Running a construction business means dealing with financial challenges that most other industries simply don’t face. You’re juggling multiple projects, managing long-term contracts, and trying to keep track of costs that can change daily. Traditional accounting methods just don’t cut it when you’re dealing with retainage, progress billing, and projects that span multiple years.

Construction accounting addresses these unique challenges head-on. It’s designed specifically for contractors who need to track costs by project, manage complex billing schedules, and stay compliant with industry-specific regulations. This guide will walk you through everything you need to know to get your construction accounting right.

Key Takeaways

- Construction accounting focuses on project-based financial management rather than general business operations

- Two main revenue recognition methods exist: Percentage-of-Completion and Completed Contract Method

- Job costing helps you track profitability for each individual project

- Work-in-Progress reports are essential for monitoring ongoing project performance

- Specialized software can streamline your accounting processes significantly

- Proper cost control directly impacts your bottom line and project success

What is Construction Accounting?

Construction accounting is a specialized approach to financial management that addresses the unique operational requirements of the construction industry. Unlike regular business accounting that focuses on standard operations, construction accounting solely focuses on the specific challenges that construction projects bring – extended timelines, complex cost structures, and contractual obligations that can stretch over multiple years.

As per Statista, the construction sector alone contributes over $2 trillion annually to the US economy, making proper financial management more crucial for business success. Construction accounting ensures that each project remains financially viable and closely monitored from start to finish.

Note: If you’re curious to dive deeper, feel free to check out our other guide on retention in construction accounting. It’s packed with practical tips that can help you manage your projects even better

Construction Accounting vs Traditional Accounting

The main difference between construction and traditional accounting lies in how you track your business financial operations. Traditional accounting typically measures performance annually or quarterly with predictable income streams. However, Construction Accounting requires you to manage multiple projects simultaneously while maintaining detailed cost breakdowns for every contract.

Here’s what makes construction accounting different:

Project-focused approach: Instead of looking at your entire business as one unit, construction accounting treats each project as its own profit center. This allows you to understand which jobs make money and which ones don’t.

Decentralized operations: Construction companies often work across multiple locations simultaneously. You need to track equipment and materials moving between job sites, along with travelling costs that affect your overall project expenses.

Long-term contract management: Construction projects frequently take months or even years to complete. Your accounting system needs to handle contracts that span multiple accounting periods while managing progress payments and retainage.

Complex revenue recognition: Unlike businesses that complete transactions quickly, construction companies must decide when to recognize revenue – as work progresses or when projects are complete.

Why Construction Accounting Matters for Your Business

Construction accounting isn’t just about staying compliant with tax requirements – it’s a strategic tool that can transform your business performance. Companies with sophisticated accounting systems consistently outperform competitors through better cost control, improved cash flow management, and data-driven decision making.

The construction industry’s unique challenges require specialized approaches that traditional bookkeeping methods simply can’t handle. Investment in proper accounting systems, processes, and expertise pays dividends through improved profitability, better project insights, and reduced financial risks.

Whether you’re a small contractor just getting started or an established company looking to improve performance, focusing on construction accounting fundamentals will provide measurable benefits for your business success.

Key Components of Construction Accounting

Although there are numerous approaches to construction accounting, they all generally have certain essential features in common. These fundamental guidelines will help you keep track of all the different costs associated with a project. The following are important components of construction accounting:

Job Costing Explained

Job costing is the foundation of construction accounting. It involves treating each project as a separate business entity, allowing you to track all costs associated with that specific job. This includes direct costs like materials and labor, as well as indirect costs like equipment usage and overhead allocation.

Effective job costing helps you:

- Submit more accurate bids on future projects

- Identify which types of work generate the best profit margins

- Spot cost overruns before they become major problems

- Make informed decisions about resource allocation

Project-Based Accounts:

Instead of concentrating on the overall operations of a company, construction accounting concentrates on specific projects. Although the contractor’s overall income and expenses are influenced by all of these projects, construction accounting is primarily concerned with controlling costs and profitability for individual projects. Rather than following a set procedure, they are therefore better able to keep an eye on the requirements and specifications of every project.

Decentralised Production

Accountants in the construction industry sometimes work for decentralised companies those that conduct business in several locations at once. It is crucial that these businesses keep track of the movements of their supplies and machinery between locations. It is imperative for contractors to maintain precise documentation of mobilization expenditures in order to furnish their clients with bills that fairly reflect their overall outlays.

Long-Term Contracts

Another crucial component of construction accounting is monitoring the status of long-term contract projects. The completion of construction projects can frequently take several months or even years. Since many companies depend on contracts to pay for their manufacturing costs, accountants frequently have to keep track of every item related to long-term agreements.

Contract Revenue Recognition

Managing revenue recognition for construction contracts requires careful attention to timing and compliance requirements. You need to decide whether to recognize revenue as work progresses or wait until project completion. This choice affects your cash flow, tax obligations, and financial reporting.

The Financial Accounting Standards Board provides guidance through ASC 606, which requires contractors to recognize revenue as performance obligations are satisfied. For most construction companies, this means recognizing revenue as work progresses rather than waiting for project completion.

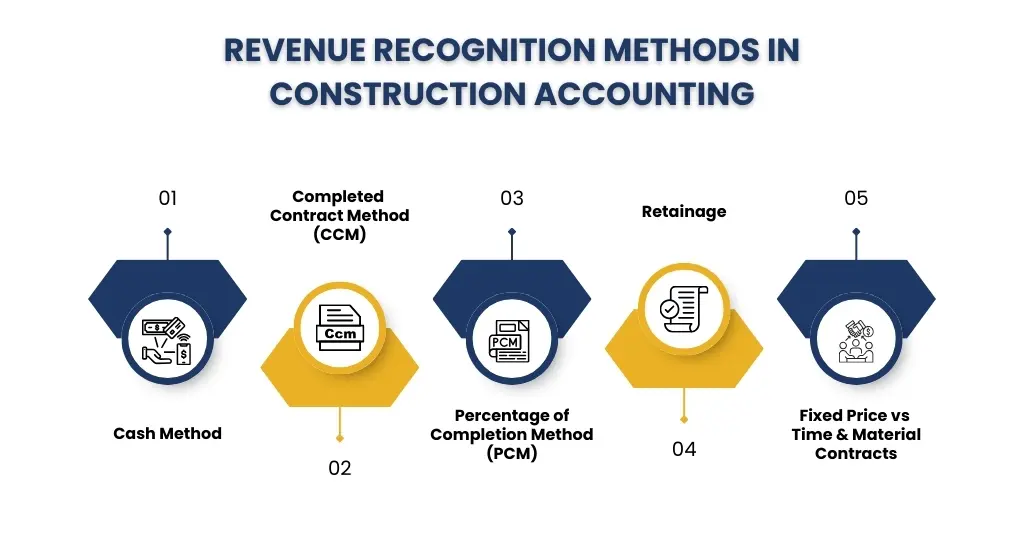

What Are the Different Approaches to Construction Accounting?

Cash Method

The cash method tracks money as it actually moves in and out of your business. You record income when clients pay you and expenses when you actually spend money on materials or equipment. Many contractors prefer this method because it’s straightforward and aligns with cash flow reality.

This approach works well for smaller contractors with shorter project timelines. However, it can create challenges for tax planning and doesn’t provide the detailed project analysis that larger contractors need.

Completed Contract Method (CCM)

With the completed contract method, you track all project costs as work progresses but don’t recognize revenue until the entire project is finished. This approach simplifies accounting procedures and aligns tax obligations with actual cash receipts.

CCM offers several advantages:

- Tax obligations occur when you receive payment

- Simplified record-keeping requirements

- Reduced risk of paying taxes before getting paid by clients

However, CCM can distort your financial statements during project execution, showing minimal activity followed by large revenue spikes upon completion.

Percentage of Completion Method (PCM)

The percentage of completion method recognizes revenue and expenses as work progresses throughout the project lifecycle. You calculate what percentage of the total project is complete, then recognize that percentage of the total contract revenue.

For example, if you’re working on a $500,000 project that’s 40% complete, you would recognize $200,000 in revenue for that accounting period.

The IRS requires PCM for larger contractors – specifically those with average gross receipts exceeding $27 million over the prior three-year period. This method provides more accurate ongoing business performance data but requires sophisticated tracking systems.

Contract Retainage Method

Contract retainage involves clients withholding a portion of your payment until project completion and their satisfaction with the work. Typically, clients hold back 5-10% of each progress payment as security against potential issues.

Managing retainage requires careful tracking of:

- Amounts held by each client

- Release dates and conditions

- Impact on cash flow projections

- Accounting treatment of retained amounts

Fixed Price and Time & Material Methods

Fixed price contracts provide clients with a precise, all-inclusive project cost upfront. This approach is common for projects requiring competitive bidding. It gives clients budget certainty but puts cost control pressure on contractors.

Time and material contracts allow you to bill clients for actual labor hours and materials used, plus an agreed markup. This method provides more flexibility for handling unexpected project changes but requires detailed documentation of all expenses.

Essential Financial Reports Required in Construction Accounting:

Work-in-Progress (WIP) Reports

WIP reports are your most important financial management tool. They show the current status of all active projects, including costs incurred, revenue earned, and expected profitability. A comprehensive WIP report includes:

- Total contract value including approved change orders

- Costs incurred to date across all categories

- Estimated costs to complete the project

- Percentage of work completed

- Revenue that should be recognized

- Amount billed to the client

- Over-billing or under-billing positions

Regular WIP analysis helps you identify problem projects early and take corrective action before small issues become major losses.

Cash Flow Management

Construction companies face unique cash flow challenges due to project payment terms, retainage schedules, and timing gaps between expenses and payments. Effective cash flow management involves:

Progress billing optimization: Structure your payment schedules to align with major expense periods rather than arbitrary monthly intervals.

Retainage tracking: Monitor retention amounts across all projects and plan for their eventual release.

Credit facilities: Establish lines of credit to bridge timing gaps between project expenses and client payments.

Many construction companies fail not because they’re unprofitable, but because they can’t manage cash flow during growth periods or economic downturns.

Best Construction Accounting Software Options for US Contractors

Key Features to Look For

Modern construction accounting software should include:

- Real-time job costing with detailed category tracking

- Automated progress billing and invoice generation

- Comprehensive WIP reporting with customizable formats

- Equipment cost allocation across multiple projects

- Subcontractor management and payment processing

- Integration capabilities with project management systems

- Mobile access for field data entry

- Built-in compliance support for prevailing wage and tax requirements

Popular Software Solutions

FOUNDATION Software

FOUNDATION Software specializes exclusively in construction accounting. It offers comprehensive job costing, equipment tracking, and industry-specific compliance features that address contractors’ unique needs.

Sage 300 Construction and Real Estate

Sage 300 Construction and Real Estate provides robust functionality for mid-sized to large construction companies. It’s particularly strong at handling complex multi-company structures and advanced project management integration.

QuickBooks Enterprise

QuickBooks Enterprise with construction features offers familiar QuickBooks functionality enhanced with construction-specific tools. This works well for smaller contractors who need basic construction accounting capabilities without extensive complexity.

When choosing software, consider your current business size, growth plans, project complexity, and how well the system integrates with your existing tools.

Key US Tax Considerations for Construction Contractors in 2025

Construction-Specific US Tax Deductions

Construction companies can take advantage of several industry-specific tax benefits:

Section 179 deductions

Section 179 deductions allow immediate expensing of equipment purchases rather than depreciating them over several years. For 2025, you can deduct up to $1,160,000 in qualifying equipment purchases.

Bonus depreciation

Bonus depreciation provides additional first-year deductions for qualifying property. Current rules allow 80% bonus depreciation for equipment placed in service during 2025.

Work Opportunity Tax Credits

Work Opportunity Tax Credits offer incentives for hiring workers from targeted groups, including veterans, ex-felons, and long-term unemployed individuals.

Accounting Method Impact on Taxes

Your choice between PCM and CCM significantly affects your tax timing:

PCM creates tax obligations during project execution, often before you receive full payment from clients. This requires careful cash flow planning but provides more consistent year-to-year tax obligations.

CCM aligns tax obligations with cash receipts, which particularly benefits contractors with long project cycles or clients who pay slowly.

Understanding these implications helps you choose the right method for your business and plan accordingly.

Cost Control Strategies

Budgeting and Monitoring Techniques

Effective cost control starts with accurate project budgeting during the estimating process:

Detailed cost breakdowns involve analyzing every project component from materials and labor to equipment and subcontractor costs.

Historical cost analysis uses data from previous similar projects to improve budget accuracy and identify cost trends.

Regular monitoring through weekly cost reports provides timely feedback on project performance, enabling quick responses to cost overruns.

Change order management ensures proper documentation, pricing, and client approval before incurring additional costs.

Common Construction Accounting Challenges US Contractors Face

Multi-location payroll becomes complex when workers move between states with different tax requirements. Cloud-based systems and professional payroll services help manage these complications.

Change order documentation requires detailed recording of scope changes and cost impacts before work begins. Many contractors lose money by performing change order work based on verbal agreements.

Revenue recognition accuracy balances accounting standards with tax optimization and cash flow management. Proper system integration helps maintain this balance.

Best Construction Accounting Practices for US Contractors

Technology Integration

Successful construction companies integrate their accounting systems with project management processes:

Real-time cost tracking

Real-time cost tracking connects field operations with financial systems, providing immediate feedback on project performance.

Cloud-based access

Cloud-based access enables financial information access from any location, supporting decentralized construction operations.

Mobile applications

Mobile applications bring accounting functionality to job sites for immediate data entry and progress documentation.

Regular Financial Analysis

Consistent reporting provides the foundation for effective business management:

Monthly WIP reviews identify project performance trends and enable proactive management responses.

Quarterly business assessments step back from individual projects to analyze overall business performance and market opportunities.

Annual system evaluation assesses accounting effectiveness and guides technology or process improvements.

FAQs: Frequently Asked Questions

What’s the main difference between job costing and regular accounting?

Job costing tracks all expenses and revenues by individual project rather than looking at your overall business operations. This lets you see which projects make money and which ones lose money, helping you make better bidding and business decisions.

When do I need to use the Percentage-of-Completion Method?

The IRS requires PCM when your average gross receipts over three years exceed $27 million. Smaller contractors can choose between PCM and the Completed Contract Method based on what works better for their business.

What reports are most important for construction companies?

Work-in-Progress (WIP) reports are the most critical because they show your current project status and expected profitability. Job cost reports, cash flow projections, and project-specific profit and loss statements are also essential for good financial management.

How can I improve my construction company’s cash flow?

Focus on optimizing your progress billing schedules, actively managing retainage collections, coordinating your expense timing with payment receipts, and maintaining appropriate credit facilities to bridge timing gaps between projects.

What construction accounting software works best for smaller contractors?

QuickBooks Enterprise with construction features works well for basic needs and familiar interfaces. FOUNDATION Software offers more sophisticated construction-specific capabilities. Your choice should depend on your business size, project complexity, and growth plans.

Conclusion

Construction projects are special in that they have lengthy deadlines, substantial budgets, and intricate contracts, all of which call for the use of certain accounting techniques to guarantee sound financial management. Inaccurate financial reporting, lost income, and legal problems may result from not adhering to these standards.

That’s where e2e Accounting comes in, offering simple, reliable construction accounting services tailored for contractors. They help you stay compliant and focused on your projects, while handling all the financial details smoothly.

Disclaimer: This guide provides general information about construction accounting principles in the USA but does not constitute professional advice. For specific accounting, tax, or legal issues related to your construction business, please consult a certified accountant or legal professional.