Small business owners are frequently the one unprepared for tax season.

One minute you are focused on sales, clients, payroll, and busy with many other things. Suddenly, the next moment you start searching through receipts, trying to recall where that expense went, and hope your numbers make sense before filing deadlines arrive.

Do you know what? Tax season doesn’t have to be stressful. With a simple checklist and a little tax preparation, you can stay organized, avoid last-minute surprises, and make sure you are not leaving money on the table.

After reading this blog, paying taxes this year will be a smooth and easy process. We will take you through a useful Tax Season 2026 checklist for small businesses in this article, which includes what paperwork to collect, what records to evaluate, and the crucial actions to take right away.

What is tax season?

People prepare their tax paperwork and report their income for the previous year to the IRS during tax season, which usually lasts from late January until mid-April. Additionally, consumers will pay their bills if they owe taxes or get a refund if they overpaid around this time.

Returns that are filed after tax season ends are generally considered late, which could result in penalties and costs if taxes are outstanding. Although filers who receive a timely extension have until October to file, their April tax bill is still due.

When will the tax season start 2026?

January 26, 2026, the Internal Revenue Service (IRS) formally launched the 2026 tax season in the United States. On that date, taxpayers will be able to start submitting their federal income tax returns for 2025, both electronically and through mail with IRS processing.

- Start Date: January 26, 2026: Federal individual tax returns for the 2025 tax year are accepted and processed by the IRS.

- End/Deadline (Tax Day): Unless an extension is requested, the majority of individual tax returns are due by April 15, 2026.

Although many taxpayers prepare ahead of time (compiling W-2s, 1099s, and other paperwork), you may only formally file your return after the IRS opens for the season, which was in late January this year (January 26).

How to prepare for tax season?

Early tax preparation will help you avoid costly errors, stress, and lost time. For businesses and taxpayers in the United States in particular, here is a straightforward and useful method of preparation:

Gather all tax documents early: Gather bank statements, investment reports, W-2s, 1099s, and documentation of any additional income. One of the main causes of late returns is missing paperwork.

Organise deductible expenses: Keep track of all of your expenses, including those related to your business, health care, charity, education, and mortgage interest. Clear classification minimizes errors and maximizes deductions.

Review last year’s return: To identify recurrent sources of income, deductions, or credits you might require again, review your prior tax return. It’s an easy approach to make sure you don’t forget anything crucial.

Check for tax law or income changes: Your tax situation may change if your income, filing status, dependents, or business structure changed over the year. Planning ahead avoids shocks.

Plan for payments or refunds: Set aside money early if you are expecting to pay taxes. Early filing typically results in quicker processing if you are hoping for a refund.

Decide how to file: Make an early decision on whether to work with a professional, use tax software, or file yourself. Your options are limited if you wait until the last minute.

Clean Up Your Books Before Tax Season Starts:

Make sure your financial records are correct and current before tax season starts. Check revenue and cost categories, reconcile bank and credit card statements, and correct any transactions that are missing or incorrectly classified. Clear, well-organized books help guarantee that your tax return is filed accurately and on time. Without needless stress or surprises by reducing errors and preventing last-minute panic.

To learn more about how clean up bookkeeping can streamline your financial processes, check out our detailed guide on efficient bookkeeping practices.

Review Business Expenses & Missed Deductions:

Spend some time carefully reviewing your business costs to find any deductions you might have overlooked this year. Analyze areas such as professional fees, software subscriptions, travel, home office charges, and office expenses. By reviewing these before tax season starts, you may minimize your tax bill, claim all available deductions, and avoid overpaying.

Keep Tax Forms Ready:

Before filing, make sure you have gathered and arranged all essential tax forms. W-2s, 1099s, pay cheque summaries, bank and credit card statements, and investment reports fall under this category. Early preparation of these documents facilitates a more seamless and stress-free tax season by reducing errors and preventing filing delays.

When Is Tax Season Over? Filing Deadlines That Matter

Depending on how and when you file, tax season in the United States ends gradually rather than all at once.

April 15, 2026 – Main Tax Deadline

The deadline for filing federal income tax returns and paying any outstanding taxes for the majority of people and businesses is April 15, 2026. Filing by this deadline helps you avoid penalties and interest.

The deadline for an extension is October 15, 2026.

You have until October 15, 2026, to file your return if you request an extension. Remember that an extension only extends the time you have to file; it does not extend the time you have to pay. The deadline for paying any outstanding taxes is April 15.

Business-Specific Deadlines

Some businesses have different timelines:

- March 15, 2026 – Partnerships and S corporations

- April 15, 2026 – C corporations and sole proprietors (unless extended)

Even though tax season can seem “over” after April, it’s crucial to remember company deadlines and extensions in order to stay compliant and save needless fines.

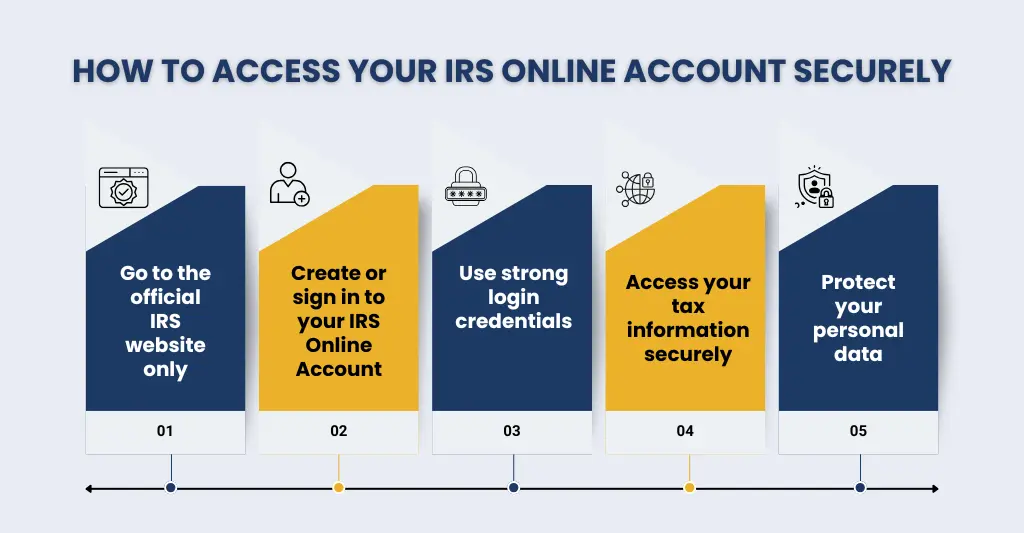

How to Access Your IRS Online Account Securely

With an IRS online account, you can manage your tax information, examine tax records, check balances, and make payments all in one place. Here’s how you get to it securely and stay clear of typical security problems:

Go to the official IRS website only:

Never click on links from emails or texts; instead, always begin on the official IRS website. Sensitive information will never be requested via unauthorized communications by the IRS.

Create or sign in to your IRS Online Account:

If you don’t already have an account, you will need to create one. This involves employing secure authentication techniques, including a government-issued ID and personal data, to confirm your identity.

Use strong login credentials:

Make a secure, one-of-a-kind password and turn on two-factor authentication (2FA). In addition to a username and password, this provides an additional degree of security.

Access your tax information securely:

You can access your transcripts, notices, payment history, and tax balance after logging in. When utilizing a shared or public device, it is extremely important to log out after every session.

Protect your personal data:

Keep in mind not to access public Wi-Fi for logging your IRS account. Update the software on your device and never give out your login credentials.

Using the IRS online account securely lets you keep in control of your tax information while lowering the risk of identity theft or fraud during tax season.

Why Filing Early Can Make Sense?

IRS 2026 tax season filing is about to begin! Early tax return filing has significant benefits for both people and corporations, and it’s not just about finishing the process.

Faster refunds: If you are eligible for a refund, you will typically get it sooner if you file early. Early returns, particularly those filed electronically, are processed by the IRS earliest.

Lower risk of fraud: Early filing lowers the risk of identity theft related to taxes. It is far more difficult for someone else to file falsely using your information once your return is on file.

More time to fix issues: Humans make mistakes so it’s obvious that mistakes may happen. So, if you start tax preparation early you have more time to fix mistakes, reply to IRS letters, and submit any missing paperwork on time.

Better cash flow planning: Budgeting and cash flow decisions are made easier when you know early on whether you owe taxes or are owed a return, especially for business owners.

Less stress as deadlines approach: Stay clear of the last-minute rush when IRS helpline number, systems, and tax specialists are at their busiest.

Accounting for Small eCommerce Businesses During Tax Season

Due to huge transaction volumes, numerous sales channels, and complicated tax regulations, small eCommerce enterprises may find IRS 2026 tax season filing difficult. But organizing your accounting makes a significant impact.

Track sales across all platforms: Make that all sales are fully recorded and reconciled from marketplaces, eBay, Shopify, Amazon, and payment gateways. Inaccurate tax reporting may result from missing or duplicate transactions.

Reconcile payment processors regularly: Compare your sales data with payouts from PayPal, Stripe, Square, and other processors. Chargebacks, fees, and reimbursements must all be precisely documented.

Manage inventory and cost of goods sold (COGS): Accurate inventory tracking is necessary for accurate profit calculations. COGS errors can affect cash flow planning and alter taxable income.

Stay on top of sales tax obligations: States may have different sales tax laws. Track sales that are taxable versus non-taxable, determine where you have nexus, and maintain records that are ready for reporting.

Prepare reports before filing: Generate profit & loss statements, balance sheets, and sales summaries before tax filing. Accurate filing and providing answers to inquiries are made easy with clean reports.

Business Income Tax: What You Need to Know This Tax Season

During tax season, business income tax can seem complicated, but knowing the fundamentals helps you stay compliant and stay clear of expensive mistakes.

Know what counts as taxable business income: Sales and service revenue, as well as any other income from commissions, interest, or side projects, are all considered taxable income. Ensure proper reporting of all sources of revenue.

Understand your business structure: Different taxes apply to companies, partnerships, LLCs, and sole proprietors. Which forms you submit, how income is recorded, and when taxes are due are all determined by your structure.

Set aside funds for tax payments: Make plans for planned or year-end tax payments if there are no taxes withheld. By doing this, cash flow issues and late fees are avoided.

Track deductible business expenses: Operating costs, software, marketing, professional fees, rent, and utilities are examples of common deductions. Having accurate records lowers taxable income and avoids problems if they are questioned.

Keep records ready for review: Keep accurate financial statements, books, and receipts. Organized records facilitate filing and bolster your figures in the event that the IRS challenges you.

IRS 2026 tax season filling can go more smoothly if you have a better understanding of your company’s finances. And if you prepare your business income taxes ahead of time.

Sales and Use Tax (What to Watch for This Tax Season)

Sales and use tax can easily catch businesses off guard, especially if you operate across states or sell online. It’s crucial to thoroughly analyze a few vital areas throughout tax season.

Confirm where you have tax obligations: Sales tax rules depend on where you have nexus, which can be triggered by physical presence or sales volume in a state. Make sure you’re registered and collecting tax where required.

Review taxable vs non-taxable sales: Different taxes apply to different goods and services. To prevent collecting too much or too little tax, double-check the classification of your offerings.

Reconcile collected tax with filings: Compare the amount you reported and paid with the sales tax you collected. Disparities are frequently caused by marketplace fees, rebates, or refunds.

Don’t overlook use tax: When sales tax was not applied to taxable purchases, use tax is applicable. Many businesses miss this, which might bring exposure during inspections or audits.

Check marketplace facilitator rules: Verify who is in charge of collecting and sending sales tax if you sell on online marketplaces. Rules differ by platform and state.

Why Businesses Rely on E2E Accounting During IRS Filing Season 2026

Businesses have to deal with stricter deadlines, strict reporting standards, and increased scrutiny during the IRS 2026 tax season filing. Making timely and accurate financial data more crucial than ever. Because E2E accounting guarantees that books are clean, reconciled, and tax-ready well in advance of filing, many businesses rely on it.

Businesses can prevent costly mistakes and last-minute hurries by implementing standardized systems for income, expenses, payroll, and sales tax data. Additionally, E2E Accounting partners closely with CPAs and tax consultants to provide audit-ready, transparent reports that speeds up filing and minimizes back-and-forth during busy times. This end-to-end support gives businesses confidence, control, and peace of mind when it matters most.

Tax season doesn’t have to be stressful! Let us help you get ahead of the game. With our Clean Up Bookkeeping services, we’ll make sure your records are organized, your deductions are maximized, and you’re ready for a smooth, hassle-free tax filing. Reach out to us today and take the first step toward a stress-free tax season!

FAQs: Frequently Asked Questions

When does the IRS tax filing season usually get underway?

The IRS tax filing season basically starts late January, when it starts letting them know it’s accepting and processing federal tax returns. Then the fun can begin.

How Early Can I Start Filing My Taxes in 2026?

It will be best if you start the tax filing process as soon as possible. Just keep in mind the filing deadline and plan accordingly.

When will I be seeing my Tax Refund in 2026?

If you decide to go the e-filing route and elect to get it directly deposited, most refunds tend to be issued within about 21 days of them accepting your return, so a lot of early birds might see some cash flow by mid-February to early March. On the other hand, if you’re claiming credits like the Earned Income Tax Credit or Additional Child Tax Credit you can expect a delay. And if there are errors on your return or you go the paper route, well… hold on to your hat.

Why filing early makes sense.

As you read on this blog, filing early is a smart move because it gets your refund in your hands faster, cuts down on the risk of tax scams, gives you more time to iron out any issues that come up and generally keeps you from losing your head at the last minute.

Are tax returns going to be bigger in 2026?

Yes, you are going to see some bigger tax refunds in 2026 compared to previous years. Due to changes in the tax code that give you bigger deductions and more credits for your 2025 returns, that you will be filing in 2026. These changes – think bigger standard deductions, expanded child tax credits and new deductions for tips and overtime, are going to give most folks an average refund that’s a cut above what they are used to.

Conclusion:

After reading this blog, you might have understood that pre-tax planning is the most important step before tax filing and tax paying. It’s not necessary to feel overburdened by tax season. Filing becomes much easier when your books are tidy, your numbers are clear, and everything is ready in advance. Little steps beforehand will make a big difference in terms of fewer surprises, reduces stress, and increases decision confidence. You don’t need to rush at the last moment.