Do you own an eCommerce store? If yes, you might be aware of current online marketing landscape it is highly competitive and dynamic. Because of the particular traits and difficulties of the firms it serves, financial management can be particularly difficult. Not just any accountant can perform the task well, you need an eCommerce accountant who has worked with eCommerce companies.

If you have previously launched a firm, you may have acquired some expertise in overseeing and operating your present enterprise. However, accounting functions differently in the internet economy.

This article will make you understand more about the responsibilities of an eCommerce accounting firms, the benefits of hiring one, and qualities of a competent accountant.

What is eCommerce Accounting?

eCommerce accounting refers to the methodical procedure of documenting, arranging, deciphering, and conveying the financial exchanges that take place within an online store. Recording sales, costs, inventories, taxes, and other important information unique to the eCommerce industry are all part of this.

The major goal of eCommerce accounting firms is to give a clear and accurate picture of the financial health of your company so that you can make informed decisions and comply with all applicable tax laws. Even with its great significance, business owners frequently overlook the need to give their eCommerce accounting further thought. As a result, there are more financial disparities, inadequate cash flow management, inaccurate tax returns, and numerous other problems that could endanger the long-term viability and stability of your company’s finances.

What Differentiates eCommerce Accounting?

Accounting for eCommerce businesses differs slightly from accounting for traditional businesses. Even while the principles are still the same, there are several variations that any owner of an eCommerce business should be aware. The top four characteristics that make eCommerce accounting unique are listed below.

Transaction Volume: Comparing eCommerce companies to traditional brick-and-mortar retailers, the former usually deal with higher transaction volumes. Refunds, sales, and other financial transactions must be precisely tracked due to the high frequency, which calls for reliable eCommerce accounting solutions.

Transaction source: Multiple channels, including social media platforms, online marketplaces, and the company website, might be the source of a transaction in eCommerce . To combine and reconcile transactions from multiple sources, this diversity necessitates a more sophisticated accounting technique.

Inventory management: Tracking stock levels, sales, and order fulfilment across several channels and warehouses is a key component of eCommerce inventory management. For eCommerce accounting to guarantee accurate cost of goods sold (COGS) and profit margins, sophisticated inventory accounting systems are needed. eCommerce accounting firms have good expertise to manage all the inventory components effectively.

Integration and Data Collection: The operations of eCommerce companies mostly rely on digital tools and platforms. Accurate financial reporting requires the integration of data from several sources (such as payment gateways, shopping carts, and accounting software).

Multi-currency transactions: Numerous eCommerce companies are international and handle transactions in various currencies. Conversion to the company’s base currency and controlling exchange rate variations are necessary for accounting of these transactions. eCommerce accounting firms have experienced eCommerce accountants who can skilfully handle multi-currency transactions.

Customer Feedback and interactions: eCommerce companies frequently use digital platforms to communicate with clients and obtain feedback from them. This input can influence financial choices like product pricing and marketing costs, even though it has little to do with eCommerce accounting specifically.

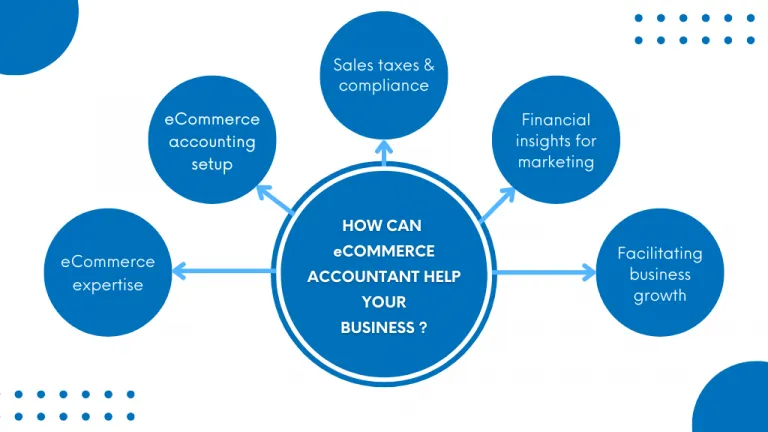

How eCommerce Accounting Firms Elevate Online Business Growth?

There are several vital tasks for your business that eCommerce accountant can do. Let’s understand them in detail to see the advantages that can be beneficial for your eCommerce business.

Preparing and adjusting book entries:

Making sense of your company’s financial records is the responsibility of an accountant. The complete picture is still unknown because your early financial records merely detail transactions. In order for you to comprehend the flow of your income and expenses, your accountants balance these transactions.

They aid in keeping track of the precise timings and dates of your financial transactions as well. Certain businesses have set times for their financial transactions. However, if you’re inexperienced, you could think that you lost money. eCommerce accounting firms can maintain your books tidy and well-organised while assisting with these problems.

Collaborating with your business auditors:

Many new sellers believe that audits are not necessary for small firms. In reality, though, small firms are the ones that most tax collection agencies devote their resources to auditing because they frequently file taxes wrongly.

Accountants assist in ensuring that the financial data you have is accurate and can collaborate with the auditor to resolve any possible problems. When your audit reports are completed satisfactorily, you may also be eligible for loans and even join with sponsors to grow your company.

Managing tax issues:

Tax collection and filing, particularly sales tax in the e-commerce sector, can be quite complicated. If you don’t understand how the taxing system operates, you’ll lose money by paying more than is necessary or face penalties. ECommerce tax accountants make sure you stay out of trouble and continue to handle taxes in a seamless and legal manner.

Accountants can help you regarding , determine how much sales tax to charge for your goods, pay your taxes on time to avoid problems, make sure that sales tax compliance is done correctly and on time, negotiate tax breaks, and even look for ways to qualify for exemptions.

Precise forecasting and risk analysis:

The information in your books is useful for more than only your current and prior circumstances. It can also be used by your accountants to project your future earnings. Experts in eCommerce accounting analyse recorded data to establish a pattern that predicts your earnings for the upcoming months.

Trends in eCommerce also shift quickly. It is not possible for eCommerce vendors such as yourself to use the same approach all year round; this will make it more challenging to stay ahead of your rivals. Finding these details requires forecasting in order to evaluate your next course of action and get the best outcomes.

What to look for when hiring an eCommerce accountant?

In the long term, hiring outside accounting and other services will be beneficial to your business even though it may seem needless and unsecure at first. Of course, it’s crucial to pick the right expert to believe. Selecting the appropriate external service to invest in is important.

Top factors to take into account when selecting an eCommerce accountant are as follows:

- Relevant experience: Seek for an accountant with specific knowledge of online retailers. Managing your costs may change depending on the systems used by sales channel platforms like Shopify or Amazon. eCommerce -savvy accountants understand how to effectively navigate these competitive, dynamic marketplaces and grow your company.

- Proficiency with accounting tools: Proficient eCommerce accounting firms possess extensive knowledge of well-known platforms such as Xero, QuickBooks Online, and other accounting software. Their ability to use these technologies effectively optimises accounting procedures and increases productivity.

- Understanding tax implications: Particularly when it comes to sales tax, foreign transactions, and nexus requirements, eCommerce enterprises have special tax considerations. Your selected accountant ought to be well-versed in tax laws and capable of ensuring that all applicable requirements are followed.

- Proactive Financial analysis & Planning: Proficient accountants in eCommerce proactively examine financial information, spot patterns, and offer strategic advice for expanding a company. Seek out an accountant who provides help on budgeting, cash flow analysis, and precise financial forecasts.

With their assistance, you’ll be able to allocate resources wisely, make well-informed judgments, and confidently handle the ups and downs of the internet marketplace.

Final words:

Are you assured that eCommerce accounting firms can assist you with your company’s requirements? Hiring eCommerce accounting firms is a smart choice in that case. Spending precious money on subpar service is not advised. At E2E accounting, we provide eCommerce businesses with the greatest service.

Our income tax, sales tax, and bookkeeping services are ideal for small enterprises. We also automate our procedures with the greatest accounting software. You may be confident that you are in good hands right away because our specialists have experience managing eCommerce firms.

To discuss all of your eCommerce accounting issues we are just a call away.