Running a dental practice isn’t just about healthy smiles, it’s about keeping your financial health in check, too. Between patient care, staff management, and insurance paperwork, your accounting can easily fall to the bottom of the to-do list.

But here’s the truth: even minor accounting issues for dentists can snowball into serious financial headaches — from cash flow gaps to tax-time stress.

If you’ve ever wondered why your numbers don’t quite match your expectations, you’re not alone. In this post, we’ll walk through the 10 most common accounting issues for dentists, how to fix them, and how E2E Accounting can help you keep your dental finances as spotless as your patients’ teeth.

Understanding the Financial Landscape of a Dental Practice

Before diving into the problems, let’s look at why dental accounting is so complex.

Unlike general businesses, dental practices juggle:

- Insurance reimbursements and patient co-pays

- Equipment leases and supply costs

- Payroll for hygienists and assistants

- Regulatory compliance and tax deductions specific to healthcare

All these moving parts make dental bookkeeping a different beast altogether. Traditional CPAs may not fully understand the nuances of dental practice financial management, leading to common and costly accounting mistakes.

That’s why having a specialist on your side matters.

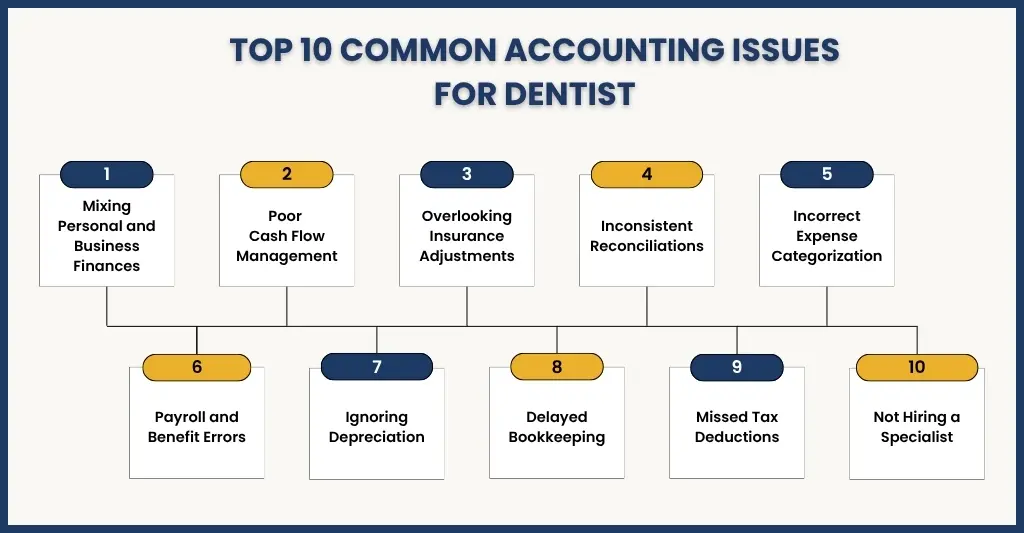

10 Common Accounting Issues for Dentists

Let’s break down the biggest financial challenges in dental practices and what you can do about them.

1. Mixing Personal and Business Finances

It happens more often than you’d think, a personal purchase made from the practice account “just this once”. But those small overlaps create messy financial records and IRS red flags.

How to Fix it:

- Open separate business and personal accounts.

- Pay yourself through proper distributions or payroll.

- Use bookkeeping software like QuickBooks Online to track business-only transactions.

2. Poor Cash Flow Management

Cash flow is the heartbeat of your dental practice. Many dentists struggle with irregular inflows due to insurance delays, payment plans, or seasonal patient visits.

How to Fix it:

- Forecast expenses 3–6 months in advance.

- Automate billing reminders and payment follow-ups.

- Keep a cash reserve for slow periods.

E2E Accounting can help you design a cash flow management plan that balances income timing with operational costs.

3. Overlooking Insurance Adjustments and Write-Offs

Insurance reimbursements can be confusing. If adjustments and write-offs aren’t recorded correctly, your revenue reports won’t reflect reality.

How to Fix it:

- Reconcile insurance EOBs (Explanation of Benefits) regularly.

- Use dental-specific accounting software that integrates with your practice management system.

- Have your accountant verify adjustment entries each month.

4. Inconsistent Bank and Credit Card Reconciliations

If your bank accounts aren’t reconciled monthly, small discrepancies can lead to massive accounting errors over time.

How to Fix it:

- Set a monthly reconciliation schedule.

- Use automation tools to flag mismatches early.

- Have your accountant review reconciliations before closing the month.

At E2E Accounting, we handle reconciliation so you can focus on patient care instead of spreadsheets.

5. Incorrect Categorisation of Expenses

From dental supplies to continuing education, not all expenses are created equal. Misclassifying costs can distort your profit margins and affect tax deductions.

How to Fix it:

- Create a clear chart of accounts tailored to your dental practice.

- Tag recurring expenses consistently.

- Review expense categories quarterly with your bookkeeper or CPA.

This small fix can make a huge difference in understanding your real profit and loss.

6. Payroll and Employee Benefit Errors

Managing hygienists, assistants, and office staff payroll is a major responsibility — and one of the most error-prone areas in dental practices.

How to Fix it:

- Use a reputable payroll system with tax filing automation.

- Keep a close record of the benefits and deductions to ensure that they remain in accordance with the rules of the IRS.

- Conduct periodic payroll audits to ensure accuracy.

7. Ignoring Depreciation of Equipment and Assets

Dental chairs, X-ray machines, and sterilisers are significant investments. Not accounting for their depreciation properly can inflate your taxable income.

How to Fix it:

- Keep records of all the fixed assets with purchasing dates and depreciation.

- Use IRS Section 179 deductions strategically for new equipment.

- Before the end of the year, consult your accountant to do the best depreciation planning.

8. Inaccurate or Delayed Bookkeeping

Falling behind on bookkeeping leads to guesswork. You might miss out on key trends, late payments, or expense leaks.

How to Fix it:

- Schedule bookkeeping updates weekly or biweekly.

- Outsource to professionals offering Catch-Up Bookkeeping if you’re behind.

- Use cloud-based tools to stay up to date in real time.

E2E Accounting’s dental bookkeeping team specialises in clean-up bookkeeping and catch-up bookkeeping — this would be an ideal choice if you’ve been putting it off.

9. Overlooking Dental Tax Deductions and Compliance

Many dentists overpay on taxes because they’re unaware of eligible deductions — from lab fees and uniforms to CE courses and sterilisation supplies.

How to Fix it:

- Keep detailed receipts and documentation throughout the year.

- Track all deductible expenses under the right categories.

- Engage the services of people who are knowledgeable in dental tax compliance and deductions.

E2E Accounting will help you to be sure that you have not missed any deductions or made any errors in reporting that will result in the issuance of an IRS notice.

10. Relying on a Generic CPA Instead of a Dental Accountant

A regular CPA might be great for basic accounting, but they often miss the financial nuances unique to dental practices — like production tracking, collections ratios, and insurance write-offs.

How to Fix it:

- Partner with Dental Accountants who specialise in your industry.

- Get monthly financial reports in a format that is specific to your practice KPIs.

- Schedule quarterly reviews to determine trends in profitability.

E2E Accounting provides tailored accounting services to dentists, integrating dental industry understanding with the use of up-to-date financial instruments to make improved decisions.

Your patients trust specialists — shouldn’t your finances have one too? Meet the dental accountants who understand your practice better than any CPA.

Tips to Avoid Accounting Issues in Your Dental Practice

Here’s how you can stay financially healthy year-round:

- Go digital – Practice management and accounting systems should be cloud-based.

- Automate everything – Invoicing, payroll and bank feeds are time-saving and have minimal human error.

- Schedule financial checkups – As you do with dental checkups, have a monthly check with your accountant.

- Educate your team – Ensure that personnel are educated on the significance of billing and data entry on accounting accuracy.

- Track KPIs – Monitor collection rate, overhead percentage, and net production monthly.

These small habits can prevent 90% of common dental accounting problems before they start.

When to Bring in Professional Help

If you’re noticing inconsistencies in your reports, frequent cash shortages, or IRS anxiety creeping in — it’s time to get help.

Outsourcing to a team like E2E Accounting can give you:

- Professional dental accounts and financial reporting.

- Up-to-date, reconciled accounts every month

- Cash flow and tax planning.

- Calmness of mind that you have the right numbers that are up-to-date.

Consider us as your financial hygienist – we make your books clean, and your practice will run smoothly and well.

FAQs: Frequently Asked Questions

Can I use regular accounting software for my dental practice?

Yes, however, it should be applied to dental-specific settings or combined with tools. E2E Accounting modifies QuickBooks Online and Xero in accordance with dental processes.

How often should I reconcile my accounts?

At least monthly. Timely reconciliation aids in the detection of mistakes at an early stage, as well as proper financial reporting.

What’s the difference between a dental accountant and a regular CPA?

A dental accountant knows the dental industry metrics, insurance duties, and deductions that are unique to dental practices, providing you with more relevant financial guidance.

What if my books are months behind?

No worries, E2E Accounting offers Catch-Up Bookkeeping Services to get you up to date fast, with zero judgement.

Conclusion

Your patients expect you to take care of their oral health; however, the financial health of your practice should receive routine care as well.

With these accounting problems resolved for dentists, you will know how to be more profitable, have easier tax seasons and have better financial expansions.

Bookkeeping errors or antiquated systems should not be a drag. Collaborate with E2E Accounting, your clear and consistent companion on keeping the finances of your dental organisation clean, compliant, and future-ready.

Ready to fix your accounting issues for good?

Let’s give your dental books the expert care they deserve.

Contact E2E Accounting today — and smile knowing your practice’s finances are finally in great shape.