You may have been in this exasperating situation, especially when you are in the construction industry and have done a good job, fulfilled all the deadlines, yet there remains a big portion of your payment pending. It is retention, and as much as it is supposed to account for and provide quality assurance, it turns out to be a grave financial drain to both the contractor and the subcontractor.

Retention in construction industry is not only about keeping track of unpaid money but also safeguarding your financial position and keeping your business on its feet in between contractual projects. Ineffective liquidity management may result in project delays, business losses, or have the opposite effect of providing your business with an advantageous boost to its financial standing; however, through the proper accounting standards, you can make this possible challenge part of your financial strategy, not only manageable but even foreseeable.

In this guide, we’ll dive deep into what retention is, why it exists, the laws governing it in the U.S., and how you can track, manage, and recover it effectively. You’ll also discover how partnering with professional accountants who understand construction accounting can make all the difference in safeguarding your cash flow.

What Is Retention in Construction?

Retention (more commonly known as retainage) refers to a percentage of a contract payment which is not paid out to the contractor or the project owners until the construction project is completely finished and inspected. In most cases, this is a retention of 5 to 10 % of the amount of the contract.

The rationale of retention is simple: it is a way to make sure that the contractors and subcontractors complete the work to the necessary quality standard and solve any defects within the defects liability period (also referred to as the warranty or maintenance period).

In terms of accounting, retention accounting is a recognition of this undisbursed sum of money as accounts receivable – a revenue which you have earned but not yet received. It’s crucial to record and track retention properly in your books because if ignored or misclassified, it can distort your profit and loss statements, mislead investors, and complicate construction financial reporting.

Suppose you enter into a contract amounting to $500,000 with a 10% retention clause. This will imply that they will withhold the amount of $50000 until the project is completed and accepted. You may have an amount of $500,000 charged to your progress invoices, but only $450,000 will be disbursed at this point in time, the remaining will be held until the project is finished or the defects liability period lapses.

Why Do Construction Projects Use Retention?

The main reason behind retention is to secure the project owner and hold the contractors and subcontractors accountable. Construction projects are not simple, and owners require some confidence that the construction will be completed well and any faults fixed.

Retention helps ensure that:

- Contractors complete all project deliverables.

- Subcontractors fix defects or unfinished work promptly.

- Quality standards are maintained throughout the project lifecycle.

- The owner has leverage to ensure full compliance with contract terms.

But for contractors, retention often feels like a financial burden. That withheld amount could be used for payroll, materials, or new projects — instead, it’s tied up for months or even years. This is the reason why project cash flow analysis and construction accounting should be performed well. You must plan these withheld funds, predict cash flow correctly and make sure that your business remains afloat in the meantime of cash retention release.

Legal Rules Required for Retention in the U.S.

Retention rules aren’t uniform across the United States. The amount of retention that can be withheld, the duration, and the time that should be released are all determined by the legislation of each state.

The following is a summary of some of the most frequently used rules of law:

- Maximum Retention Percentages:

Most states cap retention at 5%–10% of the contract value. For example, California limits public project retention to 5%, while private contracts can be negotiated. - Prompt Payment Laws:

Once a project reaches substantial completion, many states require owners or general contractors to release retention payments within a set period — typically 30 to 60 days. - Interest on Late Payments:

Several states impose interest penalties if retention isn’t released on time. Contractors can legally claim interest for overdue amounts. - Subcontractor Protections:

Under many state laws, general contractors must release retention to subcontractors shortly after receiving their own retention payment. - Retention in Federal Projects:

Contracts that are regulated by the Federal Acquisition Regulation (FAR) are also limited by federal contracts, requiring open documentation about the retention.

Failing to observe these legal requirements may result in controversy, fines or forfeited claims. That is why retention risk management should be included in your contract review and accounting strategy.

How Can Contractors Track and Manage Retention Effectively?

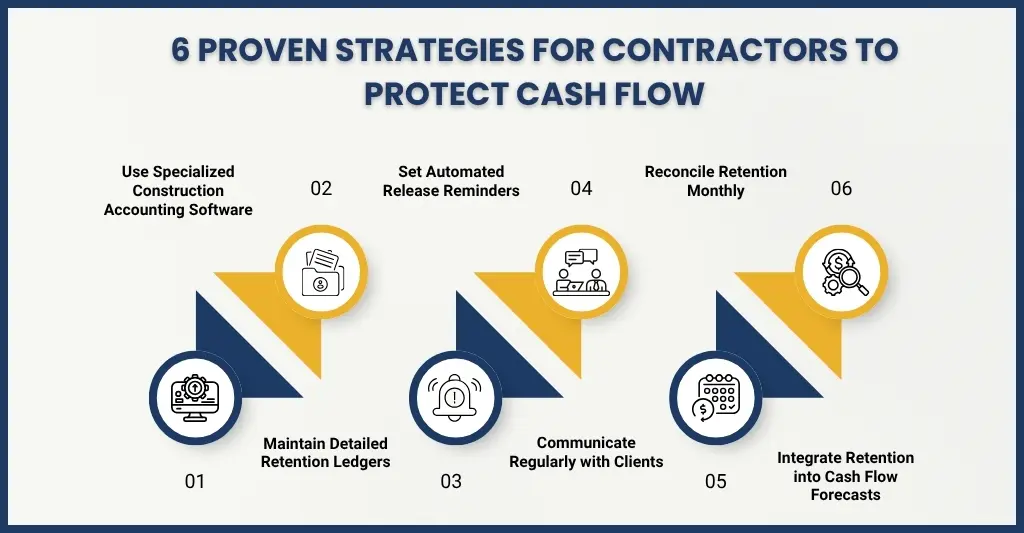

Clarity, consistency and control are the beginning of proper construction retention management. The following is how you can construct a system that will ensure your retention tracking remains watertight:

1. Use Specialised Construction Accounting Software

Generic accounting solutions fail in the case of retention accounting. Select software that is construction industry specific, e.g., QuickBooks Contractor Edition, Sage 300 Construction or Procore, and make use of it to manage retention and progress billing independently.

2. Maintain Detailed Retention Ledgers

Set up a separate account for retention receivable and retention payable. This ensures your balance sheet reflects the correct financial position and prevents double-counting income.

3. Schedule Retention Release Tracking

Develop automated retention release date reminders and remind clients of the date prior to it. Do not think they will publish it on their own initiative; follow-up is the primary concern.

4. Communicate Regularly

Be proactive. Early send progress reports, inspection reports and certificates of completion. Effective communication will minimise conflicts and speed up retention release.

5. Conduct Periodic Reconciliations

Share retention balances on a monthly basis. Adjust your general ledger to project records in order to identify irregularities when they are minor problems rather than significant ones.

6. Integrate Retention Into Cash Flow Forecasts

Never forget withheld retention when you are projecting your cash flows. This assists you in budgeting for shortfalls in funding and allows you to be liquid during the project.

What Are the Risks of Mismanaging Retention?

If you’re not tracking retention properly, you’re walking a financial tightrope. Here are the most common risks of poor retention management:

- Cash Flow Crises: Retention locks up funds that could otherwise be used for operations or new bids.

- Accounting Errors: Misclassifying retention distorts your income and taxes.

- Missed Payments: Without systematic tracking, you might forget to claim retention, losing thousands of dollars.

- Legal Disputes: Poor recordkeeping weakens your position if you need to take legal action for unpaid retention.

- Delayed Projects: Lack of retention visibility can disrupt your ability to fund ongoing work.

The takeaway? Treat retention as part of your working capital strategy — not just an afterthought.

How Can Contractors Negotiate Retention Terms?

You don’t always have to accept whatever retention terms are presented to you. Smart contractors know how to negotiate fairer retention conditions.

Here’s how:

- Request a Lower Retention Rate: If you have a proven record of quality work, ask for 5% instead of 10%.

- Push for Phased Releases: Negotiate retention releases after key milestones, such as 50% completion or inspection approval.

- Clarify “Substantial Completion”: Define this term clearly in the contract to avoid disputes about when retention is due.

- Include Early Release Clauses: If your work is completed before the entire project, you can request early payment.

Good contract negotiation backed by construction contract management expertise can make a significant difference in your cash flow stability.

How Can Accounting Practices Protect Contractors from Retention Delays?

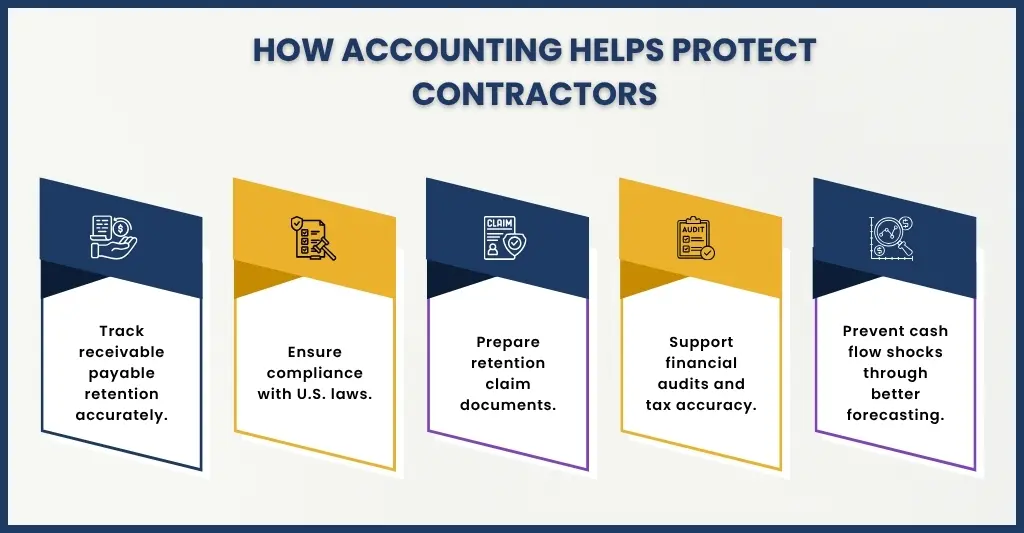

An experienced construction accountant does more than balance your books — they protect your business from hidden financial risks.

Professional construction accounting practices help by:

- Keeping detailed retention ledgers for both receivables and payables.

- Ensuring retention amounts are properly recognised in construction financial reporting.

- Preparing documents to claim retention on time.

- Monitoring defects liability accounting schedules.

- Maintaining compliance with U.S. accounting standards and state laws.

With expert accountants handling your retention, you’ll avoid underreporting income, misclassifying assets, or facing cash flow shocks.

How Can Contractors Recover Unpaid Retention?

If you’re still waiting months after project completion, don’t just accept it — take action.

- Send a Formal Demand Letter: Remind the client or general contractor of the payment terms and attach supporting documents.

- Review Your Contract: Check for retention release clauses and any notice requirements.

- Use Lien Rights: Most states allow contractors to file mechanic’s liens to claim unpaid retention.

- Engage an Accountant or Attorney: Professionals can ensure your claim is well-supported and compliant with state regulations.

- Document Everything: Keep inspection reports, completion certificates, and correspondence organised — documentation is your best defense.

Persistence and professionalism usually get retention released faster than confrontation.

What Are Best Practices for Construction Retention Management?

Here’s a checklist for retention best practices every contractor should follow:

- Use dedicated retention tracking systems.

- Maintain separate retention ledgers for receivables and payables.

- Conduct monthly reconciliations.

- Integrate retention into your cash flow analysis.

- Follow up on retention payments consistently.

- Understand state-specific retention laws.

- Partner with specialised construction accountants.

These practices will help ensure transparency, prevent revenue leakage, and keep your books audit-ready.

Tired of waiting on retention and juggling cash flow? See how our dedicated construction accountants streamline retainage tracking and payment recovery so you get paid faster — Book Your Consultation Today!

FAQs: Frequently Asked Questions

What is the difference between retainage and retention?

They mean the same thing — money withheld until project completion.

How much retention is typical in the U.S.?

Usually 5–10%, depending on the contract and state law.

When should retention be released?

Most states require release within 30–60 days after substantial completion or inspection approval

Can subcontractors claim retention directly?

Usually not. Retention flows through the main contractor, though prompt payment laws may give subcontractors rights to claim earlier.

How is retention treated for tax purposes?

Retention isn’t taxable until it’s received or due, depending on your accounting method (cash or accrual).

Conclusion

Retention might be a reality of the construction industry — but it doesn’t have to be a financial roadblock. You can keep a check on your cash flow by learning the accounting of retention, keeping better track of the receivables, and keeping your construction financial reporting transparent.

We are a firm that focuses on assisting contractors and other construction companies to optimise their retention management, cash flow projections, and compliance at E2E Accounting. Our expert construction accountants understand U.S. construction regulations and can help you recover unpaid retention while keeping your books accurate and audit-ready.

Don’t let withheld payments tie up your working capital. Let E2E Accounting handle the details — so you can focus on building, not bookkeeping