Construction work is largely a matter of guesswork, especially when it comes to tracking jobs and profits. During the construction phase, you will encounter bills to pay, materials to order, teams to manage, and a multitude of other tasks in between. To manage them efficiently, you will need Work in Progress reports in construction, a method of accounting specifically designed for the construction industry that tracks costs and revenues throughout the lifecycle of construction projects. Without WIP, you can say goodbye to running your construction project smoothly.

So, how does it work? And why it matters so much to construction companies and more, we will understand all this deeply in this blog.

What is a WIP Report in Construction?

An essential part of construction accounting, Work in Progress reports in construction calculate the work progress, allowing you to see what has been completed and what remains, thereby enabling you to manage your budget effectively.

WIP report tracks:

- Costs incurred to date (labor, materials, overhead)

- Revenue recognized based on completed work

- Estimated profit margins for each project

WIP reports provide real-time visibility of your project performance, allowing you to make informed decisions related to budget and risk accordingly.

Why WIP Reports Matter for Construction Companies?

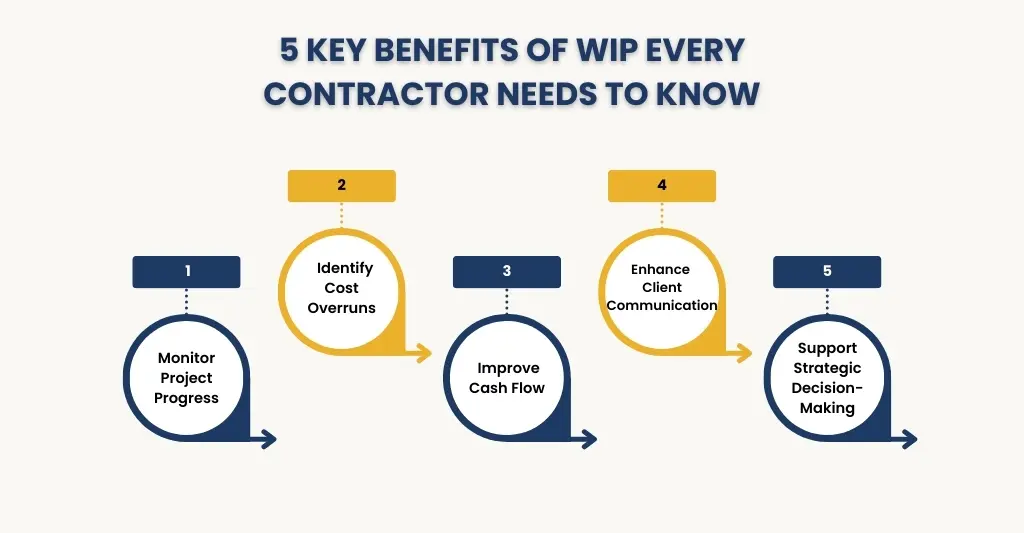

WIP reports have a significant impact on the running of construction businesses because they help in:

Monitor Project Progress: By comparing actual costs to estimated costs and revenue.

- Identify Cost Overruns Early: It detects inefficiencies in labor, materials, or overhead before they escalate, allowing for prompt corrective action.

- Improve Cash Flow Planning: It understands when revenue will be recognized and plans payments accordingly.

- Enhance Client Communication: It provides your clients with accurate status updates and progress billing.

- Support Strategic Decision-Making: It will help you in deciding whether to continue, adjust, or renegotiate projects based on financial insights.

What Should a Construction WIP Report Include?

A well-made construction WIP report will certainly provide important data, which gives your insight into the construction status and budget situation. These important data are:

- Total current value of the contract

- Amount of revenue received to date

- Total original estimated costs

- Amount billed to date

- Revised estimated costs

- Percentage completion of the project

- Total costs to date

- Whether a project is currently over or underbilled

The Role of Job Costing in WIP Reporting

Job costing is key to accurate WIP reporting as it assigns direct costs like labor, materials and subcontractor fees to specific construction projects. This detailed tracking allows you to monitor actual expenses at every stage so your WIP reports reflect true project costs and profitability.

Job costing with WIP reporting gives you better cost control and timely variance identification. It supports precise revenue recognition and billing so you can maintain accurate financial records and increase project profitability.

How Do You Create an Accurate WIP Report?

To create an accurate WIP report, you will need a foolproof data collection mechanism and a structured analysis to ensure accuracy and usefulness. Here’s a detailed step-by-step guide:

Collection of Project Data

Start by gathering all the relevant data related to your project. This includes:

- Cost Information: Labor costs, materials purchased, subcontractor fees, equipment rentals, and overhead expenses.

- Invoices: All invoices from subcontractors and suppliers must be mentioned to show the actual costs.

- Labor Cost: Track hours worked by employees and subcontractors to assign accurate labor costs to the project.

- Expenses on Materials: This includes materials that are purchased and used. Additionally, returned material and wastage are also considered to maintain accurate cost tracking.

Determine Percentage Completion

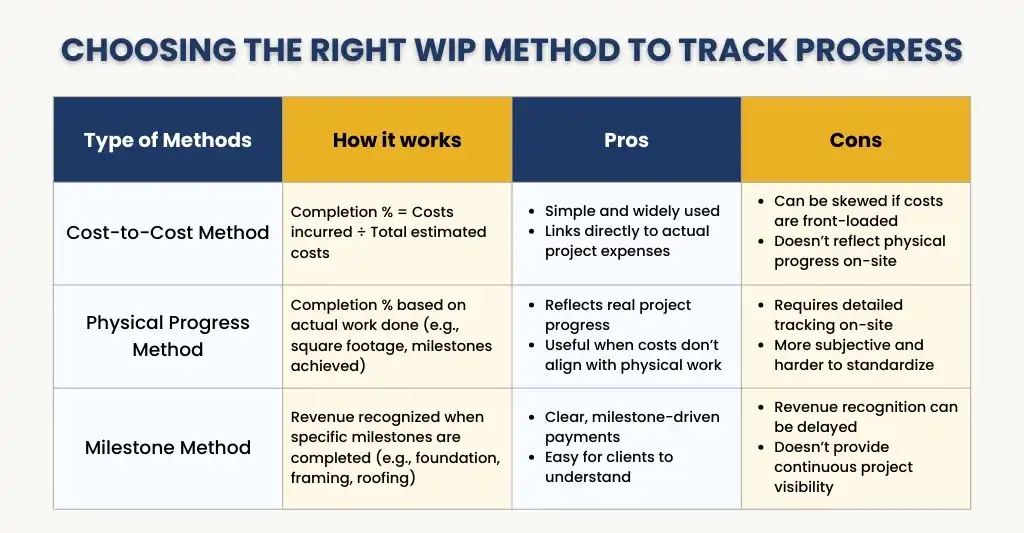

Calculate how much of the project has been completed. This is important for recognizing revenue and understanding project status. Common methods include:

- Cost-to-Cost Method: Under this method, the completion percentage is based on the ratio of costs incurred to total estimated costs.

- Physical Progress Method: Evaluating the progress based on the actual work done through square footage or project milestones.

- Milestone Method: Funds are released upon achieving specific milestones, such as the completion of the foundation.

You will need to select the appropriate method based on the project type, contract terms, and accounting standards.

Calculate Revenue to Date

Once the percentage completion is determined, calculate the revenue earned so far:

- Multiply the percentage of completion by the total contract revenue.

- Include adjustments for approved change orders or additional work that affects the contract value.

- Ensure that revenue recognition aligns with your accounting standards (GAAP or IFRS if applicable).

This step enables you to determine the amount of revenue that can be recognized for the project at its current stage.

Compare Costs vs. Revenue

Once the revenue is calculated, subtract total costs incurred to date from the recognized revenue to determine the project’s profitability.

- Profit or Loss: A positive result indicates profitability, and a negative result suggests overruns.

- Variance Analysis: Identify areas where costs are exceeding estimates (e.g., labor, materials, or subcontractors). Identify areas where costs are exceeding labor, materials, or subcontractors.

- Decision-Making: The comparison will help you make informed decisions, control costs, allocate resources effectively, and adjust schedules accordingly.

Regular comparisons will enable you to act quickly and prevent financial losses.

Include Change Orders

A change in orders brings in changes to the original project scope, thus affecting both costs and revenue. To make the changes, you need to:

- Adjust both estimated costs and contract revenue to reflect these changes.

- Track the impact of change orders separately to understand how modifications affect project profitability.

- Ensure all adjustments are documented and approved by management and clients.

Accounting for change orders keeps your WIP report accurate and prevents under- or overstatement of project margins.

Generate the Report

Finally, summarize all collected data into a clear and structured WIP report. The report will contain:

- Key Sections: Project name, start and end dates, estimated and actual costs, percentage completion, revenue recognized, change orders, and profitability.

- Easy-to-Understand Format: Utilize tables, charts, or dashboards to make the report clear and accessible for management and stakeholders.

- Select Frequency: Update the WIP report on a weekly or monthly basis, depending on the project’s size and complexity, to maintain up-to-date insights.

A well-prepared WIP report provides accurate insights into your project’s financial health and guides you in informed decision-making. Thus, helping you stay on budget and improve your profits.

How WIP Reports Help Track Project Profitability

By comparing estimated costs with actual expenditures and revenue recognized, WIP reports allow you to:

- Identify projects running over budget early

- Fine-tune resource allocation for efficiency

- Ensure accurate billing and client invoicing

- Improve forecasting for future projects

- Make informed decisions on continuing or revising the project scope

WIP Reports and Their Impact on Financial and Cash Flow Statements

Accurate WIP reports record work in progress as an asset on the balance sheet and recognize revenue on the income statement according to US GAAP. This gives you a clear view of project profitability.

WIP reporting also supports cash flow management by aligning revenue recognition with billing and collections so you have sufficient liquidity. This improves financial planning and increases lender and investor confidence.

WIP Report Calculation Methods

Under the WIP report in construction, there are three calculation methods. These are:

- Cost-to-Cost Method: Under this method, the completion percentage will be based on the ratio of costs incurred to total estimated costs.

- Physical Progress Method: Evaluating the progress based on the actual work done through square footage or project milestones.

- Milestone Method: Funds are released when specific milestones are achieved, for instance, completion of the foundation

Tax and Regulatory Considerations for WIP Reporting in the US

WIP reporting is required for construction companies to comply with IRS regulations and accounting standards like GAAP and FASB. Proper revenue recognition using the percentage-of-completion method ensures taxable income is reported correctly, reflecting the true financial status of active projects.

You also need to stay up to date on federal, state and local tax laws that affect construction contracts. Compliance helps you avoid penalties and supports transparent financial reporting, which builds trust with investors and regulators.

Common Mistakes in WIP Reporting

Construction accounting is quite complex, and the WIP report plays a vital role in project financial management, offering insights into project progress and financial health. However, while preparing the WIP report, some common mistakes can happen, which will impact its accuracy and reliability. Let’s examine some common mistakes and learn how to avoid them.

Incomplete or Inaccurate Data Entry

Failing to consistently record all project-related costs, billings, and progress accurately can lead to incomplete and inaccurate WIP reports. Such inaccurate reports will lead to incorrect financial statements, distorting the proper financial health of a project.

Decisions made based on inaccurate data will harm the project. Therefore, importance must be given to accurate record-keeping in WIP, as it is the basis for sound financial and project decisions.

Inconsistent Reporting Periods

Inconsistencies in reporting periods, such as irregular intervals for generating WIP reports, will make tracking progress difficult. Regular reporting intervals are crucial for analyzing project data effectively and deriving actionable insights.

When WIP reports are not harmonized with the project’s billing cycles or accounting periods, it can lead to confusion and misinterpretation of the project’s performance and financial health. Hence, prioritizing standardization of the reporting period makes it easier to spot anomalies, patterns, and potential issues early.

Failure to Update Estimates

When original cost estimates are not updated to reflect changes in costs, the WIP report will not accurately reflect the project’s actual financial status. This happens when the changes in order come, which impacts the project finances. Hence, it is essential to update revenue and ensure that the WIP report reflects it accurately to show the actual financial status.

Not Addressing Overbilling or Underbilling

Failing to address overbilling or underbilling will have a significant impact on the accuracy of the project’s financial standing. Such discrepancies make it difficult to understand the actual financial standing and affect decision-making processes.

To maintain financial accuracy, it is essential to address overbilling and underbilling issues promptly. This ensures that billings align accurately with earned revenue, providing a more precise and more realistic representation of the project’s financial position.

Misinterpreting Percentage of Completion (POC)

Errors in the percentage-of-completion method will lead to errors in revenue recognition. To avoid such mistakes, you must ensure that the POC method you use in the WIP reporting aligns with the Financial Accounting Standards Board (FASB) standards and guidelines. Adherence to FASB will ensure accurate cost tracking, project completion percentages, and revenue recognition, thereby ensuring compliance with relevant accounting standards.

Lack of Detailed Notes

Lack of detailed notes will impede the provision of a clear understanding of your project’s financial trajectory. Without disclosing the assumptions underlying cost and revenue projections, the methodologies used for progress measurement leave stakeholders with an incomplete understanding of the underlying assumptions. Not showing it will lead to less reliability in the report and misunderstandings.

How Accountants and Software Improve WIP Reporting

When preparing WIP reports, you will need to perform multiple calculations and manually enter data, which is a time-consuming and error-prone process. That’s why investing in construction accounting software or in accountants who can operate it makes sense. The software ensures smooth operation and prevents errors through automation.

An accounting software can achieve:

- Automation in cost tracking and revenue recognition

- Integration with project management and payroll systems

- Real-time dashboards and alerts for variances

- Compliance with GAAP or IRS rules for revenue recognition

- Reduction in errors and saving administrative time

Popular construction accounting software, such as QuickBooks, is ideal for construction WIP reporting. However, operating it requires experience and training, which your staff may not have. In such situations, you can partner with an accounting outsourcing firm whose accountants know how to operate the software, and you can avail its services.

FAQs: Frequently Asked Questions

What is a WIP report in construction?

WIP report tracks the financial status of ongoing projects, providing details on incurred costs, recognized revenue, and projected profitability. It’s indispensable for contractors navigating the complexities of construction accounting, helping them maintain financial clarity and control.

What is the purpose of WIP?

WIP tracks how manufacturing costs flow through the production process, capturing costs for goods that are not yet finished.

How often should I generate WIP reports?

Typically, on a weekly or monthly basis, depending on the project size and cash flow needs.

Do I need specialized software for WIP reporting?

While spreadsheets can be effective, construction accounting software enhances accuracy, saves time, and integrates seamlessly with payroll and project management systems.

How to calculate WIP for construction?

To create a WIP report, first add the total contract value to date, estimated costs, actual cost to date, and total billed revenue. From there, you can calculate the percentage completion, earned revenue, and whether the project is over- or under-billed.

Conclusion

WIP reports in construction are the perfect tool for tracking a project’s profitability, managing costs, and making informed decisions. By producing accurate reports, monitoring variances, and utilizing accounting software through your partner accounting outsourcing firm, your firm can enhance cash flow, increase profits, and remain competitive in the US market.

When it comes to staying competitive and ahead of the curve, partnering with an accounting outsourcing provider like E2E Accounting may be an interesting option. We have construction accountants who specialize in handling accounting work for construction companies, including WIP reports. Our work in WIP reports has earned us respect in the US construction market and attracted new clients to entrust us with their projects. Do you need any assistance in this aspect? Contact us, and we will streamline WIP reporting.