Running a Shopify store in the United States is exciting but many store owners struggle to keep the numbers hidden. Shopify accounting may become difficult when dealing with daily sales, refunds, payment gateway fees, sales tax requirements, and inventory movements. A single discrepancy between your Shopify dashboard and your books might cause cash flow problems, improper profit margins, and unanticipated tax liabilities.

This is where Shopify Accounting Services for your US online store can make all the difference. With the appropriate accounting system, every sale, charge, and tax is accurately tracked, your financial reports remain IRS-ready, and you get a clear picture of what your store is genuinely earning. Instead of responding to data at the end of the month, you can utilize real-time information to price intelligently, better manage inventory, and confidently scale your Shopify business.

What Are Shopify Accounting Services?

Shopify Accounting Services manages your store’s financial data from start to finish, ensuring that every transaction is precisely recorded and in accordance with US accounting and tax standards. These services go beyond basic bookkeeping by connecting your Shopify store to your accounting system, providing you with a clear and dependable view of your company’s finances.

Typically, Shopify accounting includes keeping track of daily sales, refunds, discounts, and payment gateway fees, reconciling Shopify payouts with bank deposits, controlling inventory expenses, and creating accurate financial reports. It also entails managing US sales tax data, tracking profit margins, and keeping your books ready for CPA and IRS audits.

In basic terms, Shopify Accounting Services assist US online store owners in transitioning from “guessing profits” to understanding precisely where their money comes from, where it goes, and how to expand the business sustainably.

Why Shopify Stores Need Specialized Accounting Support?

Shopify stores handle high-volume transactions, refunds, payment fees, and multi-state sales tax, which general accounting sometimes overlooks. Specialized Shopify accounting guarantees that sales, payouts, inventories, and taxes are properly documented. This provides store owners with precise profitability, clean accounts, and clear financial insights, allowing them to grow confidently.

Signs Your Shopify Store Has Outgrown DIY Bookkeeping

If your Shopify store is growing, DIY bookkeeping can rapidly become stressful. One obvious sign is when your Shopify sales do not match your bank deposits owing to fees, refunds, or chargebacks. Another warning flag is depending on uncertain estimations rather than knowing your actual profit margins.

Struggling to track inventory prices, falling behind on reconciliations, or being uncertain about cross-state sales tax requirements all indicate the need for professional assistance. When bookkeeping consumes time away from marketing, fulfillment, or expansion planning, your Shopify store has most certainly outgrown DIY bookkeeping.

Revenue and Activity Milestones to Consider Hiring a Shopify Accountant

Over the years as your Shopify store expands, certain income and activity thresholds indicate that it’s time to hire an expert. Consistent monthly sales, handling a high volume of daily purchases, and processing frequent refunds and chargebacks are the reasons to hire a shopify accountant. The time when business grows doing DIY bookkeeping can be a tough task.

Expanding into numerous US states, managing sales tax responsibilities, introducing different payment channels, and growing inventories across items and facilities are all significant milestones. At this point, a Shopify accountant assists with keeping your records clean, ensuring compliance, and providing solid financial data to support confident growth decisions.

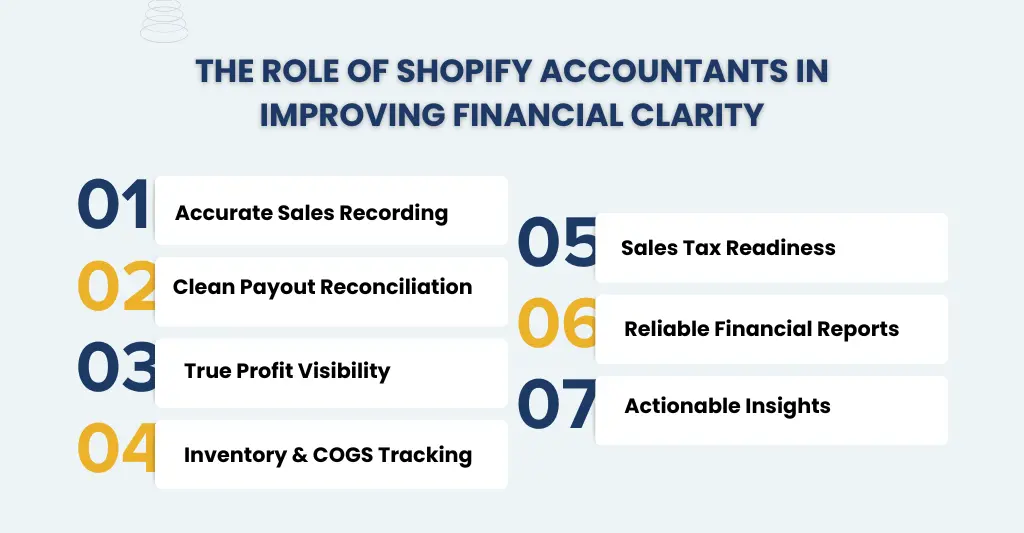

The Role of Shopify Accountants in Improving Financial Clarity

- Accurate Sales Recording: Shopify accountants verify that every sale, refund, discount, and chargeback is appropriately recorded, so your income figures represent reality rather than estimation.

- Clean Payout Reconciliation: They reconcile Shopify payouts with bank deposits, allowing for payment gateway fees and timing differences, to avoid cash flow confusion.

- True Profit Visibility: They assess your true profit margins, which include product expenses, shipping, returns, and platform fees, rather than just top-line sales.

- Inventory & COGS Tracking: Shopify accountants correctly track inventory movement and cost of goods sold, allowing you to identify which products generate revenue.

- Sales Tax Readiness: They organize and review sales tax data across states, ensuring that your books are structured and ready for CPA filing and compliance.

- Reliable Financial Reports: You will receive clear monthly reports such as profit and loss statements and balance sheets. Accurate financial reports will help you to make informed business decisions.

- Actionable Insights: Shopify accountants use clean data to help you identify trends, effectively manage cash flow, and confidently plan for development.

How Shopify Accounting Services Help With Sales Tax Compliance?

Sales tax is one of the biggest headaches when it comes to running a Shopify store in the US – especially when you’re selling in multiple states. Luckily Shopify Accounting Services is there to lend a hand by getting your sales data in order and figuring out where you’re left with sales tax to pay based on what your business is up to.

Shopify accountants get their heads around what’s taxable and what’s not – as well as sizing up where you’re at risk of being considered ‘present’ in a given state. They then double check that the sales tax you are collecting through Shopify shows up properly in your books. Plus they cross check your sales tax reports with your payment records just to make sure that nothing has been reported incorrectly.

Shopify Accounting Services gets rid of the stress of messing things up – penalties, last minute surprises and all that – by keeping all your sales tax info clear, consistent and ready to go for submission, so you can have the confidence that your store will stay on the right side of the law even as it keeps on growing.

When to Choose eCommerce Bookkeeping vs Full Shopify Accounting Services?

The size, activity, and aims of your store will determine whether you should use basic eCommerce bookkeeping or complete Shopify accounting.

eCommerce Bookkeeping is appropriate when your Shopify store has a minimal transaction volume and simple procedures. It focuses on recording sales, expenses, and bank reconciliations, providing basic financial visibility.

Full Shopify Accounting Services are the best option as your business grows. If you manage large order volumes, various payment methods, inventory complexity, multi-state sales tax, or require precise financial reporting for planning and tax filing, full accounting assistance is required.

In brief, bookkeeping maintains your records in order, whereas full Shopify accounting allows you to evaluate performance, stay compliant, and make confident growth decisions.

Real Benefits of Hiring Shopify Accounting Services for Your Business

Hiring Shopify Accounting Services provides your organization with more than simply organized records; it provides insight and control over your cash. Accounting for fees, refunds, shipping, and inventory costs, in addition to sales totals, yields correct profit estimates.

Using these services will save time by handling reconciliations, reporting, and tax-ready records. It will allow you to concentrate on business development. Further, it also benefits in reducing compliance risks by organizing sales tax data and preparing financial statements for CPA and IRS review.

Most importantly, Shopify accounting provides trustworthy cash flow and performance analytics, allowing you to confidently make wiser pricing, inventory, and scaling decisions.

Grow Your Shopify Store with Optimized Accounting Services

In any kind of business, growth is not just about increasing revenue; it’s also about understanding your numbers at all stages. Optimized Shopify accounting services provide a clear perspective of cash flow, profit margins, and costs, allowing you to identify what’s driving growth and what’s holding it back.

With reliable financial data, you can better price your products, manage your inventory, and confidently plan your marketing budget. Instead of responding to surprises at the end of the month, you make informed judgments. The end result is a Shopify store that scales seamlessly, remains compliant, and expands on a solid financial base.

Tired of Shopify Sales That Don’t Match Your Bank Account? Let Corient’s US eCommerce accounting specialists clean up your books, fix your reconciliations, and keep you 100% IRS-compliant — starting now.

FAQs: Frequently Asked Questions

How do Shopify Accounting Services increase profitability?

Shopify accountants calculate your true profit margins by tracking all expenditures, including fees, refunds, shipping, and inventory. This allows you to better price things, manage expenses, and scale more profitably.

Can Shopify Accounting Services help you with US sales tax compliance?

Yes. Shopify accountants organize taxable sales data, track sales tax collected, and prepare records for filing. This lowers the possibility of underreporting, penalties, and compliance concerns.

Are Shopify Accounting Services ideal for small and growing businesses?

Absolutely, these services scale with your company and are beneficial to both growing Shopify stores and established companies that require clarity, compliance, and dependable financial information.

Conclusion:

Increasing traffic and conversions isn’t enough to build a successful Shopify store in the US. As your company grows, financial precision, reporting clarity, and tax readiness are just as vital as sales. Shopify Accounting Services keep you in control by ensuring that every transaction is properly documented, profits are readily understood, and sales tax data is arranged for compliance.

With clean books and dependable financial insights, you can confidently plan inventory, marketing expenses, and expansion. Instead of responding to figures after the fact, you make informed decisions that promote consistent, long-term growth.