Online shopping has unquestionably risen to the top of the consumer’s favourite method of purchase in almost every part of the world. Numerous retailers became interested in creating an eCommerce platform and began to sell their goods online. Competition is getting fiercer in the eCommerce business.

Online start-ups may wish to consider all the important aspects of launching an eCommerce firm in order to get off the ground and have an advantage over many other successful eCommerce sellers. Once an eCommerce business is launched, entrepreneurs need to be motivated and persistent to bring their ideas to life.

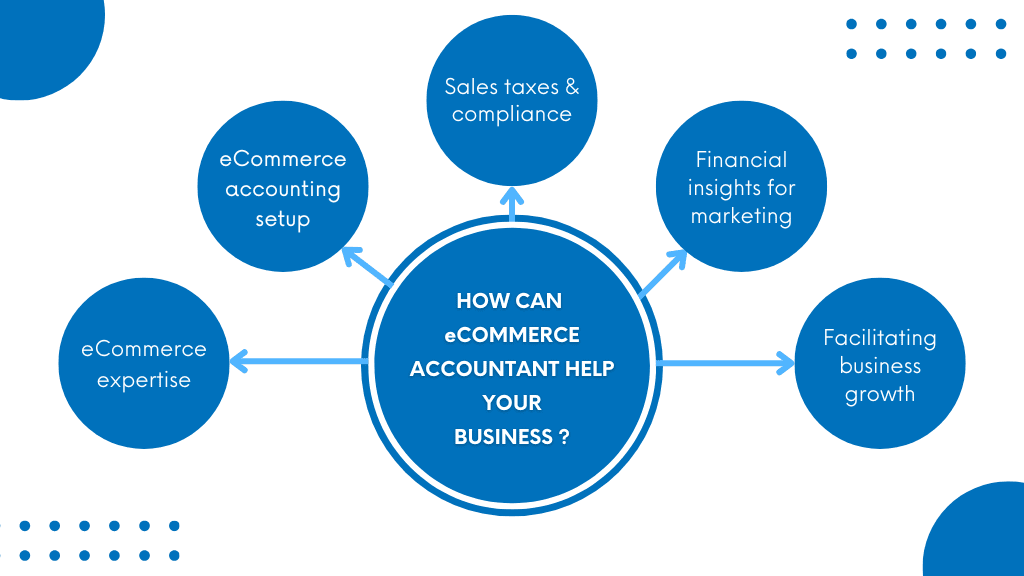

Managing eCommerce business and other activities is tough task. Therefore, in the chaos of managing every task looking after accounting and bookkeeping is often left out. But maintaining eCommerce bookkeeping is essential to your financial well-being and goes beyond simply monitoring sales.

Keeping your books organised can seem like a difficult undertaking, especially with the influx of digital transactions from different platforms and currencies. However, becoming proficient in this area might help your company expand while maintaining tax compliance.

Are you prepared to learn the fundamentals of bookkeeping for eCommerce? Let’s go through what you need to know about 2025!

What is meant by eCommerce Bookkeeping?

From managing your inventory and promoting your brand to selling your goods and responding to consumer inquiries. Another crucial element of any eCommerce business is eCommerce bookkeeping.

The procedure of documenting, preserving, and organising the financial transactions of your eCommerce firm is known as eCommerce bookkeeping. It enables you to monitor your income and expenses, these records provide you with valuable information about the financial health of your company. Financial statements and reports, balance sheets, cash flow statements, profit and loss statements, can be created using this data.

Having accurate records makes it easier to manage inventories, track cash flow, and evaluate profit margins. Gaining insight into your financial situation enables you to make well-informed decisions that can spur development.

Additionally, careful recordkeeping makes it easier to spot patterns over time. Based on consumer behaviour, this data aids in customising marketing tactics and improving product offerings.

Putting effort into accurate bookkeeping also builds confidence with stakeholders and investors. Strong financial accounts show that your business operates with professionalism and dependability in the highly competitive eCommerce market.

Challenges in Bookkeeping for eCommerce Business

When it comes to bookkeeping, eCommerce enterprises encounter a number of challenges that traditional businesses do not encounter. Among the difficulties that eCommerce enterprises encounter when it comes to bookkeeping are the following:

Tracking inventory for various sales channel: An important factor in an eCommerce company’s success is inventory management. To help serve the consumer promptly, one needs to know which products are in excess or insufficient. It can be challenging, though, particularly when there are several items, warehouses, and/or sales channels.

An integrated inventory management tool makes it easier to manage and record the goods on a variety of online selling platforms. Selling on more than one online platform prevents one platform from recording sales from another and prevents the creation of an accurate inventory record.

It is essential to have a uniform platform for recording inventory, tracking, and updating accounts. For eCommerce enterprises, bookkeeping need a standardised platform for documenting all sales and sales returns.

Merchant fee tracking:

The majority of eCommerce companies use a variety of eCommerce platforms, each of which charges merchant fees, to sell their goods and services. Although the majority of platforms charge a fixed monthly merchant fee, the eCommerce platform may impose additional, more complex fees.

One more thing these costs will vary depending on the eCommerce platform. For the business owner, this presents a significant difficulty since it may be hard to determine the true cost of income.

Choosing bookkeeping software:

The most difficult aspect of bookkeeping for eCommerce businesses is choosing the best bookkeeping software for eCommerce. Accounting software designed for eCommerce companies is appropriate given the intricacy of eCommerce accounting.

The majority of accounting and bookkeeping issues, if not all of them, can be resolved by bookkeeping software. Many accounting programs available on the market either have an eCommerce module or enable integrations with numerous other programs that support the operations of an online store.

Balance Reconciliation for various sales channel:

Inventory and channel receivables fluctuate with each transaction, thus it’s critical to promptly enter channel sales into your accounting program to ensure a proper balance reconciliation between what is receivable according to the sales channel and what is recorded in your books. It becomes challenging to reconcile inventory information with sales records when sales are made on separate platforms.

Profitability of Business:

Determining the precise profitability of e-commerce enterprises is challenging due to the presence of various sales channels. In order to calculate profitability, one must keep track of sales and purchases, commissions or fees given to sellers, sales tax obligations, shipping costs, any applicable discounts, inventory, returns, and so on. In order to precisely ascertain the productivity and profitability of the company, account reconciliation requires the collection of accurate data.

Key Elements of eCommerce Bookkeeping

Cash Flow Statement:

The most important piece of information for online company bookkeeping is this one. Every penny that a business spends is detailed in the cash flow statement. It contains details on the revenue stream, inventories, and rent. It contains information on taxes and upkeep.

Business owners can get a sense of their income and profit by looking at their cash flow. Online retailers should take note of this message. They will be aware of the use of their funds. They will be able to keep a healthy profit margin thanks to this.

Balance Sheet:

A company’s assets and liabilities are listed on its balance sheet. It includes the owner’s equity as well. There are two columns in this statement. The company’s assets are listed in one column, and its liabilities are listed in the other.

Your eCommerce business’s assets consist of cash funds, merchandise, and equipment. Among the liabilities are unpaid business loans or mortgages.

Risk management:

Risk management in eCommerce bookkeeping entails identifying and reducing possible financial hazards that can have an influence on the company.

This entails evaluating the risks associated with market volatility, payment processing, fraud, and cybersecurity. The eCommerce industry’s long-term viability and financial integrity are safeguarded by effective risk management techniques.

Income Statement:

An income statement shows how much money a business makes over a given period of time. This could be a quarter, a year, or a month. Both operating and non-operating income will be displayed on the statement. Operating income is the money you make from regular business operations.

This is derived from the sales of your inventory in an eCommerce retail enterprise. Non-operating income is the money you make from sources unrelated to your business. The profits from investing in stocks or real estate serve as an illustration.

Sales Reporting:

To learn more about the operation of the eCommerce company, sales reporting entails monitoring and evaluating sales data. Sales reporting in eCommerce bookkeeping is creating reports that offer comprehensive data on sales patterns, consumer behaviour, product performance, and income from various sales channels. Business owners can make well-informed decisions about pricing, inventory control, and marketing tactics with the use of sales reports.

The Best Ways to Keep your Books Organised

- Any eCommerce company must maintain an orderly bookkeeping system. Establishing a routine is the first step. Make time every week to go over and update your financial records.

- Use distinct categories for every transaction. This facilitates easy inventory, expense, and sales tracking. Think about labelling or color-coding files for easy access.

- Ø Use technology to make things easier. Numerous processes can be automated using cloud-based bookkeeping software, which saves time and minimises human mistake.

- Ø Reconcile accounts and bank statements on a regular basis. By doing this, accuracy is guaranteed and inconsistencies are brought to light before they become serious problems.

- Ø Don’t overlook the paperwork! Store digital invoices and receipts in a central location. Having everything easily accessible will significantly reduce the stress of tax season.

- Ø Examine your finances once a month to spot patterns or areas that require immediate action. Being proactive improves decision-making skills and prevents surprises.

The Future of eCommerce Bookkeeping: Trends to Watch

In the future, the field of eCommerce bookkeeping is expected to undergo major change. More efficient and streamlined procedures are being made possible by technology. An increasingly important role is being played by artificial intelligence, which automates tedious procedures and offers insights previously only available to highly skilled eCommerce accountants.

Cloud-based solutions are also growing in popularity among eCommerce companies. They provide business owners with real-time access to financial data from any location, making it simpler than ever to manage their accounts. It will also be possible to track sales across several channels with ease thanks to the integration of different systems.

The growth of subscription-based accounting services designed especially for internet shops is another trend that is gaining popularity. In addition to standard bookkeeping, these services include financial projections and strategic counsel tailored to your particular business plan.

Conclusion:

Those who wish to launch an eCommerce company should start right by hiring eCommerce accountants and organising their finance department before all the work piles up. Since Amazon, Shopify, Etsy, Ebay, Alibaba, and Woocommerce are the largest players in the e-commerce business, it can be extremely difficult for start-ups to sell things online in the same area.