More than knowledge on how a heating, ventilation and air conditioning (HVAC) business can be technologically executed, it needs financial intelligence to succeed in the US. With several projects to handle, clients to attend to, and teams to supervise, HVAC contractors have a hard time keeping their books in an organised manner. It is here that HVAC accounting takes place.

HVAC accounting is the practice of managing financial transactions, tracking job costs, payroll, and taxes specifically for US heating, ventilation, and air conditioning contractors. It is a specialized accounting solution tailored to HVAC companies, providing contractors with financial clarity to minimize tax liabilities and maximize profitability.

We will take you through the basics of HVAC bookkeeping in this guide, from integrating the systems to managing job cost accounting and processing payroll in selecting the appropriate software. Whether you are starting a new venture or upgrading your financial systems, this guide will help you with smoother, smarter and stress-free financial processes.

What Is HVAC Accounting?

An HVAC accounting (also HVAC construction accounting or HVAC service business accounting) is a specialised set of financial management practices that are applied to HVAC contractor and service businesses. It includes job costing, cash flow monitoring, payroll processing, tax planning, and financial reporting, all aligned according to the unique needs of the HVAC operations. As compared to general accounting, HVAC accounting has to consider seasonal variations in job costing and equipment depreciation, as well as labor tracking.

Job Costing for HVAC Contractors

Job costing enables you to monitor all the expenses, such as labor, materials, equipment, and subcontractors, associated with specific projects. It helps you determine which job is more profitable and otherwise.

Why it matters:

- Improves bid accuracy

- Prevents budget overruns

- Informs future pricing strategies

Cash Flow Management in HVAC Business

The HVAC industry is seasonal in nature; thus, cash flow management is important. Therefore, due to the fluctuating nature of the business, it is necessary to keep track of cash inflow and outflow and any upcoming expenses so that you are cash-ready throughout the year.

Best practices include:

- Cash flow forecasting

- Invoice automation

- Managing AR/AP cycles

Payroll Management for HVAC Companies

Payroll can be complex due to variable hours, overtime, field technicians, training and handling union pay rules. It must also comply with federal and state tax requirements.

Effective payroll management includes:

- Accurate time tracking per job

- Automating tax withholdings and filings

- Complying with necessary labor laws

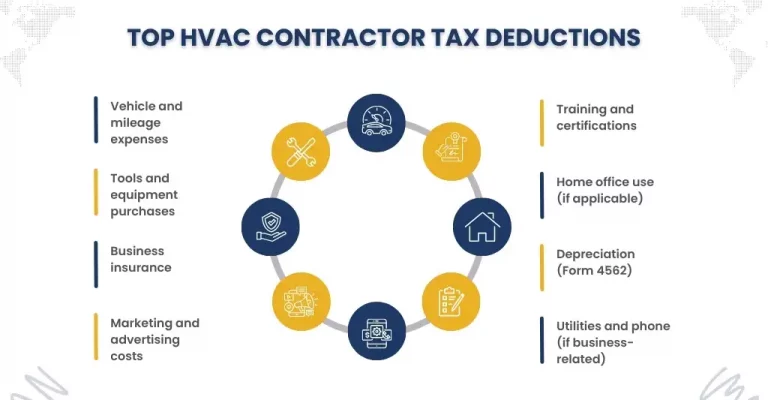

HVAC Contractor Tax Deductions

Tax saving plays a major role in the bottom line. Adequate accounting of deductible expenses would assist HVAC contractors in reducing taxable revenues and saving thousands annually.

Common deductible items:

- Vehicle and mileage expenses

- Tools and equipment purchases

- Business insurance

- Marketing and advertising costs

- Training and certifications

- Home office use (if applicable)

Integration with accounting: These should be properly categorised and recorded within your accounting system throughout the year to make it easy and precise to file your taxes.

Accounting Software for HVAC Contractors

Selecting proper accounting software that is tailored according to your business aids in automating and centralising your financial activities such as invoicing, job costing, payroll and reporting.

Look for software with:

- Field service integrations

- Mobile access

- Customisable reporting

- Payroll and tax modules

Understanding and implementing these practices will help HVAC contractors have the ability to develop a clear insight with regard to the financial activities of the business, eradicate mistakes, maximise profitability, and position the enterprises as financially successful in the long term.

Note: You can also check out our other blog on accounting software for construction business

Why HVAC Accounting Is Important for Contractors

The environment that HVAC contractors work in is also extremely dynamic, where they balance the needs of job sites, equipment, seasonal demand and coordination of labor. Any inaccuracy in accounting, and you will easily lose sight of where your business is standing financially.

Here’s why HVAC accounting is essential:

- Improves Profit Margins: When a contractor can identify where the money is made or lost on each job, it will be easy to eliminate inefficiencies and allow the price of services to be kept more efficiently.

- Manages Seasonal Volatility: HVAC tasks usually peak up during the summer and the winter. Good accounting also allows you to anticipate slow times and conserve the cash reserves.

- Ensures Compliance: The contractors have to manage income tax, sales tax, employment tax and local HVAC-related queries in some cases that are specific to licensing requirements. With proper accounting, you are will always be audit-ready.

- Enables Scalable Growth: As capital costs are explicit, you can make the strategic move of hiring employees, expanding service areas, or buying new machines.

- Attracts Investors or Lenders: You might be planning to sell your business or expand it; in both situations, clean books and consistent financial reports will make your business more attractive to external parties.

A successful HVAC business can suffer the underpayment of bills, exceeding budget or tax problems when the accounting is neglected. On the contrary, a firm foundation in accounting ensures growth and efficiency within operations.

How to Set Up an HVAC Accounting System: Step-by-Step Guide

Setting up an HVAC accounting system involves these critical steps:

1. Choose an Accounting Method

Most small HVAC businesses use the cash basis method initially, which records income when received and expenses when paid. However, larger firms may switch to the accrual basis for better long-term visibility.

2. Open a Separate Business Bank Account

Never intermix personal and business. Create a special business account to make it easier to write bookkeeping and reporting.

3. Use Job Costing Tools

Introduce job costing when it comes to HVAC contractors. This will help in monitoring each project in terms of labor, materials, as well as overheads. It will make you understand which jobs will be profitable and which one will not.

4. Implement Accounting Software

Invest in an accounting software that focuses on HVAC contractors and enables real-time dashboards, payroll, and field service app integrations.

5. Establish a Payroll System

Use compliant payroll management for HVAC companies that includes tax withholding, workers’ compensation, and time tracking.

6. Create a Chart of Accounts

Customise your chart of accounts to have HVAC-specific classifications, such as equipment rental and subcontractor labor and travel and marketing.

How to Manage HVAC Financial Transactions

Efficient transaction management includes:

- Daily Reconciling: Reconcile all the payments and invoices with bank transactions

- Invoice Promptly: Send out the invoices as soon as the job is complete in order to better cash flow

- Track Accounts Receivable: Track overdue accounts on a regular basis

- Monitor Expenses: Categorise costs to identify any irrelevant expenses

- Use Digital Tools: Leverage the services of Bill.com and NorthOne platforms, which will enable you to digitalise your payments and have a better understanding of your cash flow

When you have a proper cash flow management arrangement in your HVAC business, it means you will be able to pay your staff and place orders, as well as invest in expansion without any hitch.

Common HVAC Accounting Challenges and How to Overcome Them

| Challenge | Solution |

| Inaccurate job costing | Use digital job-costing systems with labor/material tracking |

| Poor cash flow management | Forecast cash flow using seasonal trends and client payment patterns |

| Payroll errors and compliance issues | Automate with a payroll platform integrated with your accounting software |

| Missed tax deductions | Hire a CPA who knows HVAC contractor tax deductions |

| Failure to have field and office integration | Link the field with accounting using cloud-based tools |

Key Accounting Terms Every HVAC Contractor Should Know

- Job Costing: Charging a particular project with expenses

- Accounts Receivable (AR): The money which customers owe your company

- Accounts Payable (AP): The money your business owes to your vendors or subcontractors

- Gross Profit Margin: Revenue minus direct costs

- Depreciation: Decrease in the value of assets over the period

- Cash Flow: Inflow and outflow of money in your business

These terms are highly essential in explaining the reports and making strategic financial decisions.

HVAC Tax Deductions and IRS Compliance Tips for Contractors

Effective tax planning can save a lot of taxes payable on the income of your HVAC business, whereas omitting a deduction and not following all the instructions as given by IRS can result in a penalty. Here’s how to navigate tax season smartly:

HVAC contractors are entitled to various tax deductions, including:

Common HVAC Contractor Tax Deductions:

- Expenses on vehicles and the mileage covered during work-related traveling

- Tools and equipment purchases

- Home office deductions (if applicable)

- Advertising and Marketing expenditures

- Upgrade courses and certification

- Business insurance costs

IRS Compliance Tips:

- Keep detailed receipts and records

- File quarterly estimated taxes if required

- Use IRS Form 4562 for equipment depreciation

- Stay updated on tax code changes that impact small businesses

Work with a tax advisor familiar with the HVAC industry to avoid penalties and maximise returns.

Choosing the Right HVAC Accounting Software

Selecting the right tool can streamline operations and eliminate manual work. Look for:

| Feature | Why It Matters |

| Job costing | Tracks profit by job |

| Time tracking integration | Helps manage payroll accurately |

| Invoicing and payments | Speeds up collections and improves cash flow |

| Payroll processing | Ensures compliance and saves time |

| Cloud-based access | Allows field and office teams to stay connected |

| Reporting and dashboards | Enables informed decision-making |

Top Picks for HVAC Accounting Software:

- QuickBooks Online + Housecall Pro

- Jobber (Field service management + accounting tools)

- Xero with HVAC integrations

- Sage 50cloud for larger businesses

Frequently Asked Questions: HVAC Accounting FAQs

What’s the best accounting method for HVAC contractors?

Most small contractors use cash-basis accounting. However, accrual basis may be better for larger operations or those with complex project timelines.

How do I track profitability per job?

Use job costing tools to assign expenses and income to each job. This helps you see what’s truly profitable.

Can I deduct my vehicle and fuel costs?

Yes, if used for business purposes. Keep accurate mileage logs and receipts to claim HVAC contractor tax deductions.

What’s the best way to manage payroll?

Employ the HVAC company’s payroll management software, such as Gusto or ADP, particularly the one that is compatible with your accounting software.

Do I need an accountant for my HVAC business?

It is not mandatory to have an accountant with knowledge of HVAC accounting, but having one will free your time, money, and compliance concerns.

Wrapping Up

Competent HVAC accounting is not only maintaining the ledger but growing a better, more profitable company. Whether it is cash management processes, payroll, job costs or business deductions, all aspects of the financial process are part of the ultimate success of your company. With the help of proper systems, tools and plans, the HVAC contractors can cease worrying about the spreadsheets and start doing what they do most effectively, leaving their customers comfortable all year round.

Smart Accounting = Smart Business. Invest in it today, and have a lasting business tomorrow.

Need help navigating your HVAC finances?

You may look at accounting tools that are designed to fit contractors or seek the advice of a specialist so that they create a tailored plan. Your finances should not be just a side effect: use them as your competitive advantage.

Contact E2E Accounting today for all your HVAC Accounting needs!