Tax time is a difficult time in the marketplace for any eCommerce seller, but it is also a time to garner money that you deserve. The fact is that several online business owners fail to get a substantial amount of savings only due to the lack of awareness about which particular expenses are subject to Ecommerce Tax Deductions. You might either have a dropshipping company, a flourishing Shopify store, or Etsy business with homemade products, but whatever the source of your revenue, being aware of your eligible expenses could tremendously decrease your taxable income.

In this blog post, we are going to familiarise you with the concept of Ecommerce Tax Deductions, by introducing you to ten commonly missed deductions. We will also provide some e-commerce-related affordable tax-saving tips that will help ecommerce sellers reduce their taxes.

What Are Ecommerce Tax Deductions?

Ecommerce Tax Deductions are business expenses that are permissible and which you can deduct from the total revenue to ascertain how much you owe in taxes. IRS will deduct any necessary and ordinary business expenditure which you can use to facilitate your operations. In the eCommerce business, this can range from hosting your site to wrapping material costs, advertising and even part of your home office.

The ecommerce tax deductions available can help the sellers reduce their total tax burden, thereby making more money available to spend at the end of the day.

Importance of the Tax Deductions on Ecommerce Businesses

The eCommerce marketplace is highly competitive, and with each dollar of savings, one could make a lot of reinvestments and growth. The reason why tax credits and deductions on ecommerce businesses would be important is as follows:

- Cash Flow Management- Since less tax will be paid, it will imply that the operations have more cash flow.

- Business Expansion: The money that is saved can be redirected to marketing, buffers or new platforms.

- Regulatory Compliance: Due to your knowledge of your deductible expenses on online businesses, it assists you to avoid both penalties of underreporting and over-reporting.

- Maximised ROI: Enables informed decision-making

It is not just your money that you are ignoring when you ignore deductions; it is money that can also be used in putting your business ahead of the competition.

10 Key Tax Deductions for Ecommerce Businesses

These are the top ten eCommerce tax filing deductions you might fail to claim:

1. Home Office Tax Deduction

In case you devote a portion of your house solely and consistently to business, the portion of rent, utilities, mortgage interest and insurance is deductible.

2. Internet and Phone Expenses

The online businesses have a deductible expense on the internet and business-related costs on mobile phones. All you need to do is ensure that you do not deduct the personal use.

3. Website Development and Hosting Charges

Whether you are buying your domain name and Shopify, Wix, or a hosting service also falls under necessities and is totally deductible.

4. Software and Subscriptions

Your accounting software, graphical design software or inventory management application, such as QuickBooks, Canva or ShipStation, incurring monthly fees are considered as ecommerce business tax credits.

5. Advertisement and Marketing

All the advertising, including Facebook, Google PPC, influencer, and email marketing software, can be paid as the marketing cost.

6. Office Supplies and equipment.

The expenses that can be used as deductions include printer paper, ink, pens, tape, as well as bigger devices such as laptops or ring lights utilised in photos of products.

7. Shipping and Packaging

One can write off expenses on packaging material, postage, third-party logistics services, and even shipping insurance.

8. Education and training

Tax-saving tips related to business or eCommerce that are often missed by ecommerce sellers include courses, webinars, books and conferences.

9. Business Insurance

Product liability, general liability and cyber liability can be deducted.

10. Professional Services

Professional fees incurred in accounting, taxation advice or consultants or lawyers who facilitate your business are allowed.

How to Claim Your E-commerce Tax Deductions

To take advantage of your ecommerce tax deductions, here’s a step-by-step guide to doing it right:

1. Maintain Detailed and Accurate Records

Every deduction that the IRS demands needs evidence. Track and document:

- Receipts and invoices

- Subscription confirmations

- Contracts with service providers

- Bank, credit card statements

Doing this can be made easier by using a cloud-based bookkeeping tool such as QuickBooks, Xero, or Bench and leaving the task of categorisation of expenses and generating reports to the tool.

2. Separate Personal and Business Finances

Most people have the tendency of combining personal and business expenses. Open a dedicated:

- Business checking account

- Business credit card

This not only makes it easier to do ecommerce bookkeeping, but also makes your deductions more legitimate.

3. Categorise Expenses Correctly

Categorise your business expenses into the right IRS categories (e.g., advertising, office supplies, utilities). The misclassification will result in the cancellation of the deduction or even an audit.

4. Use the Correct Tax Forms

Most sole proprietors and all single-member LLCs report business income and expenses using Schedule C (Form 1040). The S-Corps or partnerships are other types of entities that may need other forms like Form 1120-S or Form 1065.

5. Consult a Tax Professional

A qualified CPA or a specialist can help:

- Find tax deductions related to each industry.

- Maximise expenditure tax-wise

- File tax returns accurately

They are also able to assist in quarterly estimated taxes so as to prevent underpayment charges.

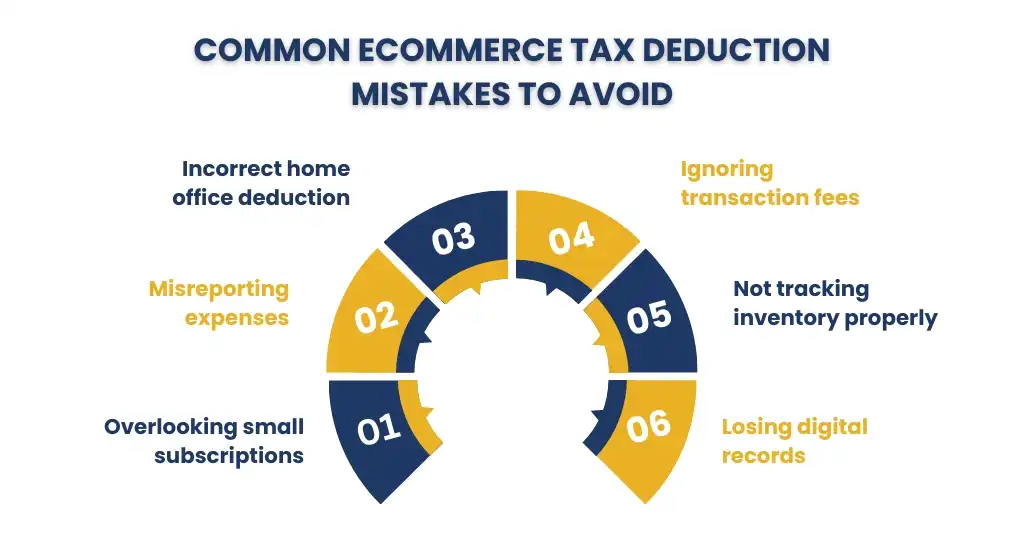

Common Ecommerce Tax Deduction Mistakes to Avoid

The sellers of eCommerce are likely to make very expensive mistakes even under ideal circumstances. These are the most popular pitfalls and the way to avoid them:

1. Overlooking Small, Recurring Expenses

Software monthly subscriptions (e.g., Canva, Mailchimp, Shopify apps) are easily overlooked. These little expenses accumulate and are 100% deductible.

2. Misreporting or Estimating Expenses

Any attempt to guess the amount of a deduction which is undocumented can raise a red flag. Keep real-life figures and support them with receipts/documentation in any form.

3. Not Claiming the Home Office Deduction Correctly

To qualify, the home office must be:

- Used exclusively for business

- Your principal place of business

Partial use (e.g., working at the dining table) doesn’t qualify. Also, be sure to calculate the space as a percentage of your home to deduct appropriate portions of utilities, rent, etc.

4. Forgetting to Deduct Transaction Fees

Payment processors like PayPal, Stripe, and Square take a percentage of each sale. These are legitimate ecommerce tax filing deductions that are often overlooked.

5. Failing to Track Inventory and Cost of Goods Sold (COGS)

Many new sellers forget that you can only deduct inventory when it’s sold. Be sure to calculate beginning inventory + purchases – ending inventory = COGS.

6. Missing Out on Startup and Educational Expenses

Many forget to deduct one-time expenses such as:

- Registering an LLC

- Domain purchases

- Business courses or certifications

7. Not Keeping Digital Records

Receipts are lost or faded. Utilise a digital tool such as Dext, Expensify or a basic Google Drive folder where you can keep records electronically stored.

Key Strategies for Maximising Deductions

Having understood what you can and cannot do, here is what to do so that you can maximise your e-commerce tax deductions so that you keep more of your profit:

1. Conduct Quarterly Expense Reviews

Do not wait to make it during tax time. Make time on a quarterly basis to:

- Check incomes and expenditures.

- Find out unclaimed deductions

- Reconcile transactions

This will keep you organised and will not cause you any stress when it comes to paying your taxes.

2. Automate Your Bookkeeping

You can classify and monitor expenses with the help of automation software, such as Bench, Wave, or QuickBooks Online, and avoid the cost of error, and countless hours to enter data manually.

3. Track Mileage for Business Travel

You can deduct mileage when you get to the post office, supplier or business meeting in your car. Track trips with mile-tracking applications such as MileIQ or Everlance and use the same to estimate your deduction.

4. Hire a Tax Advisor Who Specialises in E-commerce

An expert on tax deductions in ecommerce will be able to find your company some savings strategies based on your business model, what form you use drop shipments, sell real products, or provide digital products.

5. Leverage Pre-Tax Purchases

When possible, put in deductible expenses on your business account so they will be allowed as business expenses, and tracking reimbursements will not be your biggest problem.

6. Reinvest Tax Savings into Your Business

Use saved funds strategically:

- Upgrade your tech stack

- Invest in better packaging

- Expand advertising

This not only grows your business but also increases future deductions.

7. Keep Up With IRS Changes

The tax laws keep on changing. Stay in the know by following reputable tax blogs or by following the IRS small-business newsletter.

Frequently Asked Questions

1. Can I deduct social media ads from my taxes?

Yes, advertising payment on a social site, such as Facebook, Instagram or Google Ads, is a write-off as a marketing cost.

2. Is inventory a tax deduction for eCommerce?

Although the cost of inventory is not deductible, the cost of goods sold (COGS) is what you paid to provide the products sold in the year.

3. What if I use a spare bedroom as an office and storage?

You might be allowed to expense them; however, they must be strictly used on business. Claims should be calculated by a tax expert.

4. Are PayPal or Stripe fees deductible?

Yes, and all the fees you incur because of the payment gateways are necessary to be deducted off your operating expenses.

5. Do I need to hire an accountant to claim deductions?

Not necessarily, but it can be truly accurate and make you save the most using the help of a professional, preferably the ones who understands the tax credits applied to the ecommerce businesses.

Conclusion

All Ecommerce merchants have a responsibility to take advantage of the Ecommerce Tax Deductions available to them, not only because it is a smart move but one that is vital to the profitability of their existence in a competitive digital marketplace. Full tax deductions on ecommerce can explain which deductions you can access and how to minimise your tax burden legally by keeping good records that will help you invest the saved amount on your growth.

The importance of strategic tax planning is never less of a word to look down upon, despite being forced to file your own taxes or being met by accounting professionals to do it on your behalf. In order to receive customised guidance and professional support, you may use the help of an eCommerce-specific accounting company, such as E2E Accounting, which provides customised tools and information dedicated to online sellers.

Never miss out on these useful deductions that could save you thousands of dollars in business and ensure that your business has more of your earned revenue in your hands and not the hands of the taxman.