storage, Security, and Transportation of Equipment: Deductions are available for costs directly related to construction activities, such as fuel and car rental, tool storage, and equipment transportation.

Vehicle, Travel, and Job-site Expense Deduction

Construction work necessitates frequent movement, including material transportation, supplier meetings, and site visits. Many of these regular expenses are tax-deductible, but they are frequently underclaimed due to improper tracking by contractors.

- Vehicle Usage for Work: You can deduct a portion of the cost of fuel, insurance, repairs, and maintenance if you use your car for business purposes, such as visiting locations, picking up supplies, or seeing clients. Depending on which is more advantageous, contractors may provide mileage rates or actual expenses.

- Travel Between Job Sites: Visits to suppliers, local travel for deliveries or inspections, and trips between several locations in a single day are all deductible as long as they are related to work and properly documented.

- Transporting Materials & Equipment: Project-related deductions include the cost of renting vans, trucks, or trailers, as well as delivery fees for transporting equipment, supplies, and tools to and from construction sites.

- Accommodation & Meals for Overnight Work: Hotel stays, meals, and incidental travel costs can be written off if a project needs you to spend the night away from home, as long as they are directly related to project responsibilities.

- Parking, Tolls & Permit Fees: Short-term permits, toll payments, daily parking at construction sites, and congestion fees are all valid but frequently disregarded deductions.

- Job-Site Utilities & Temporary Facilities: Essential job-site costs that are entirely deductible when linked to project completion include temporary electricity, water supply, portable restrooms, and site-office rents.

Home Office and Administrative Deductions

Many contractors manage estimates, schedule projects, process bills, and communicate with clients while operating a portion of their business from home. When properly reported, the deductible costs associated with these behind-the-scenes actions can drastically lower your tax liability.

- Home Office Space Used for Work: You can deduct a percentage of your rent or mortgage interest, utilities, council tax, and internet expenses if you utilize a specific area at home for project scheduling, bookkeeping, or client communications.

- Office Supplies & Stationery: Printers, ink, paper, folders, calculators, and regular office supplies are all completely deductible as company costs.

- Administrative Software & Tools: Subscriptions for cloud storage, bookkeeping software, estimating apps, invoicing tools, and communication platforms (like Zoom or Microsoft Teams) are all deductible administrative expenses.

- Phone & Internet Used for Business: If you use your mobile phone and broadband for job management, team coordination, or customer communication, you can deduct a portion of your expenses.

- Professional Fees & Memberships: As long as they support your business operations, expenses for trade groups, industry memberships, legal counsel, and expert advice are deductible.

- Training & Skill Development: You can also deduct online courses, safety certificates, compliance training, and refresher courses related to your construction work.

- Business Insurance Policies: When they directly support the firm, liability insurance, equipment insurance, and professional liability insurance are all acceptable costs.

Insurance, Safety Gear, and Employee-Related Deductions

One of the most important aspects of operating a construction company is safeguarding your workers, tools, and building sites. Many of the expenses related to personnel management and safety are completely tax-deductible. These deductions lower overall operational costs while assisting contractors in maintaining compliance.

- Business and Liability Insurance: Because they directly protect your company and employees, premiums for professional indemnity plans, equipment insurance, car insurance, contractor’s all-risk coverage, and public liability insurance are deductible.

- Safety Gear and Protective Equipment: Helmets, gloves, boots, high-visibility jackets, safety glasses, ear protection, and other PPE are all considered required business expenses. Many contractors overlook this recurring deduction because these things need to be replaced regularly.

- Employee Wages and Benefits: As long as they are related to your workforce, wages, overtime, holiday pay, sick pay, and employer payments like health insurance or pension contributions are all deductible.

- Training, Certifications, and Compliance Courses: First-aid certifications, CSCS cards, equipment-operation training, and health and safety training are all deductible since they maintain workers’ competence and compliance on the job.

- Uniforms and Workwear: Deductible Employee expenses include branded uniforms, sturdy apparel for on-site work, and replacements for damaged workwear.

Depreciation and Capital Allowances for Construction Assets

Long-term assets like trucks, machinery, and specialized equipment are crucial to construction companies. Contractors can lower their taxable income and reclaim some of their investment by claiming depreciation or capital allowances because these items lose value over time.

What Is Depreciation for Construction Assets?

Depreciation enables contractors to stretch the cost of expensive assets over the course of their useful lives, such as heavy tools, vehicles, cranes, and excavators. The cost is gradually subtracted each year rather than being claimed in full up front.

- Capital Allowances for Machinery and Equipment

Contractors are able to deduct a portion of their annual costs since many construction assets are eligible for capital allowances. This usually applies to things utilized for business, such as automobiles, power tools, machinery, and site equipment.

- Annual Investment Allowance (AIA): AIA allows contractors to deduct, up to a certain amount, the entire cost of qualified machinery and plant in the same tax year. This is particularly helpful for companies upgrading fleets or buying new equipment.

- Writing Down Allowances (WDA): Contractors may be eligible for Writing Down Allowances if an asset is ineligible for AIA or if the AIA cap has already been achieved. These enable the annual deduction of a portion of the asset’s value based on HMRC’s specified rates.

- First-Year Allowances (FYA): First-Year Allowances, which enable contractors to deduct 100% of the cost in the first year, may be available for some environmentally friendly or energy-efficient equipment.

- Record-Keeping for Asset Claims: To properly claim depreciation or allowances, accurate records of purchase dates, costs, usage, and business purpose are necessary. Maintaining accurate records also aids in preventing HMRC mistakes.

Bookkeeping and Record-keeping Practices to Support Decisions

A legitimate construction expense becomes an eligible tax deduction through careful bookkeeping. Even valid costs may be rejected in the absence of appropriate documentation. Clear record-keeping is crucial for construction companies, whose costs are split over several locations and projects.

Keep job-specific records: Keep separate records of each project’s earnings and outlays. Materials, payments to subcontractors, equipment rentals, and site costs should all be connected to the specific task. This facilitates the calculation of project-level profitability and the justification of deductions.

Save all invoices and receipts: Save copies of fuel receipts, tool purchases, hire fees, supplier invoices, and subcontractor bills. Digital copies are permissible as long as they are comprehensive and true. One of the most frequent causes of deductions being lowered or denied is missing documentation.

Separate business and personal spending: For construction-related costs, use a separate business credit card and bank account. Combining personal and business expenses increases the possibility of mistakes during a tax examination and makes it more difficult to justify what is deductible.

Maintain accurate mileage and vehicle logs: Keep track of the dates, locations, and reason for your trip if you want to claim deductions for your car. This is particularly crucial for commuting between different job locations, supply runs, and site visits.

Track asset purchases and depreciation: Keep track of the date, price, and commercial use of any equipment, vehicles, and tools. This guarantees you don’t lose out on long-term tax benefits and supports capital allowance or depreciation claims.

Use reliable bookkeeping software: Automated spending tracking, document storage, and report generation are all made possible by construction-friendly bookkeeping software. Additionally, it saves time and minimizes human mistake when submitting taxes.

In addition to keeping you compliant and ready in case your records are ever examined, sound bookkeeping procedures guarantee that construction tax deductions are precise, justifiable, and maximized.

Common Mistakes Construction Businesses Make When Claiming Deductions

Many construction companies miss out on valid tax deductions, not because the expense isn’t permitted, but rather because of preventable errors. Knowing these typical mistakes can help you avoid problems and safeguard your claims.

Poor or missing documentation: Making expense claims without the appropriate invoices or receipts is one of the biggest errors. Generally speaking, bank statements are insufficient. Genuine building costs may be denied in the absence of convincing evidence.

Mixing personal and business expenses: It is challenging to distinguish deductible expenses when personal and company expenses are made using the same bank account or credit card. This causes uncertainty when filing taxes and frequently results in overclaiming or underclaiming costs.

Claiming non-allowable expenses: Some expenses, such personal attire (not safety gear), fines, or private travel, may seem like work-related expenses but are not tax deductible. Making these claims may result in mistakes and raise the possibility of fines.

Not tracking tools and equipment properly: Missed depreciation or capital allowance claims may result from failing to document the cost, purchase date, and use of tools and machines.

Late or rushed record-keeping: Errors are more likely while trying to sort expenses at the last minute. Accurate and comprehensive deductions are ensured by consistent recordkeeping throughout the year.

Construction companies can securely claim deductions, lower their tax risks, and maintain greater financial control all year long by avoiding these typical blunders.

How to Plan a Tax Strategy to Maximize Construction Tax Deductions

Effective construction tax deduction claims require more than just year-end expense reporting. Construction companies can lower their tax obligations while maintaining compliance with a well-thought-out tax plan.

Review expenses regularly, not annually: Check your expenses on a regular or monthly basis instead of waiting until tax season. Frequent evaluations guarantee that nothing is overlooked or incorrectly categorized and aid in the early identification of deductible expenses.

Time major purchases wisely: When making purchases of machinery, tools, and equipment, keep tax timing in mind. Purchasing before or after the year-end may affect when and how capital allowances or deductions are claimed, depending on the tax laws.

Understand what qualifies as a deduction: Understand the distinction between capital expenditures and daily operating costs. Larger assets may need to be claimed over time, although materials, subcontractor fees, safety equipment, and site expenses are typically deductible.

Separate projects for clearer tax planning: You can analyze which projects result in higher costs and where deductions are strongest by keeping job-wise statistics. Better predicting and more smart bidding for upcoming contracts are supported by this.

Plan for vehicle and travel claims: Select the most advantageous way to submit a claim for car expenditures, and keep accurate records all year long. Maintaining accurate records maximizes permissible claims without taking any chances.

Wondering if you’re missing out on tax savings for your construction business? Let us help you uncover the deductions you may be leaving on the table — Book Your Free Consultation Today!

FAQs: Frequently Asked Questions

Can I deduct tools and equipment from my taxes?

Sure. Larger machinery and equipment are often claimed through capital allowances over time, although smaller tools may be claimed as regular expenses. Purchase records must be accurate.

Which costs are not deductible from construction taxes?

Private travel expenditures, fines, penalties, and regular clothing (not safety gear) are not permitted. Errors or penalties may result from claiming these.

What happens if I submit a deduction claim incorrectly?

It is preferable to fix mistakes as soon as you become aware of them. While sincere errors are typically correctable, frequent or negligent errors may result in consequences.

Conclusion:

If construction tax deductions are properly claimed and backed up by appropriate documentation, they can significantly improve your bottom line. The proper approach to taxes can help construction companies save money and maintain compliance, from monitoring site-specific costs and maintaining precise documentation to avoiding frequent mistakes and managing expenses in advance.

Effective bookkeeping, frequent evaluations, and a well-thought-out tax plan guarantee that you don’t overlook permitted deductions or make mistakes that could cause issues down the road. Construction companies can confidently manage their tax situation and concentrate more on completing projects and expanding the company by being organized throughout the year and obtaining the appropriate expert assistance when necessary.

Don’t miss out on valuable Construction Tax Deductions. Get in touch with our skilled team today to streamline your tax planning and secure the savings you deserve.