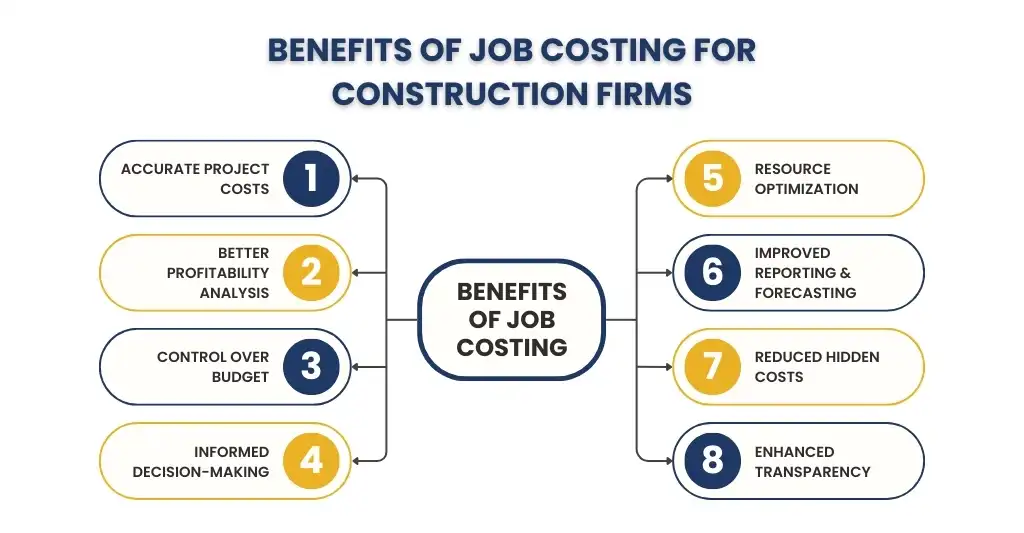

Job costing is the process of tracking and managing all the expenses of a project to get accurate budgeting and maximum profit. Why is job costing important for construction companies? It helps you control labor, materials and overhead costs, avoid budget blowouts and make informed decisions that will make your project successful.

Job costing gives you a clear breakdown of all project expenses, where money is being spent and where you can save, monitors real time costs to prevent overspending and improves profit margins by controlling job specific costs.

Understanding job costing is key to managing your projects efficiently and protecting your profits. In this guide you will learn the basics of job costing, how to implement it and how accounting support can help you with cost control.

What is Job Costing in Construction Projects

Job costing in construction is a specific accounting method that tracks all costs and revenues for each project not the business as a whole. This project based approach breaks down expenses into detailed categories like labor hours, materials, equipment and overheads, both direct and indirect costs for accurate profitability analysis.

This detailed cost tracking helps construction managers to identify budget overruns, optimize resource allocation and make data driven decisions throughout the project lifecycle. It will improve bidding accuracy and overall business profitability by giving clear insights into each project’s financial performance.

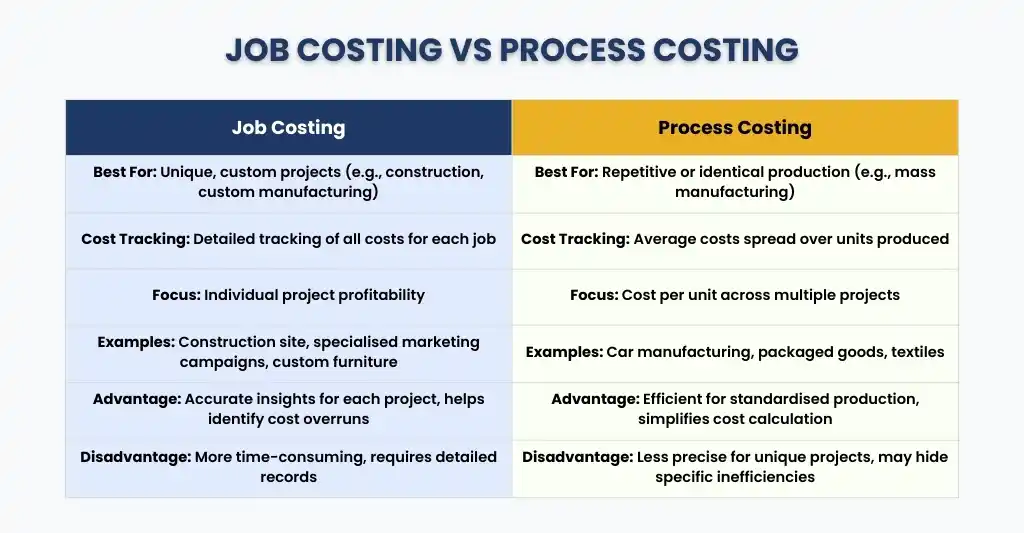

Job Costing vs. Process Costing: Which Method Works Best?

There are two methods to understand costs effectively in the construction industry: job costing and process costing.

Job Costing

The job costing method is ideal for the construction industry and for tracking each unique project’s associated costs.

Process Costing

The process costing method is ideal for the manufacturing industry, which has a repetitive and identical process. Under this method, you can track the costs of multiple projects.

One of the significant differences between job costing and process costing is whether you are working on a single project or multiple projects. Job costing is ideal for individual projects, while process costing is used for multiple projects of a similar nature over a period of time.

Breaking Down Construction Costs: What You Need to Track

Every construction project is unique; therefore, it is essential to get a job costing for each project. To get accurate job costing and to avoid surprises, you will need to categorize expenses. These categories are as follows:

Direct Costs

These costs are directly related to your job, which include labor, tools, and equipment or subcontracts.

Indirect Costs

These are costs that are not directly related to the job but are needed to support completion. The expenses include project management fees, the cost of hiring owned equipment, and indirect labor such as consultants.

Committed Costs

These are costs that are not yet settled, including unposted payroll, purchase orders pending payment, and any open contract agreements.

Essential Job Costing Terms Every Contractor Should Know

You will encounter specific terms that are commonly used in job costing. These terms are:

Committed Costs

Committed costs are those costs within the projects that have been committed to paying.

Some examples of committed costs include:

- Open subcontractor agreements

This includes the cost of subcontractors who have not been paid.

- Purchase orders

Purchase orders for materials, equipment, and other items that you have ordered or may have ordered but not yet paid for.

- Time from the field

Labor of workers working time on the field that has been reported but not processed through payroll.

- Expenses from the field

Purchases made while on-site, such as for materials or other equipment. These are offset against the overall project budget.

Keeping track of committed costs is difficult and can affect the funds you have left to spend. In some cases, this means you spend more than what’s available, putting your project in a deficit.

Equipment Cost

Equipment costing considers all the machinery and equipment required to do the job. Some of this equipment has already been purchased, rented, or owned. Under equipment cost also comes the cost of running and maintaining it, including fuel and depreciation costs.

To identify equipment costs, you need to consider:

- Revenue: Under it comes its usage, transportation, and costs when left idle

- Cost-to-own: Depreciation, insurance, and interest

- Cost-to-operate: Maintenance and repairs

Work in Progress

Under “Work in Progress,” you can calculate the percentage of work completed to date and compare it with the amount spent. This will allow you to predict the remaining and final cost.

How to Calculate Job Costs in Construction: Step-by-Step for US Firms

How to calculate job costing? It comes down to the individual costs that occur during the construction. The total construction job cost is the total of all materials, labor, equipment, subcontractor costs, and overheads.

When creating your cost estimate, apply construction job cost estimation tips like incorporating contingency buffers and detailed material quantity takeoffs for accuracy. These practices ensure your bids are competitive while reflective of realistic project costs.

Here’s a detailed step-by-step guide to ensure your construction firm gets it right every time:

Create a Cost Estimate

Before you even bid for a job, you will need to know the cost estimate. Under it comes:

- Material Costs: This includes the quantities and prices of all materials required for the project. Also, the potential waste, delivery, and storage charges will be considered.

- Labor Costs: It considers labor hours for each task for different job roles, like general laborer and skilled trades. Also, to be considered are wages, overtime, benefits, and taxes.

- Equipment & Overhead: This category takes into account the fuel, insurance, rent on equipment, and other overheads, including office expenses related to your job.

- Contingencies: Set aside a contingency fund to cover unexpected issues or changes in scope. Typically, this is 5-10% of the total cost estimate.

Assign Cost Codes

Once your cost estimate is finalized, you will need to organize the expenses into cost categories, also known as cost codes. This allows for easier tracking and comparison throughout the project. Cost codes usually fall into the following categories:

- Labor Costs: Categorize by trades or job roles (e.g., carpenters, electricians, foremen).

- Materials Costs: Contains the list of materials needed in construction, like lumber, steel, concrete, and other supplies.

- Subcontractor Costs: Tracking the payments to suppliers and subcontractors involved in the project.

- Equipment Costs: Separate equipment-related expenses, including rental and maintenance.

- Overhead Costs: These include utilities, permits, insurance, and any non-project-specific costs that impact the job.

By having well-defined cost codes, you can ensure all your expenses are recorded in an orderly manner, making it easier to track and analyze later.

Track Expenses in Real-Time

Accurate construction cost tracking requires timely logging of labor hours, material usage, and overhead expenses to maintain up-to-date financial control. Real-time expense tracking reduces the risk of surprises and allows for immediate corrective action when costs deviate from estimates.

You can track expenses as follows:

- Labor Hours: Ensuring your employees and subcontractors log their hours daily and accurately track their overtime.

- Material Receipts: When any material is purchased or delivered, log in the cost and quantity immediately to avoid discrepancies later.

- Overhead & Miscellaneous Expenses: Track expenses such as equipment usage, fuel, and other on-site costs.

- Real-time tracking will reduce discrepancies and prevent surprises. By entering the cost, you are staying updated on your project’s financial health.

Compare Estimate vs. Actual

As the project progresses, compare your original cost estimate with the actual costs incurred.

- Weekly/Monthly Variance Review: It enables the identification of costs exceeding the budget and areas where savings are being made.

- Adjust Forecasts: It helps you revise your forecast if you find that labor and materials are exceeding estimates. It helps in keeping your project financially viable.

- Cost Adjustments: If any unexpected issues arise, you can adjust your budget or utilize contingencies to keep the project on track.

By consistently comparing estimates with actual costs, you can adjust your approach in real-time and prevent financial surprises.

Generate Reports

When reports are generated at regular intervals, you will get valuable insights into profitability and financial health. The reports will contain:

- Profitability by Job: Track the profitability of each project by comparing the cost and revenue.

- Job Cost Reports: They break down the cost for labor, materials, equipment, and overhead for each job.

- Job Cost Forecasting: Using the data from your reports, forecast the remaining costs for the project and identify potential cost overruns.

Reports also help guide decisions for future bids and project planning. By reviewing detailed reports, you can better estimate future jobs, avoid common pitfalls, and price more accurately.

Tracking Hidden Costs: Closing the Gap Between Estimated and Actual Margins

Tracking hidden costs is vital to avoid profit loss in construction projects, as overlooked labor inefficiencies, material waste, and change orders can quickly erode margins. Regular variance reviews help identify these issues early to maintain profitability.

- Idle time and labor inefficiency.

- Material waste and delivery delays.

- Change orders that weren’t included in the original estimate.

- Underestimated overhead costs, such as permits or equipment fuel.

- Regular reviews and variance analysis can catch these before they become major profit-drainers.

Leveraging Job Costing Software to Simplify Tracking

Using construction job costing software can greatly simplify cost tracking and project management by automating data entry, reducing human errors, and providing real-time insights into your project costs. This software not only streamlines reporting but also supports better decision-making through accurate and up-to-date financial data.

Through job costing software, you can pull out reports that can be used for long-term planning and budgeting. These reports are:

- Job cost summary: The Job cost summary will help you in reviewing profit margins and locating inefficiencies, such as huge equipment costs.

- Unit productivity: This report helps you understand the cost of units for a construction project by assessing the output per hour, which aids in determining the total output.

- Labor analysis: Job costing software can pull labor analysis reports to help review the effectiveness and productivity of a workforce.

Proven Strategies to Optimize Your Job Costing Process

Following job costing best practices, such as standardizing cost codes and updating expenses daily, ensures accurate data and maximizes project profitability. Additionally, integrating accounting systems with construction management tools helps improve accuracy and transparency throughout your projects.

- Standardizing cost codes across all projects.

- Training your project managers to update costs daily.

- Usage of real-time dashboards for transparency.

- Regularly compare completed projects to original estimates.

- Integrate accounting with project management software for accuracy.

Common Pitfalls in Job Costing and How to Avoid Them

Job costing is important for controlling expenses and maximizing profits in construction. However, there are some common pitfalls that plague job costing. Let’s examine some of these common pitfalls.

Incomplete Data Entry

One of the common mistakes in job costing is failing to record every expense accurately and promptly. This can be due to missing receipts and unrecorded labor hours. To avoid it, you must implement real-time expense tracking and regularly review data entries.

Poor Communication

Lack of communication between the field team and office staff will cause leakage in job costing data, leading to delayed updates and overlooking unplanned expenses. By establishing daily or weekly check-ins and clear communication protocols, clear communication can be maintained.

Lumping Costs Together

When you lump all costs (labor costs, material costs, and overhead costs) together, you lose the clarity necessary to track and control expenses effectively. To avoid that, we suggest you create separate categories for labor, materials, and overhead and use job costing software with customizable cost codes.

Ignoring Variances

Failing to review variances, no matter how small, can lead to recurring mistakes, affecting long-term profitability. However, it can be avoided by reviewing job cost reports regularly and implementing a corrective action plan.

Poor Construction Cost Tracking

Poor construction cost tracking is a common pitfall leading to missed expenses and inaccurate profit margins. To reduce job costing errors, implement consistent data entry procedures, regular cross-checks, and use specialized software designed for construction accounting.

How Professional Accounting Support Can Boost Your Project Profits

Partnering with professional construction accounting support helps avoid profit loss in construction by ensuring accurate cost allocation, timely financial reporting, and a thorough review of profitability across projects. This enables you to focus more on project execution while keeping finances under control.

- Accurate and timely financial reports.

- Guidance on tax savings tied to project expenses.

- Expert setup of job costing systems and software.

- Independent review of profitability across multiple projects.

- Less admin burden, freeing you to focus on completing jobs.

FAQs: Frequently Asked Questions

Is job costing GAAP?

Job order costing and process costing are the two main costing systems that are approved by Generally Accepted Accounting Principles (GAAP), which are the financial accounting standards used in the United States.

What is the formula for job costing?

The formula for job costing involves identifying the hourly labor cost and then multiplying it by the number of hours worked

What industries commonly use job costing?

Construction companies, marketing agencies, custom manufacturers, and other businesses with unique projects use job costing to price work accurately and maximize profitability.

How does job costing differ from regular accounting?

Job costing assigns costs to individual jobs, while regular accounting records overall company expenses.

What is job costing in construction?

It’s the process of tracking labor, material, and overhead costs for each project to measure profitability.

Conclusion

Job costing is not just an accounting method; it’s a strategic tool for your construction business for making cost control, protecting profit margins, and maintaining sustainable growth. By monitoring your labor, materials, and overhead through a professional accountant, you can close the gap considerably. Looking at the construction market in the USA, job costing is no longer an option; it’s an essential tool to stay ahead of the curve.

To stay ahead of the curve, consider approaching E2E Accounting for access to our professional accountants, who have experience handling accounting work for construction businesses, including job costing. Our services have brought profits for our clients and attracted new ones. Are you looking for a change in job costing work? Contact us, and we will streamline your costs and profits.